Kenanga Research & Investment

Daily Technical Highlights – (AWC, CJCEN)

kiasutrader

Publish date: Tue, 21 Aug 2018, 09:34 AM

AWC (Not Rated)

- Yesterday, AWC gained 2.0 sen (+2.48%) to close at RM0.825 on the back of stronger than the 20-day average.

- The share has been trending upwards after it bottomed-out in June with MACD continuously in bullish convergence, possibly signal an uptrend continuation.

- Notably, momentum indicators appear in supportive for the next move higher, as displayed by a bullish MACD-crossover coupled with rising RSI to suggest a return of buying interest.

- Should buying momentum be sustained, expect the share to advance towards RM0.885 (R1) before trending higher towards RM0.950 (R2).

- Meanwhile, immediate downside support is identified at RM0.800 (S1) with the next support level found at RM0.735 (S2).

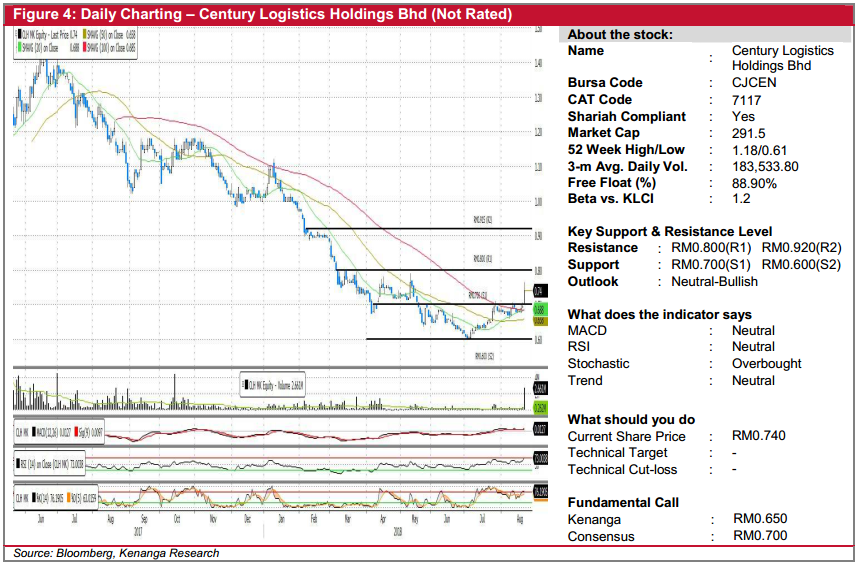

CJCEN (Not Rated)

- CJCEN gained 4.5 sen (+6.47%) to close at RM0.740 yesterday, backed by explosive trading volume with 2.6m share exchanging hands 10-fold its 20-day average.

- Yesterday’s move also marked a breakout from the prior key resistance level of RM0.700 which it tested multiple times previously potentially to signal a recovery.

- Should a follow-through buying continue, expect CJCEN to climb towards next resistance level of RM0.800 (R1), with a decisive takedown will see the share on a higher note towards RM0.920 (R2) further up.

- Conversely, support levels are seen at resistance-turned-support RM0.700 (S1) with the next support level identified at RM0.600 (S2).

Source: Kenanga Research - 21 Aug 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments