Daily technical highlights - (HENGYUAN, PENTA)

kiasutrader

Publish date: Wed, 26 Jul 2017, 08:57 AM

HENGYUAN (Not Rated). Among the top gainers for the day was HENGYUAN which rallied 24.0 sen (4.1%) to RM6.14. Trading volume was higher than usual at 3.5m shares, nearly four times the daily average. From a charting perspective, HENGYUAN has been on a healthy uptrend since the start of the year, having tripled from a low of RM2.02 in January to as high as RM6.30 in May. Although the share price staged a healthy pullback subsequently, yesterday’s bullish move has triggered a resistance breakout to signal a continuation of its prior uptrend. From here, we reckon that the share price will retest its RM6.30 (R1) high fairly soon, and should this level be taken out, further gains would then be expected towards RM7.31 (R2) next. Downside support levels are RM5.85 (S1) and RM5.33 (S2) below.

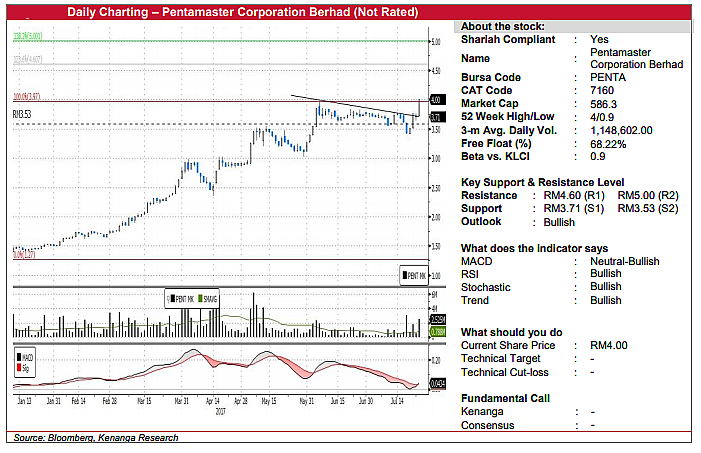

PENTA (Not Rated). Taking cue from the strong overnight close on Nasdaq, PENTA finished at a fresh all-time high of RM4.00, having rallied 29.0 sen (7.8%) for the day. Yesterday’s decisive move signaled a continuation of its major bullish trend after two months of sideways/mild downwards consolidation. The strong gains were supported by a marked increase in trading volume (2.5m shares), triple the SMAVG (20) of 0.8m. Consequently, the MACD has also crossed above its Signal line, reflecting this sudden pick-up in momentum. From here, we expect a move towards the next resistance levels of RM4.60 (R1) and possibly RM5.00 (R2) where the psychological level and Fibonacci projection level overlap. Downside support levels include the former resistance-turned-support at RM3.71 (S1) and RM3.53 (S2) below.

Source: Kenanga Research - 26 Jul 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)