Daily technical highlights – (TM, CARIMIN)

kiasutrader

Publish date: Fri, 07 Dec 2018, 08:48 AM

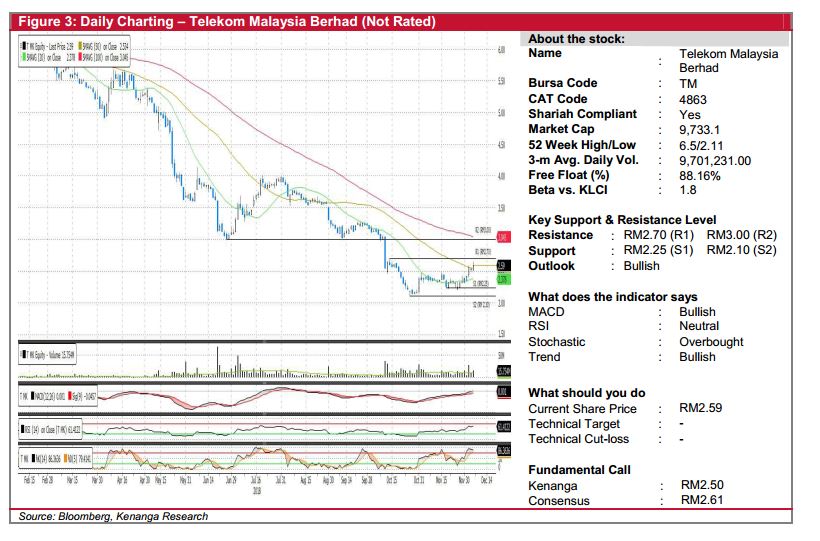

TM (Not Rated)

• Yesterday, TM gained 5.0 sen (1.97%) to close at RM2.59.

• Chart-wise, TM has been on a downtrend since early-May after the new government stance on cheaper broadband price saw major sell-down by investors.

• However, recent share price movement is positive with it trending above both the 20 and 50-day SMA.

• Coupled with positivity shown from other key momentum indicators, the share may test its immediate resistance at RM2.70 (R1) while a break above it will see next resistance at RM3.00 (R2).

• Conversely, downside support level can be found at RM2.25 (S1) and RM2.10 (S2).

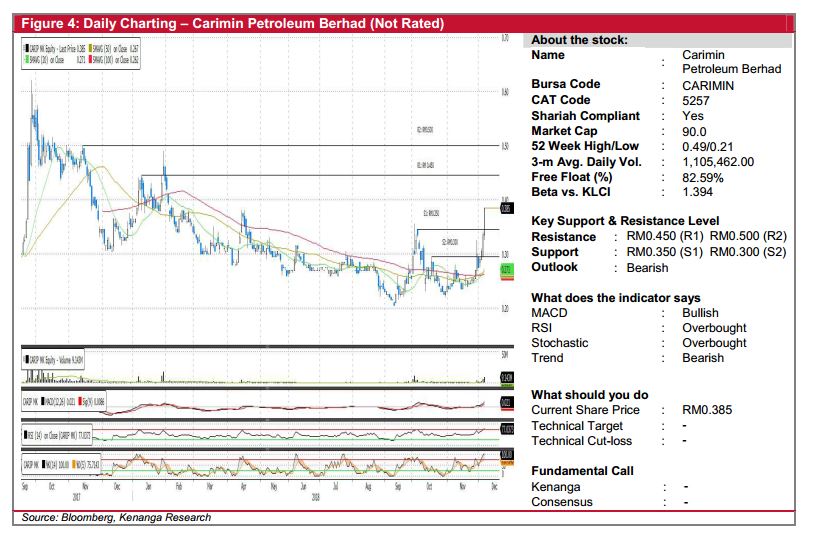

CARIMIN (Not Rated)

• CARIMIN shot up 5.0 sen (+14.93%) yesterday to close at RM0.385.

• Over the past few days, the share rallied and broke above the RM0.350 resistance level. This was also accompanied by strong trading volume.

• However, we believe that there is a possibility of short-term retracement as both the RSI and Stochastic indicators are in the overbought zone.

• Expect the share to temporarily retrace back to its support levels of RM0.350 (S1) and RM0.300 (S2) before staging another upward movement towards RM0.450 (R1) and RM0.500 (R2) resistance levels.

Source: Kenanga Research - 7 Dec 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-25

TM2024-11-22

TM2024-11-22

TM2024-11-22

TM2024-11-21

CARIMIN2024-11-21

CARIMIN2024-11-21

CARIMIN2024-11-21

TM2024-11-21

TM2024-11-21

TM2024-11-20

TM2024-11-20

TM2024-11-20

TM2024-11-20

TM2024-11-19

TM2024-11-19

TM2024-11-19

TM2024-11-18

TM2024-11-18

TM2024-11-18

TM2024-11-15

TM2024-11-15

TM2024-11-15

TM