Kenanga Research & Investment

Daily Technical Highlights – (SCOMNET, TOPGLOV)

kiasutrader

Publish date: Wed, 24 Jan 2018, 09:56 AM

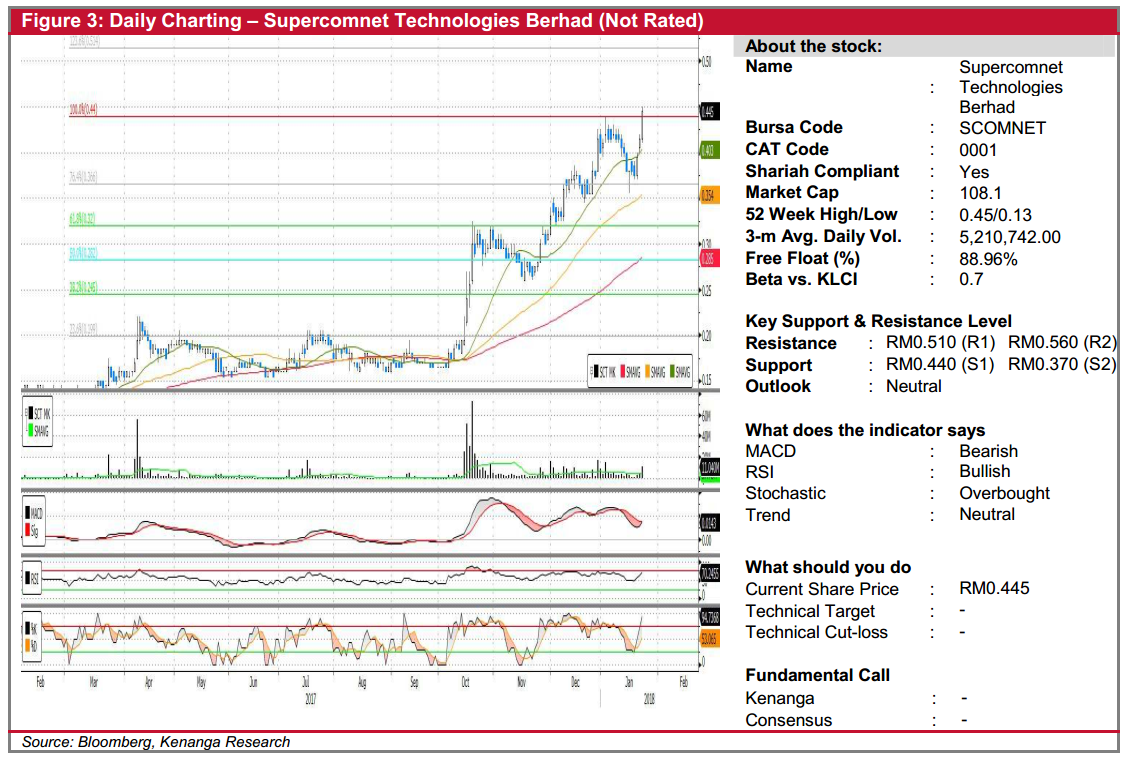

SCOMNET (Not Rated)

- SCOMNET jumped 3.0 sen (7.23%) yesterday to reach RM0.445.

- The share price has generally been on an uptrend since the announcement of the proposed acquisition of a medical device cable manufacturer back in October 2017.

- Yesterday’s move indicates that there is still strong buying interest as shown by the long-white candlestick and the higher than average trading volume.

- Expect follow-through buying from here with resistance at RM0.510 (R1) and RM0.560 (R2) levels. Downside support, on the other hand, can be found at RM0.440 (S1) and RM0.370 (S2) where these levels can be viewed as low-risk entry points.

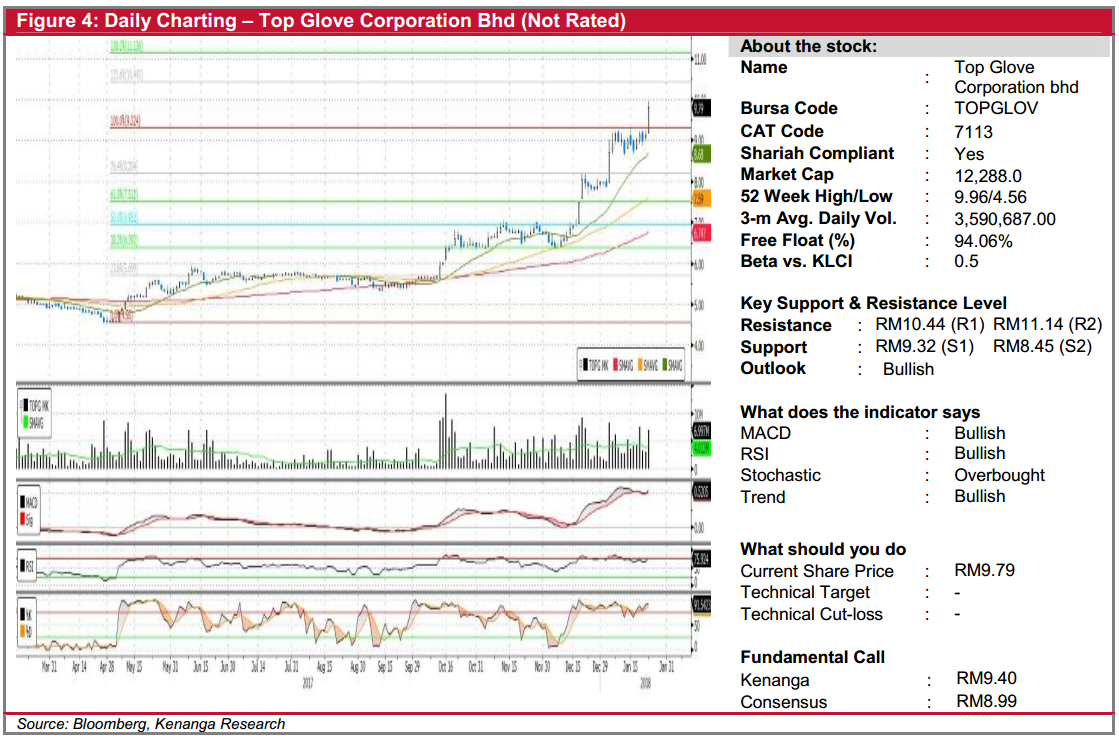

TOPGLOV (Not Rated)

- TOPGLOV surged 64.0 sen to RM9.79 (7.0%) yesterday, accompanied by strong trading volumes.

- Bullish short-to-medium term technical outlook with share price firmly above Key SMAs.

- MACD indicator showed a positive uptick with a ‘bullish crossover’ against the Signal line.

- Expect follow-through buying momentum post breakout towards RM10.44 (R1) and RM11.14 (R2) next.

- Downside support levels can be identified at RM9.32 (S1) and RM8.45 (S2).

Source: Kenanga Research - 24 Jan 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments