Benalec: Reclaiming gold from the sea, a screaming bargain

kakashit

Publish date: Tue, 20 Dec 2016, 09:15 AM

Benalec Holdings Berhad is a company that involves in coastal construction and vessel chartering. It has expertise in coastal reclamation and coastal protection work with track record spanning from year 1993 when Benalec first taken up the restoration project of a damaged bund at Sungai Belukang, Bagan Datok.

|

Contract Revenue |

131,319,988 |

|

Land Disposal |

184,515,140 |

|

Chartering Service |

7,248,188 |

A few photos on coastal reclamation works:

Benalec has an excellent track record where below is a few coastal reclamation project done by Benalec:

· Pulau Indah Industrial Park, Selangor

· Kota Laksamana, Melaka

· Cheng Ho City, Melaka

· Waterfront City, Melaka

· Nusajaya Waterfront, Johor

· Tanjung Piai Maritime Industrial Park, Johor

· Pengerang Maritime Industrial Park, Johor

Since Benalec listing in 2011, it had delivered continuous profit. As of FY 2016, Benalec has a revenue and core profit of RM24million respectively.

|

|

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

|

Revenue |

210,962,751 |

155,858,253 |

265,834,884 |

211,017,214 |

180,540,325 |

323,083,316 |

|

% |

|

-26.12% |

70.56% |

-20.62% |

-14.44% |

78.95% |

|

Profit Before Tax |

126,090,539 |

100,241,275 |

65,559,967 |

18,203,292 |

8,473,903 |

18,055,114 |

|

Other Income |

28,594,005 |

68,759,549 |

4,411,354 |

16,073,339 |

17,900,310 |

9,530,390 |

|

PPE Disposal Effect |

0 |

-988,043 |

-2,442,665 |

-2,886,576 |

0 |

-7,448,055 |

|

Forex Loss |

-153,416 |

-2,427,489 |

-472,432 |

-844,213 |

-5,689,543 |

-2,628,538 |

|

PPE Impairment & w/o |

0 |

0 |

-4,701,394 |

-16,214,677 |

-13,650,796 |

-5,968,234 |

|

Core Profit |

97,649,950 |

34,897,258 |

68,765,104 |

22,075,419 |

9,913,932 |

24,569,551 |

|

% |

|

-64.26% |

97.05% |

-67.90% |

-55.09% |

147.83% |

|

Profit Margin |

46.29% |

22.39% |

25.87% |

10.46% |

5.49% |

7.60% |

However, due to the business nature of Benalec, where reclamation works are compensated by either cash or land portion or both, has resulted in Benalec volatile Operating Cash Flow. Occasionally, a delay in land title issuance may delay recognition of revenue for Benalec due to Financial Reporting standard.

|

|

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

|

Operating Cash Flow |

3,563,548 |

-13,895,455 |

-65,217,183 |

105,583,237 |

1,030,463 |

-16,467,973 |

Benalec is an asset rich company with total asset of RM1.3billion and liability of RM 367million. Due to the sluggish property market, Benalec is facing liquidity problem due to the delay in land sale. Benalec has been holding more and more land parcels and shop houses in Melaka due to the slow turnover of inventories for sale.

Oversupply of shop houses in Malacca City ?

In FY 2015, Benalec has raised RM200 million via bond issuance while in FY 2016, Benalec has negotiated to convert its non-current payables to term loan at an interest rate of 3% per annum. This two event lead us to believe that Benalec is actively managing its obligation and is able to overcome the worsening property sentiment for the next few years.

