Kenanga Research & Investment

Daily Technical Highlights - (JOHOTIN, HENGYUAN)

kiasutrader

Publish date: Wed, 17 Jan 2018, 03:19 PM

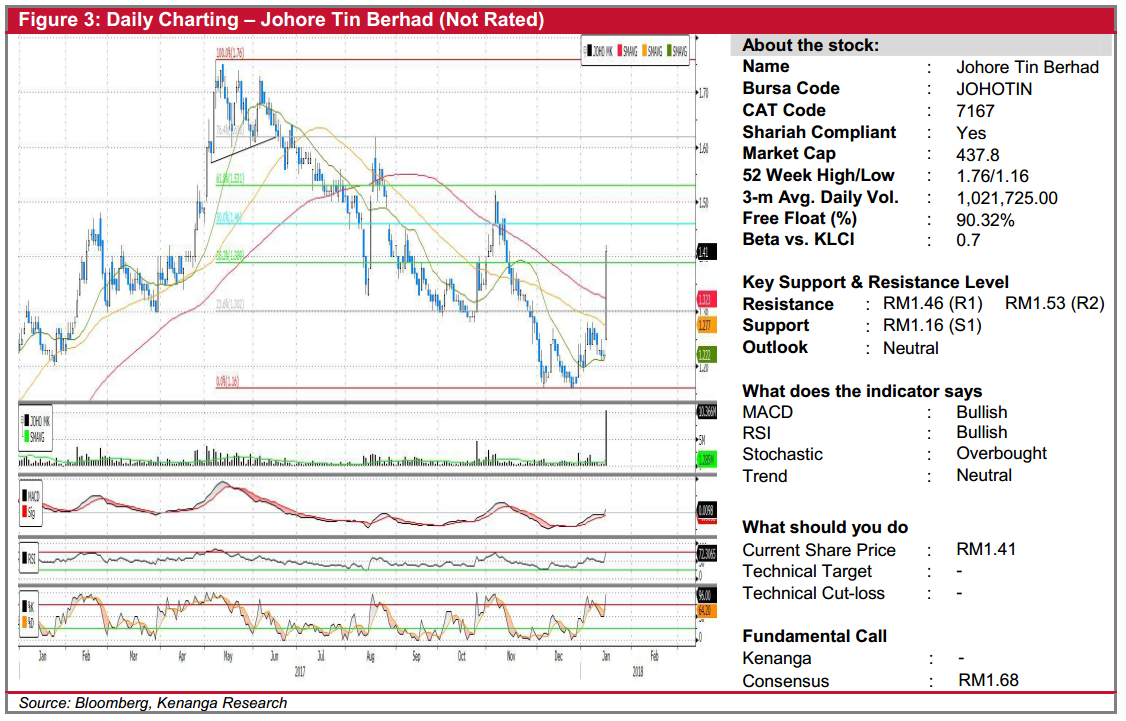

JOHOTIN (Not Rated)

- JOHOTIN advanced 19.0 sen (15.57%) yesterday to close at RM1.41.

- The move was accompanied by strong trading volume and the MACD indicator is showing positive momentum.

- Yesterday's bullish move signals that JOHOTIN has bottomed-out decisively, and is now poised for a recovery.

- Expect follow-through buying from here to bring the share price up to RM1.46 (R1) with further advancement towards RM1.53 (R2). Firm downside support, however, can be identified at RM1.16 (S1).

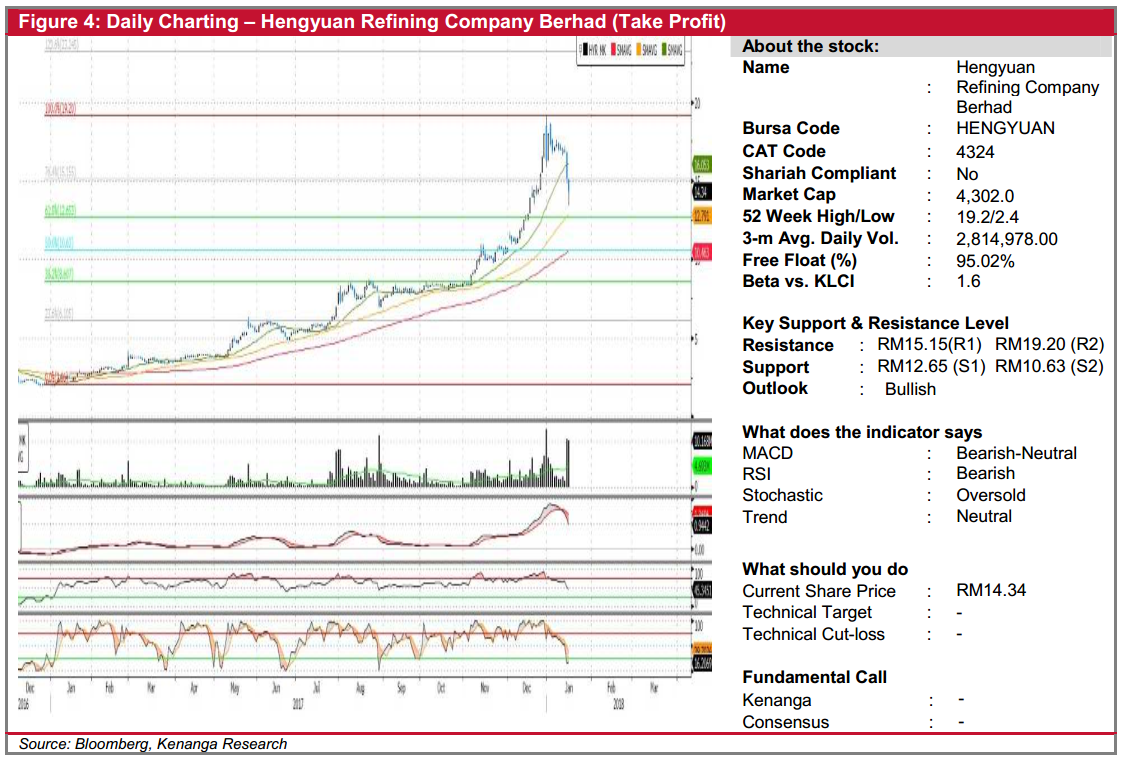

HENGYUAN (Take Profit @ RM14.34)

- Following technical “Trading Buy” call on HENGYUAN in our report dated 7-Nov-2017, the share price has performed remarkably, continuing its uptrend till early Jan 2018.

- However, amidst past two consecutive days of bearish price performance, technical picture is turning more negative. Therefore, prompted us to take profit.

- Taking profit at the current level would imply bagging total gains of 60% in a span of two months.

- Indicators suggest earlier uptrend is losing momentum as MACD crossed below signal line and RSI breakdown from 50 line.

- We reckon near-term consolidation may take place where the risk-reward ratio no longer deemed favourable to keep position.

- Resistance level is identified at RM15.15 (R1) and RM19.20 (R2). Conversely, keen investors could look to a possible reentry at more attractive levels near supports at RM12.65 (S1) and RM10.63 (S2).

Source: Kenanga Research - 17 Jan 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|