Kenanga Research & Investment

Daily Technical Highlights – (IJM, BJLAND)

kiasutrader

Publish date: Wed, 02 May 2018, 09:27 AM

IJM (Not Rated)

- IJM rallied 24.0 sen (8.76%) to end at RM2.98 on Monday.

- From a charting perspective, the share appears to have bottomed out after multiple rebounds from the RM2.53 support level over the past 2 months.

- Monday’s move saw the share closing above the 100-day SMA, completing a ‘Golden Crossover’.

- With the technical outlook improving, expect follow through buying that will see it head towards RM3.07 (R1) with further resistance at RM3.20 (R2).

- Immediate support can be identified at RM2.79 (S1) while a break below it will see the next support at RM2.53 (S2).

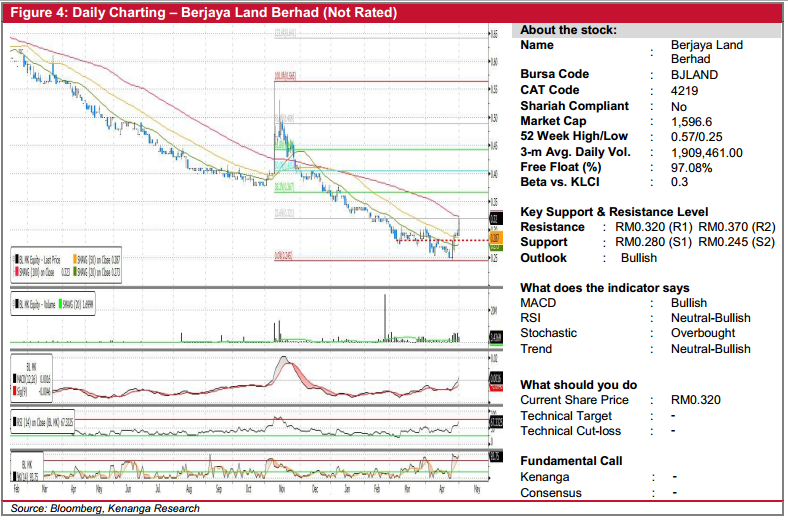

BJLAND (Not Rated)

- Monday’s close, BJLAND gained 3.0 sen (10.34%) to close at RM0.320

- The recent rallies by BJLAND could suggest a downtrend reversal as the share appears to have bottomed out last week.

- Over the past few days, it has been firmly hovering above the 20-day and 50-day SMAs with trading volume notably stronger than the average.

- Momentum indicators are generally positive as displayed by the uptrend of the MACD above Signal-line as well as upticks in both RSI and Stochastic.

- Should buying interest sustain, expect the BJLAND to rally towards RM0.320 (R1) with a decisive breakout would see the share on a clear path towards higher resistance at RM0.370 (R2).

- Otherwise, expect retracement with immediate supports level at RM0.280 (S1) and RM0.245 (S2).

Source: Kenanga Research - 2 May 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

IJM2024-11-26

IJM2024-11-26

IJM2024-11-26

IJM2024-11-26

IJM2024-11-26

IJM2024-11-26

IJM2024-11-26

IJM2024-11-26

IJM2024-11-26

IJM2024-11-26

IJM2024-11-25

BJLAND2024-11-25

IJM2024-11-25

IJM2024-11-25

IJM2024-11-25

IJM2024-11-22

IJM2024-11-22

IJM2024-11-22

IJM2024-11-21

IJM2024-11-21

IJM2024-11-21

IJM2024-11-20

IJM2024-11-20

IJM2024-11-19

IJM2024-11-18

IJMMore articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments