Beneficiaries of Sea Freight Spike? A Peer Comparison on Bursa

MarketMentor

Publish date: Mon, 24 Jun 2024, 01:09 AM

Despite the United States economy seeing a cooldown in inflation with consumer and wholesale prices softening, that might not be the story reflecting the ocean freight industry. Currently, business operators are rushing towards booking ocean freight, where ocean cargo prices to the United States could reach $20,000, and potentially touch $30,000, the Covid-19 peak that was feared by many.

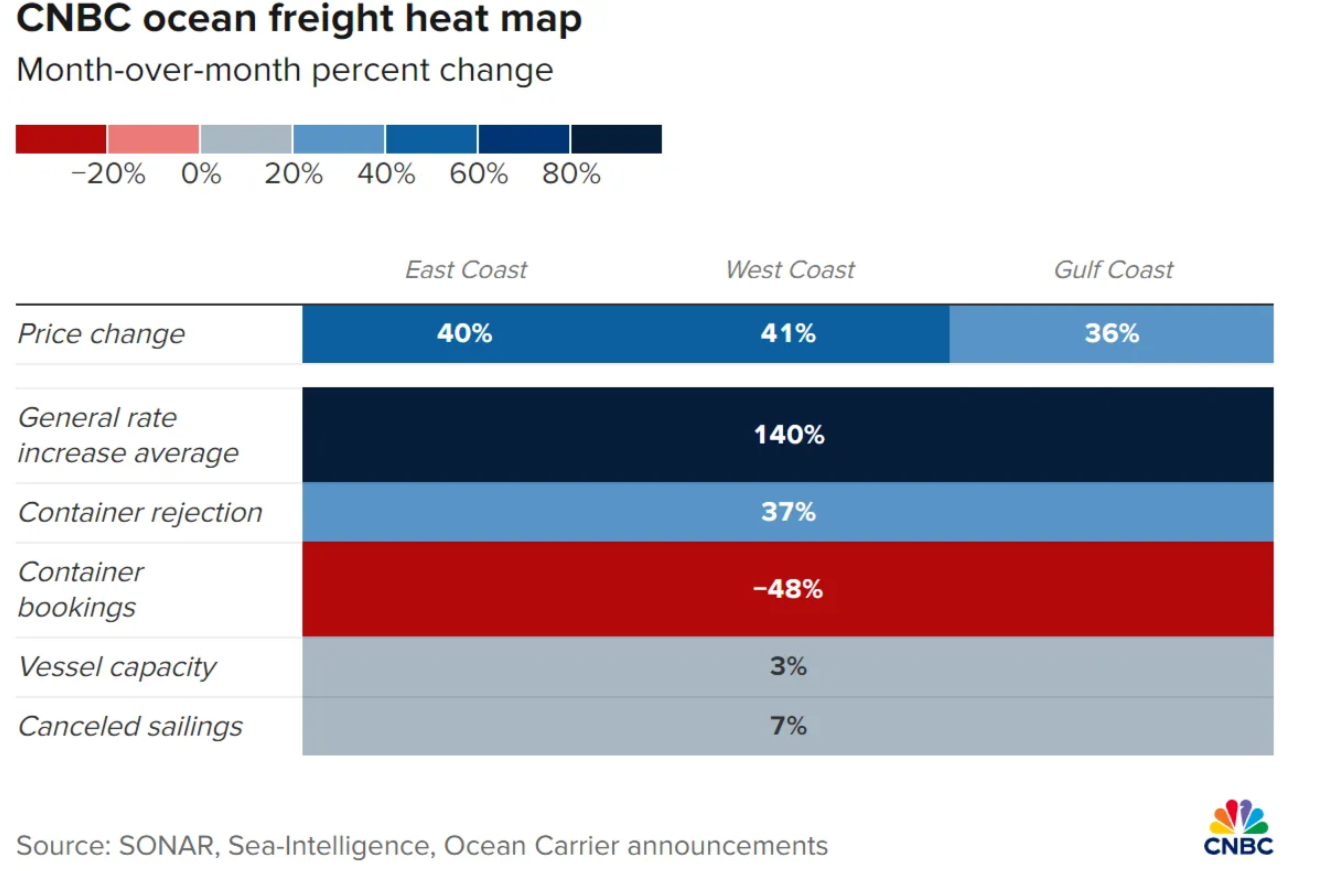

Based on CNBC’s channel check, we can see despite container bookings decreased due to drastic lack of containers and right size vessel of certain capacity overseas, a lot of shippers had moved from booking to taking spot prices (which increased by 140.0% or more, depending on routes, which could be 300.0% increase), we see this is a threat for potential inflation to come, but a major opportunity for ocean freight players locally (in Malaysia’s content).

