Daily Technical Highlights – APOLLO | ESCERAM

kiasutrader

Publish date: Thu, 11 Feb 2016, 02:49 PM

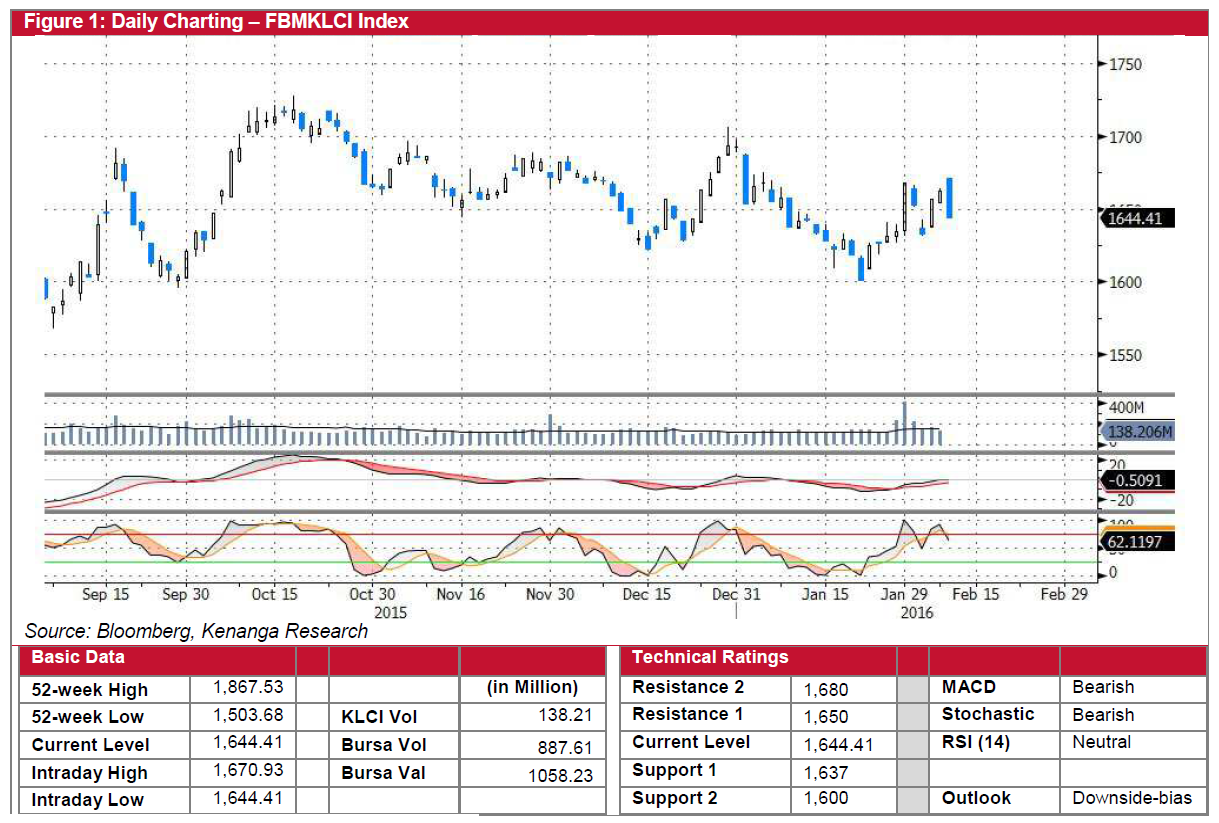

Sharply lower amid thin volume

Key Asian markets finished lower yesterday, as concerns over the health of the global economy drove investors into safe haven assets such as the Japanese Yen. Tracking the regional losses, the local benchmark FBMKLCI was down by 18.05 points (-1.09%) at 1,644.41 on thin volume. Market breadth was also weaker, with 506 losers against 249 gainers and 220 counters finished unchanged. On the daily chart, the FBMKLCI formed a long black candlestick with no shadow, and this reflects the absence of buyers throughout the day. Coupled with the overall bearish trend over the medium-term, we reckon that bias remains to the downside. Near-term support is likely to emerge at 1,637 (S1) and 1,600 (S2) while overhead resistance levels are 1,650 (R1) and 1,680 (R2).