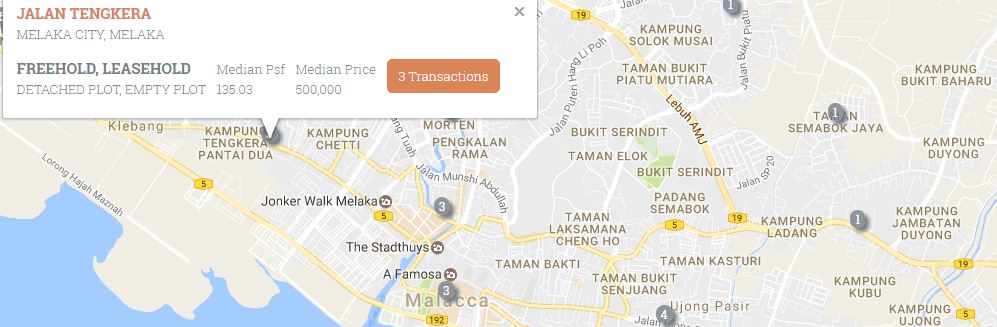

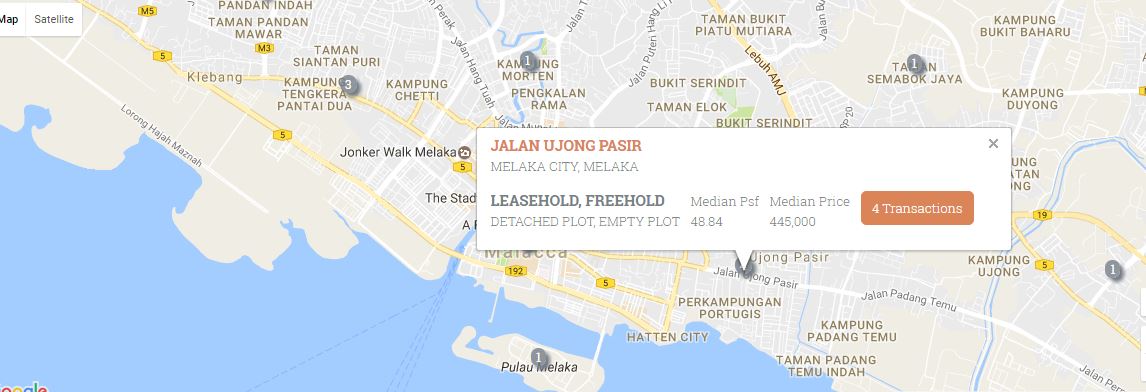

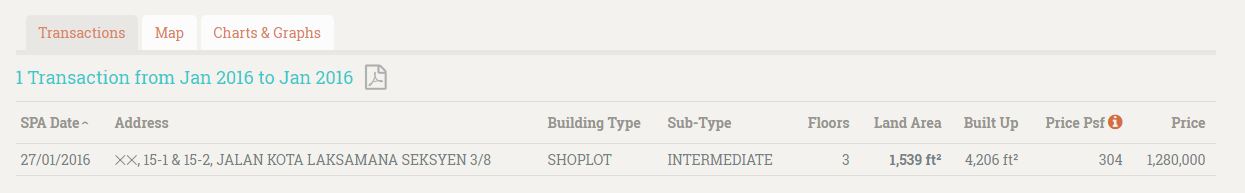

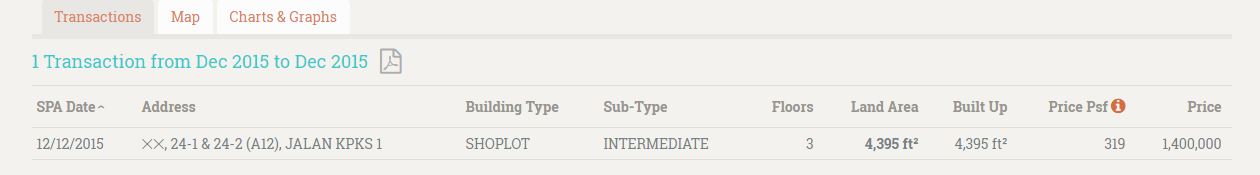

Moreover, Melaka being a UNESCO Heritage site, more land are needed to meet demand due to the restriction of development in the UNESCO site. By 2026, High Speed Rail with a station at Ayer Keroh is expected to spur Melaka growth. In year 2015, Melaka received 12.2 million visitors and we believe this figures will continue to grow in the future. All these events will only further enhance the land value of Benalec currently owns. As of FY 2016, Benalec owns 390 acres of land and 19 Shophouses in Melaka Tengah. Using datas of JPPH (Jabatan Penilaian dan Perkhidmatan Harta), recent transacted land is valued at RM57 per sqft while the recent transacted shophouses is valued at RM1.4 million. This means the properties owned by Benalec in Melaka is already worth a whopping RM420 million.

RM1.2 per share!

Besides the huge value underlies within Benalec, the long term prospect is definitely bright for Benalec. Benalec has secured reclamation contract for both Tanjung Piai Maritime Industrial Park and Pengerang Maritime Industrial Park.

Tanjung Piai Maritime Industrial Park (TPMIP) is an offshore petroleum and petrochemical hub and maritime industrial park. It is expected to capture the spill over demand from Jurong Island, Singapore. It is strategically located within Straits of Melaka, a natural sheltered harbour and it is very suitable for Very Large Crude Carrier (VLCC) to berth due to its natural water depth of more than 20m. This project will till 2035 which will keep Benalec busy for the next 20 years.

TPMIP is carried out by Spectrum Kukuh Sdn Bhd where Benalec has a 70% stake while the Johor crown prince Tunku Ismail Idris Sultan Ibrahim and Daing A. Malek Daing A. Rahaman owned the rest.. As of July, Benalec has inked a memorandum of understanding (MoU) with the company last Friday, which it declined to disclose the details, to conduct a feasibility study with the view of building and operating a greenfield oil storage terminal project at Tanjung Piai Maritime Industrial Park (TPMIP) in Johor. (http://www.thestar.com.my/business/business-news/2016/06/27/benalec-maps-out-strategy-in-johor/)

Just imagine, phase 1 of TPMIP span an area of 1,080 acres. To be conservative, we would only value its land value at RM50 per sqft despite its proximity to Jurong Island, Singapore and i-Parc Industrial Park by Mah Sing Berhad. This has given Benalec a value of RM2.05 per share (70% stake).

Pengerang Maritime Industrial Park (PMIP) is earmarked as a container port to complement with oil & gas downstream industries. It is located only 6KM away from Petronas RAPID project where RAPID is expected to produce 9 million tonnes of petroleum product and 4.5 million tonne of petrochemical product when fully operational. PMIP is expected to take 10 years to develop.

Besides the project undertaken by Benalec currently, we believe Benalec will secure contract from Kuala Linggi International Port (KLIP) expansion. This is a 10 years development project between TAG Marine and China Railway Port & Engineering Group. KLIP is expected to solve the current over congested problem in Singapore ans serve as a storage and transhipment of crude oil which is currently prohibited in the seas of Singapore.

With 23 years of experience and expertise in coastal reclamation, strong existence in West Coast of Peninsular Malaysia, we believe it has a high chance to engage in this project.

In short, bright prospect lies ahead for Benalec and sky is the limit to Benalec share price. A Blue-Chip in the making with strong presence in port and storage service is the road ahead for Benalec.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Bursa Hunter-net-Hunter

Created by kakashit | May 08, 2017

Created by kakashit | Feb 10, 2017