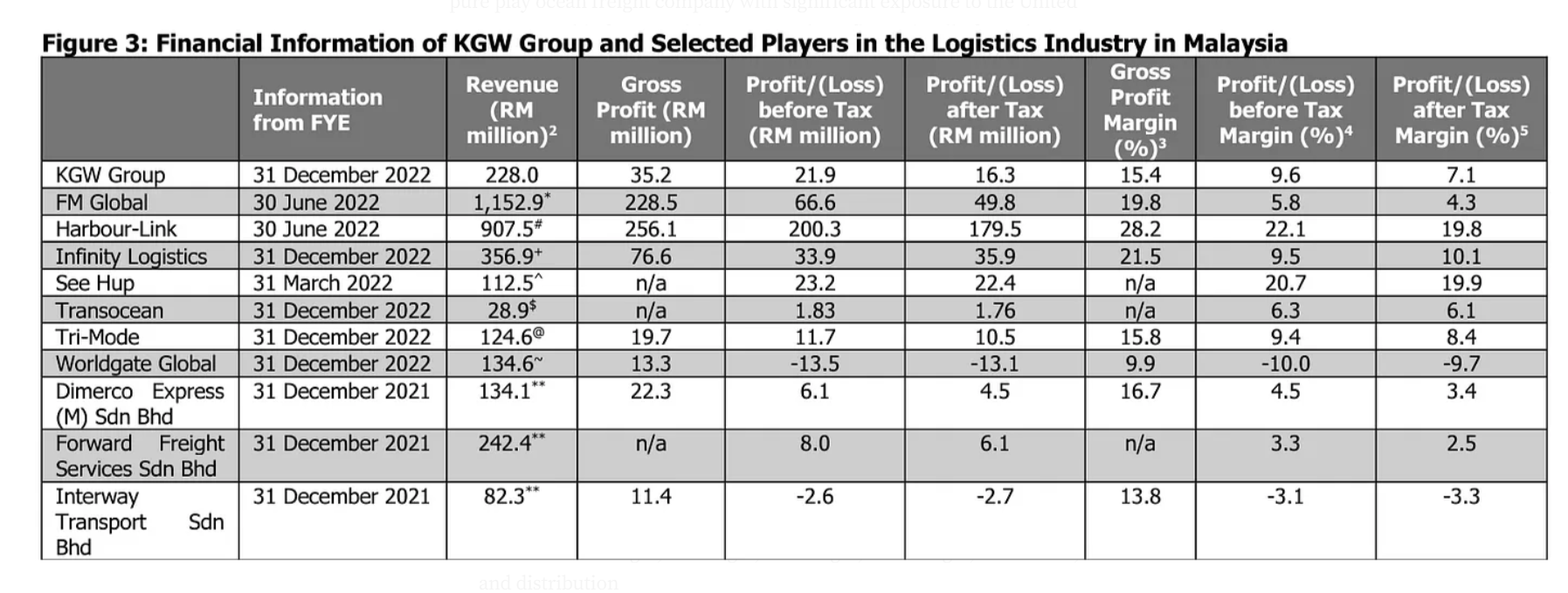

Locally, several logistics companies support the backbone of the Malaysian economy. Among them, KGW Group Berhad (KGW) stands out as the only pure play ocean freight company with significant exposure to the United States route. This focus positions KGW to benefit maximally from the recent freight rate increases. Here’s a comparison of some key players in Bursa Malaysia:

Comparison of Key Players

KGW Group (KGW):

- Focus: Pure play ocean freight

- Market Capitalisation: RM108.6 million

- Advantages: Lightweight business model, no risk of significant impairment/write-off post rate normalisation.

FM Global Logistics (FM):

- Focus: Ocean freight, air freight, rail freight, land freight, warehouse, and distribution

- Market Capitalisation: RM351.8 million

- Advantages: Diversified logistics services.

Harbour-Link Group (HARBOUR):

- Focus: Shipping and marine services

- Market Capitalisation: RM656.7 million

- Advantages: Cash-rich, though the stock price has increased significantly.

Sin-Kung Logistics (SINKUNG):

- Focus: Land-based airport to airport services

- Market Capitalisation: RM186.0 million

- Advantages: Strong presence in land logistics.

Why KGW?

KGW’s position as a pure play ocean freight company with a focused business model makes it a compelling investment. The company’s recent share price retracement, despite improving fundamentals, provides an attractive entry point for investors. Additionally, KGW’s lightweight business model reduces the risk of significant write-offs, even if freight rates normalise. This strategic positioning allows KGW to capitalise on the current surge in ocean freight rates, offering potential for substantial returns.

In conclusion, KGW Group Berhad emerges as a strong contender among Malaysian logistics companies, offering significant upside potential in the current freight rate environment. Investors looking to benefit from the spike in sea freight rates should consider KGW for its focused business model and exposure to lucrative routes.