Daily technical highlights – (BAUTO, DIALOG)

kiasutrader

Publish date: Wed, 12 Dec 2018, 09:00 AM

BAUTO (Not Rated)

• BAUTO gained 2.0 sen (+0.94%) yesterday to close at RM2.14

• Chart-wise, the share staged a rally during early November before hitting RM2.16 and started to move sideways then.

• However, recent share price movement saw it break above both the 20 and 100-day SMAs. Moreover, other momentum indicators are still in positive mode.

• We believe the share is likely to stage another rally and to test its immediate resistance at RM2.30 (R1), where a break above will see next resistance at RM2.50 (R2).

• Should there be negative news flow, downside supports can be identified at RM2.00 (S1) and RM1.80 (S2)

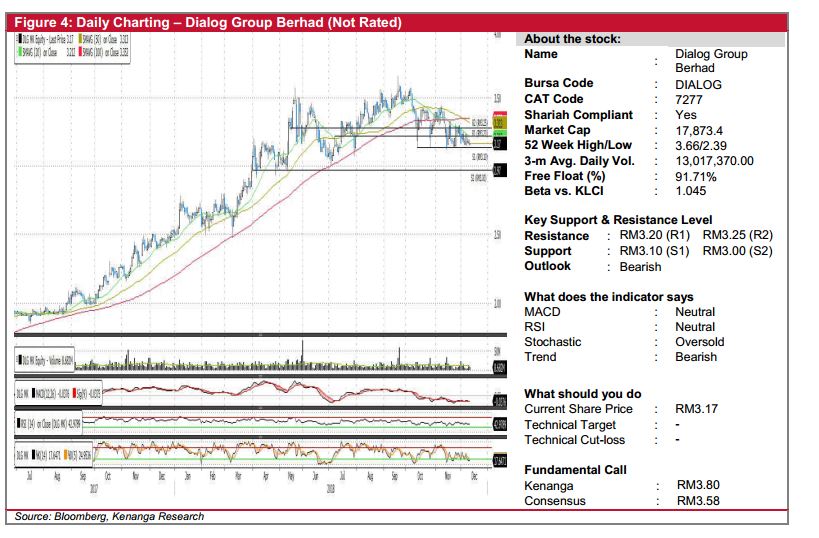

DIALOG (Not Rated)

• DIALOG closed at RM3.17 yesterday, unchanged from the previous day’s close.

• Technically, the share has been trading sideways since early-August. However, we believe there might be a possibility of a downtrend given that the recent share price movement has seen it trading below all the key SMAs, forming a ‘Death Cross’.

• Moreover, trading volume was low and other key momentum indicators lacklustre.

• Should the selling pressure follow through, we expect it to fall to its support levels at RM3.10 (S1) and RM3.00 (S2).

• Conversely, positive news may see it test its resistances at RM3.20 (R1) and RM3.25 (R2).

Source: Kenanga Research - 12 Dec 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

BAUTO2024-11-26

BAUTO2024-11-26

BAUTO2024-11-26

BAUTO2024-11-26

DIALOG2024-11-22

DIALOG2024-11-22

DIALOG2024-11-21

DIALOG2024-11-21

DIALOG2024-11-20

BAUTO2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-19

BAUTO2024-11-19

DIALOG2024-11-18

DIALOG2024-11-15

BAUTO