Kenanga Research & Investment

Daily Technical Highlights – (KGB, PMETAL)

kiasutrader

Publish date: Fri, 05 Oct 2018, 09:03 AM

KGB (Take Profit @ RM1.23)

- KGB gained 4.0 sen (+3.36%) to close at RM1.23 yesterday.

- Since our ‘Trading Buy’ call in early-September (total gains 33%), the share has enjoyed an exceptional rally, reaching a high of RM1.27 yesterday. Notably, yesterday’s candlestick closed with a long upper wick which could indicate a slow-down in bullish momentum. Key momentum indicators such as RSI and stochastic are also displaying overbought signals. Thus, we opine that a retracement may happen.

- We decide to take profit for now to realise our 32.97% gain. However, should KGB retrace to an attractive level, we may consider calling another trading buy.

- With that said, immediate support level can be identified at RM1.17 (S1) and RM1.13 (S2). Conversely, should buying momentum continue, we look towards RM1.30 (R1) and RM1.39 (R2) as resistances.

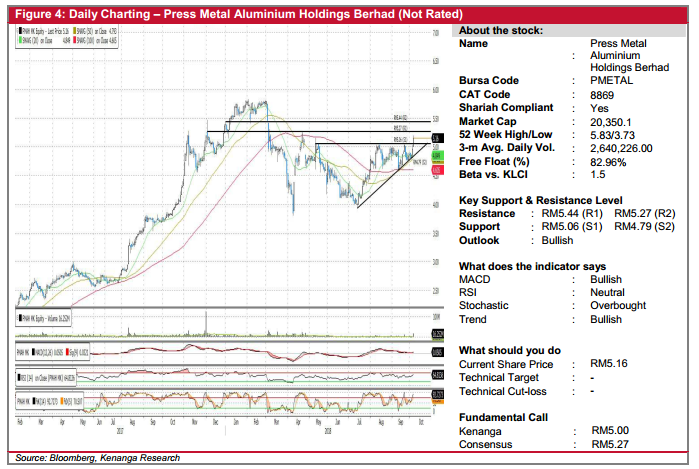

PMETAL (Not Rated)

- PMETAL rose 20.0 sen (+4.03%) to close at RM5.16, backed by exceptional trading volume.

- Technically, the share has been trading within an ascending triangle since May. Yesterday’s close saw PMETAL breaking above the top horizontal line of the ascending triangle, which has proven to be a significant level. Coupled with positive signals from key momentum indicators, we think that there may be more room for upside.

- Immediate resistance can be identified at RM5.27 (R1) and further ahead at RM5.44 (R2).

- On the other hand, support levels can be identified at RM5.06 (S1) and RM4.79 (S2).

Source: Kenanga Research - 5 Oct 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-29

KGB2024-11-29

KGB2024-11-29

KGB2024-11-29

KGB2024-11-29

KGB2024-11-29

KGB2024-11-29

KGB2024-11-29

KGB2024-11-29

KGB2024-11-29

PMETAL2024-11-29

PMETAL2024-11-28

KGB2024-11-27

KGB2024-11-27

KGB2024-11-26

KGB2024-11-26

KGB2024-11-26

KGB2024-11-26

KGB2024-11-26

KGB2024-11-25

KGB2024-11-25

KGB2024-11-21

KGB2024-11-19

KGB2024-11-19

PMETALMore articles on Kenanga Research & Investment

Bond Market Weekly Outlook - Local yields may rise moderately ahead of US jobs report

Created by kiasutrader | Nov 29, 2024

- Ringgit Weekly Outlook Fairly balanced risks, but potential USD rebound looms over risk assets

Created by kiasutrader | Nov 29, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments