Daily Technical Highlights - (TAWIN, DUFU)

kiasutrader

Publish date: Thu, 01 Jun 2017, 09:25 AM

TAWIN (TP: RM1.12, SL:RM0.825). Recall that earlier in March (report dated 16-Mar @ RM0.625), we recommended TAWIN after the share price broke out of a “Bullish Flag” pattern. Since then, the share price has climbed by as much as 50% to yesterday’s closing price of RM0.94. Although both the RSI and Stochastic indicators are overbought, TAWIN’s overall technical picture remains positive with the primary uptrend intact and share price managing a fresh consolidation breakout yesterday. Rather than taking profit in anticipation of a corrective pullback, we suggest that investors allow the profits to run, while upping the stop-loss to RM0.825 (just below the RM0.84 consolidation support).

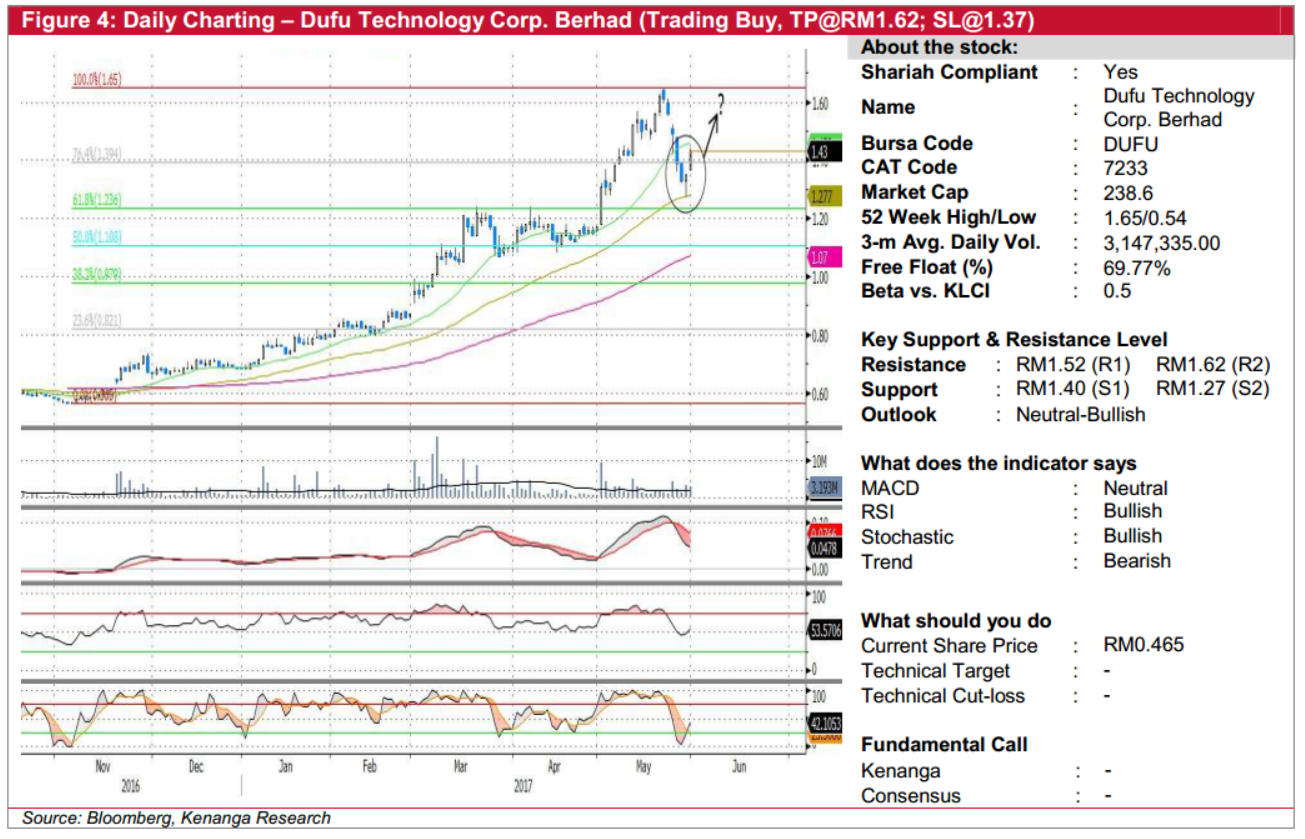

DUFU (Trading Buy, TP@RM1.62; SL@1.37). DUFU has been undergoing profit taking by investors over the past two weeks after it reached an all-time high level of RM1.65 (R2). Nonetheless, the share price has confirmed a bullish reversal with the formation of a white candlestick post the ‘Hammer’ candlestick formed two days ago, closing 8.0 sen (5.93%) higher at RM1.43 yesterday. Daily RSI and Stochastic have also reversed strongly from a low base to indicate improved buying interest on the stock. From here, DUFU could possibly reverse towards RM1.52 (R1) and possibly RM1.62 (3 bids below its previous high level of RM1.65 (R2)). Key support levels are seen at RM1.40 (S1) and RM1.27 (S2), where stoploss are placed at RM1.37 (3 bids below S1).

Source: Kenanga Research - 1 Jun 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024