Daily Technical Highlights - (KGB, BKOON)

kiasutrader

Publish date: Wed, 09 Aug 2017, 12:27 PM

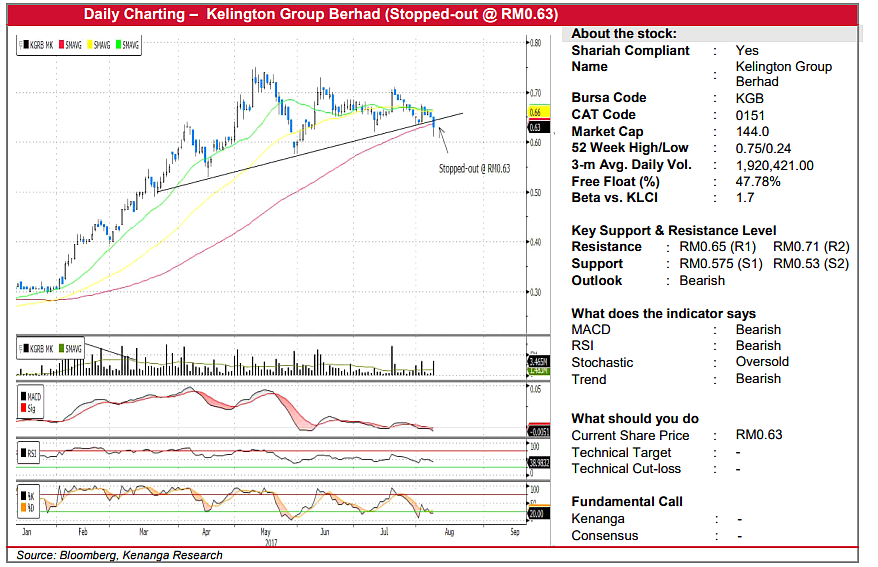

KGB (Stopped-out @ RM0.63). Earlier last month, we recommended a Trading Buy on KGB (report dated 20-Jul) after the share price broke out of a bullish “Symmetrical Triangle” pattern on high volume. Nevertheless, the gains have proven short-lived, with a subsequent retreat back to the uptrend support line over the following weeks. Yesterday, the share price further broke below this crucial support line, along with the 100-day SMA. With our RM0.63 stop-loss now triggered, and the overall technical picture showing a marked deterioration, we bring closure to our TB recommendation for now. Immediate support levels from here are RM0.575 (S1) and RM0.53 (S2) while overhead resistances are RM0.65 (R1) and RM0.71 (R2).

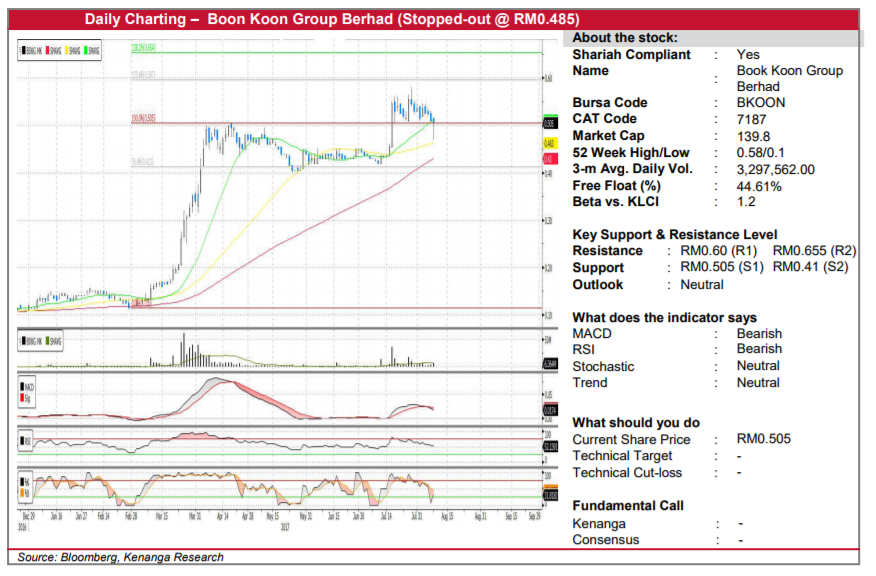

BKOON (Stopped-out @ RM0.485). Last month, we wrote on BKOON with a Trading Buy call after the share finished fresh at its nine-year high (report dated 27-July-2017). Unfortunately, the share performed less than expected, subsequently entering into a period of consolidation. Yesterday, the share hit a low of RM0.47 during its intraday trade before rebounding to close at RM0.505, triggering our stop-loss at RM0.485. Key-indicators are also showing negative signs, with the RSI trending downwards throughout the share’s consolidation phase, coupled with a newly formed bearish crossover between the MACD and its Signal-line. From here, immediate downside is guarded by its immediate support of RM0.505 (S1), in which the share retested during yesterday’s trade, while a significant break below may see the share capitulate towards the lower support at RM0.41 (S2). Meanwhile, upside resistances can be found at RM0.60 (R1) and RM0.655 (R2).

Source: Kenanga Research - 9 Aug 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024