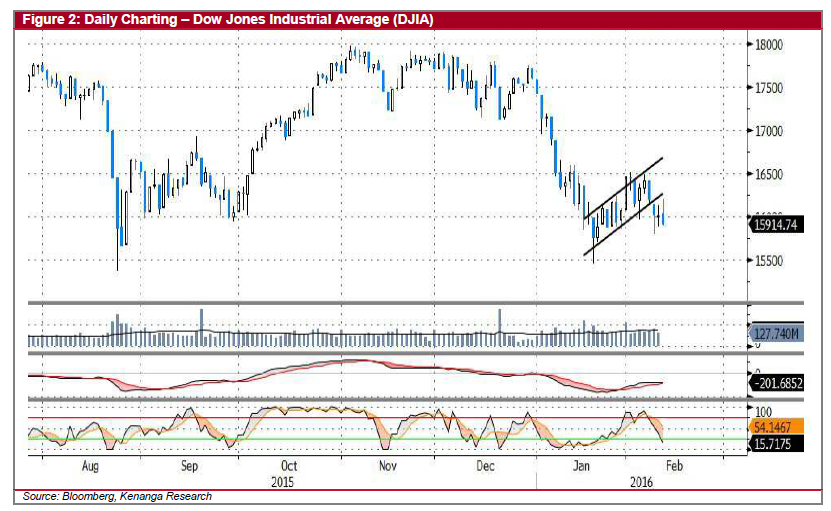

Early rally failed to hold gains

Overnight on Wall Street, stocks ended mixed as investors digested remarks by the Fed Chair Janet Yellen on the state of monetary policy. Meanwhile, the DJIA reversed an earlier rally to finish the day 99.64 points (0.62%) lower at 15,914.74. On the daily chart, the DJIA continued to inch lower for a fourth consecutive day. This follows an earlier breakdown below a “Bearish Flag” pattern on Monday which signals a continuation of its short-term downtrend. At the same time, both the MACD and Stochastic indicators remain in a negative state. Hence, bias remains to the downside with the next support level at 15,700 (S1) and 15,500 (S2). For reactionary or technical rebounds, resistance levels are located at 16,000 (R1) and 16,500 (R2).

Daily technical highlights

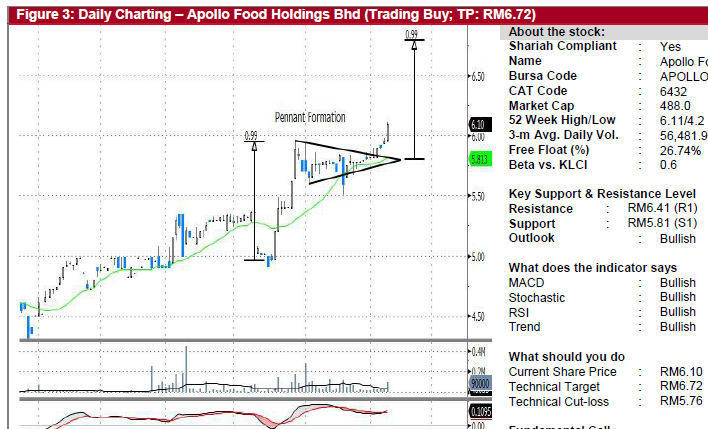

· APOLLO (Trading Buy; TP: RM 6.72). Despite the weak performance on the broader market, APOLLO’s share price rose 14.0 sen (2.35%) to close at RM6.10 on increased trading volume. In December, the company announced its 1H16 earnings which almost doubled YoY to RM20.8m owing to better gross margins and operational efficiency. Indeed, the improving performance is also reflected in the daily chart which shows that the stock has been on an uptrend since middle of last year. In fact, APOLLO had broken out of a “Bullish Pennant” formation last week, with yesterday’s increase in trading volume lending credibility to the pattern. From here, we expect buying interest to continue with a “Flagpole” measurement objective of RM6.78 (look to take profit 6.0 sen below this level). Traders buying into the stock should also employ a stop-loss level at RM5.76 (6.0 sen below the 20-day SMA).

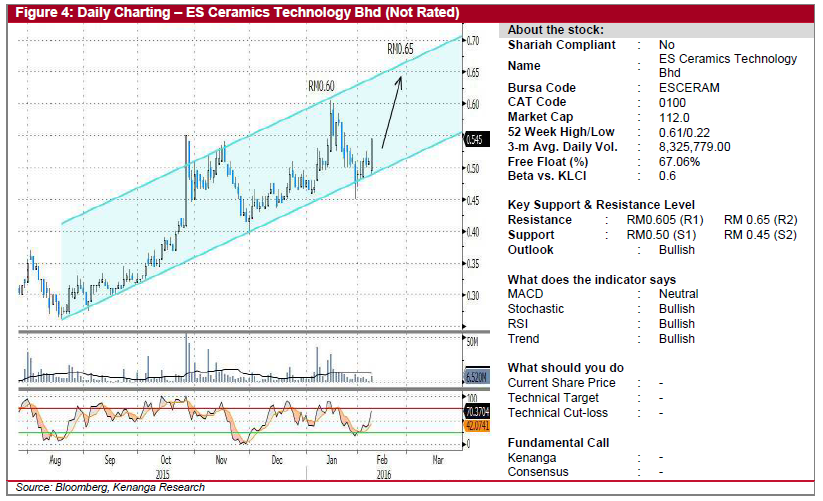

· ESCERAM (Not Rated). Ceramic glove former ESCERAM saw its share price gain 3.5 sen (6.86%) yesterday to close at 54.5 sen. The share price has been trading within an uptrend channel since August 2015, having climbed from a low of 26.0 sen to a recent high of 60.5 sen. Following a healthy pullback last month, ESCERAM appears to have marked a bottom at the channel support and is poised to continue its bullish trend. The Stochastic indicator has also turned bullish to reflect a pick-up in buying momentum. Hence, we expect the share price to move higher to retest the 60.5 sen top (R1). Further up, resistance is envisaged at the channel resistance of 65.0 sen (R2) while downside appears limited at 50.0 sen (S1) and 45.0 sen (S2).

Source: Kenanga Research - 11 Feb 2016

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024