Daily technical highlights – (MRCB, CARLSBG)

kiasutrader

Publish date: Thu, 18 Oct 2018, 08:53 AM

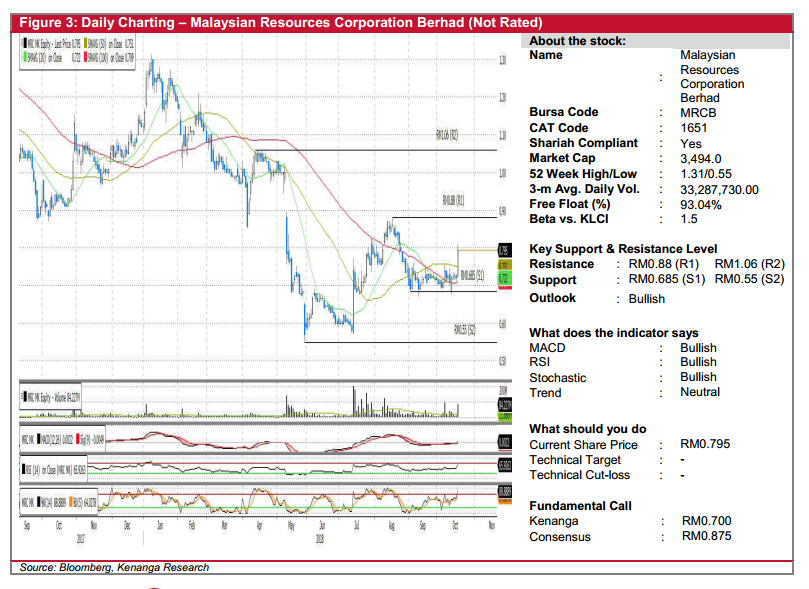

MRCB (Not Rated)

• Yesterday, MRCB jumped 7.5 sen (+10.4%) to close at RM0.795 on the back of exceptional trading volumes.

• More notably, yesterday’s move could serve as a breakout from its consolidation phase since early-Sep, with the potentially bullish outlook further backed by positive upticks from key indicators.

• From here, sustained interest should bring the share towards resistances at RM0.88 (R1) and possibly pre-election levels of around RM1.06 (R2).

• Conversely, keen investors may also look to collect at resilient support levels at RM0.685 (S1) and RM0.55 (S2).

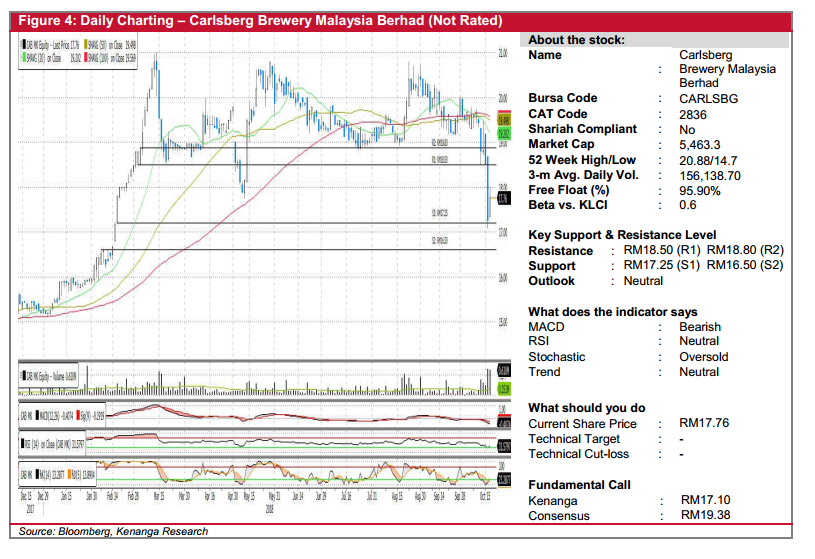

CARLSBG (Not Rated)

• CARLSBG gained 50.0 sen (+2.90%) to end at RM17.76 last night on stronger-than-average trading volume

• After the major sell-down that happened over the past few days, the share appears to have rebounded with meaningful upticks in the stochastic indicators.

• We believe that there may be a short-term rally to its resistance at RM18.50 (R1) and RM18.80 (R2).

• Should the rally be short-lived, downside supports can be identified at RM17.25 (S1) and RM16.50 (S2).

Source: Kenanga Research - 18 Oct 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|