Thong Guan Time to Accumulate

Jordan Khoo

Publish date: Mon, 24 Dec 2018, 03:31 PM

We became very interested when Thong Guan (TGUAN) reported the highest revenue ever yesterday. Many aren’t that interested in growing revenue but focused more on profits, but to us, the revenue increase signifies an expansionary business rather than merely profits which can be caused by other externalities other than business expanding.

Prospects Going Forward

Additional Production

A quick check on the quarterly report tells us that an additional stretch film production line would come in place in the fourth quarter of 2018. We would likely see a bigger revenue expansion to be reported for Q4 2018.

Although it is hard to tell if this turns into additional profit in the end, growth in getting the business larger is priority. Profit might not increase the same percentage but eventually, some efficiency management can be implemented to the factories and that can be a factor that improves profit margins.

Most businesses tend to see revenue rising and with a little cut here and there would eventually rise profits. We think that this might be the case this time around.

Resin Price Down

Plastic resins would be TGUAN’s primary raw material feed and we think that with the recent drop in resin price, the profit margin might improve somewhat similar to Q3 2017.

We do not have a HDPE historical chart and we represent the price changes for plastic resins with crude oil chart below.

In reference to the chart above, margins created by TGUAN was high up to Q3 2017. Later, the margins started to decline badly from Q4 2017 up to this quarer itself. Evidently, the region shown in red is when oil sky rocket to $84.

Meanwhile from the start of October which is also the reporting period for Q4 2018, we begin to see price dips for crude oil. Resin prices would follow suit as HDPE it is a form of petrochemical product.

We expect margins to improve for Q4 2018 results which would be reported February next year.

Foreign Exchange Factor

With USD trading at 4.18 against ringgit today and stabilizing at this region. The profit for TGUAN would continue to stay strong due to foreign currency gains.

Although we felt that if a sudden drop in USD would turn this positive factor into a problem, we are confident that with China continuously lowering the value of RMB, Ringgit would continue to see this price against the dollar.

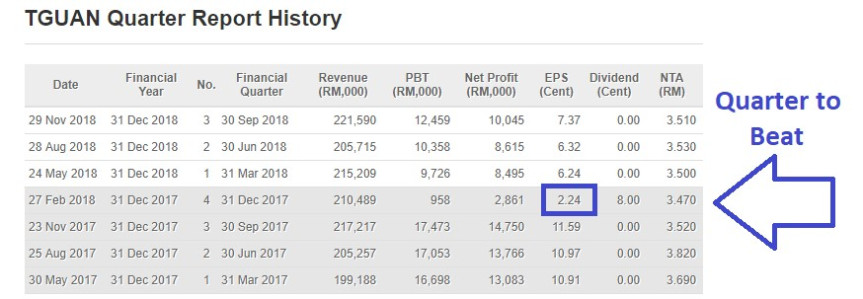

Beating Q4 2017 is Easier

The market likes to compare the profit versus what it was one year ago. The Q4 2017 could be considered one of the lowest recorded in terms of Earnings Per Share.

At only 2.24 cents EPS, a mere RM 5 million in net profit next year would have top it off easily. Coupling this with the expected rise in revenue from the new line of stretch film, we felt it can be achieved easily.

Conclusion

With so many factors pointing the prospect upwards, we felt that it is fair to be buying at current price. In addition to that, we felt that the share price has yet to move or react to the expected growth in the future.

Low liquidity is a concern for many but also an indication of a counter which isn’t covered by many. That explains the ‘no reaction’ from upcoming growth.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Sharing to all Malaysians! Let's Win Together

Created by Jordan Khoo | Jul 11, 2019

Created by Jordan Khoo | Mar 28, 2019

Created by Jordan Khoo | Mar 04, 2019

Created by Jordan Khoo | Feb 14, 2019