Kenanga Research & Investment

Daily Technical Highlights – (KGB, PENTA)

kiasutrader

Publish date: Fri, 16 Nov 2018, 08:49 AM

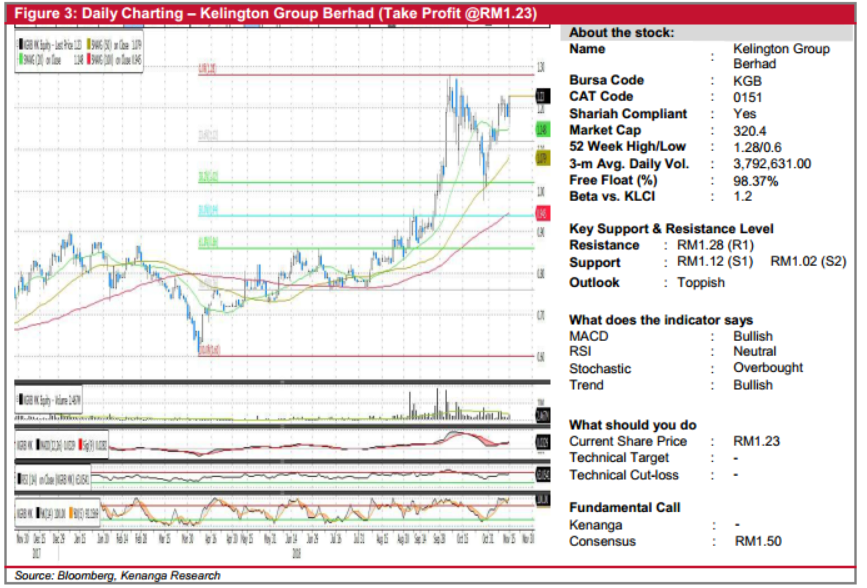

KGB (Take Profit @ RM1.23)

- KGB gained 5.0 sen (+4.24%) to close at RM1.23 yesterday.

- Chart-wise, the share has been enjoying a rally since our open position late last month before meeting some sideways consolidation this week.

- With diminishing trading volumes of late, coupled with overbought stochastic indicator, we reckon the share may be becoming toppish at this juncture, and hence, have decided to ‘Take Profit’ for now, with the share also now hovering close to our initial technical target at RM1.25 – reeking in gains of 18% over a span of just two weeks.

- From here, watch out for overhead resistance at RM1.28 (R1), as a decisive takeout may pave a start to a new uptrend.

- Conversely, immediate support level can be identified at RM1.12 (S1) and RM1.02 (S2), where we may consider a re-entry should the technical picture appears attractive again.

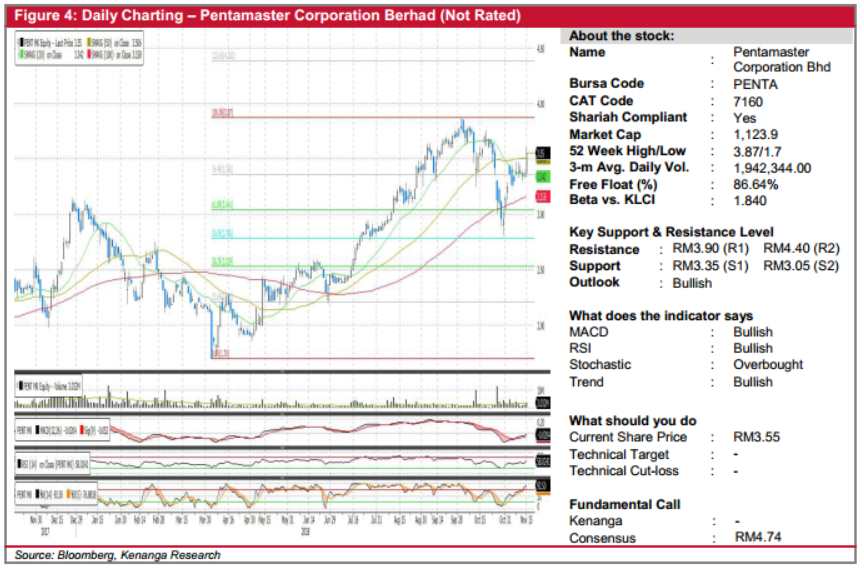

PENTA (Not Rated)

- Yesterday, PENTA gained 20.0 sen (+5.97%) to close at RM3.55.

- Chart-wise, the share has been on an uptrend since March, with yesterday move that saw the share closing above 20 and 50-day SMAs.

- Momentum indicators appear supportive for a bullish move as indicated by the bullish MACD, RSI and Stochastic.

- Should buying momentum be sustained, we look towards RM3.90 (R1) and RM4.40 (R2).

- Conversely immediate support level can be seen at RM3.35 (S1) and further down towards RM3.05 (S2).

Source: Kenanga Research - 16 Nov 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments