Kenanga Research & Investment

Daily Technical Highlights – (CARIMIN, JTIASA)

kiasutrader

Publish date: Fri, 04 Jan 2019, 09:28 AM

CARIMIN (Not Rated)

- Yesterday, CARIMIN rose 7.0 sen (+16.28%) to close at RM0.500 on higher-than-average trading volume.

- The share started to rally after going through a retracement that occurred last month. Notably, yesterday’s long white candlestick managed to break and close above the resistance level at RM0.465, which has been tested twice previously, signalling strong buying momentum.

- Additionally, momentum indicators continue to display positive upticks, prompting for possibility of a continuation of the rally.

- Should positive momentum persist, expect to find resistance at RM0.550 (R1) and RM0.620 (R2).

- Conversely, downside supports can be found at RM0.400 (S1) and RM0.420 (S2).

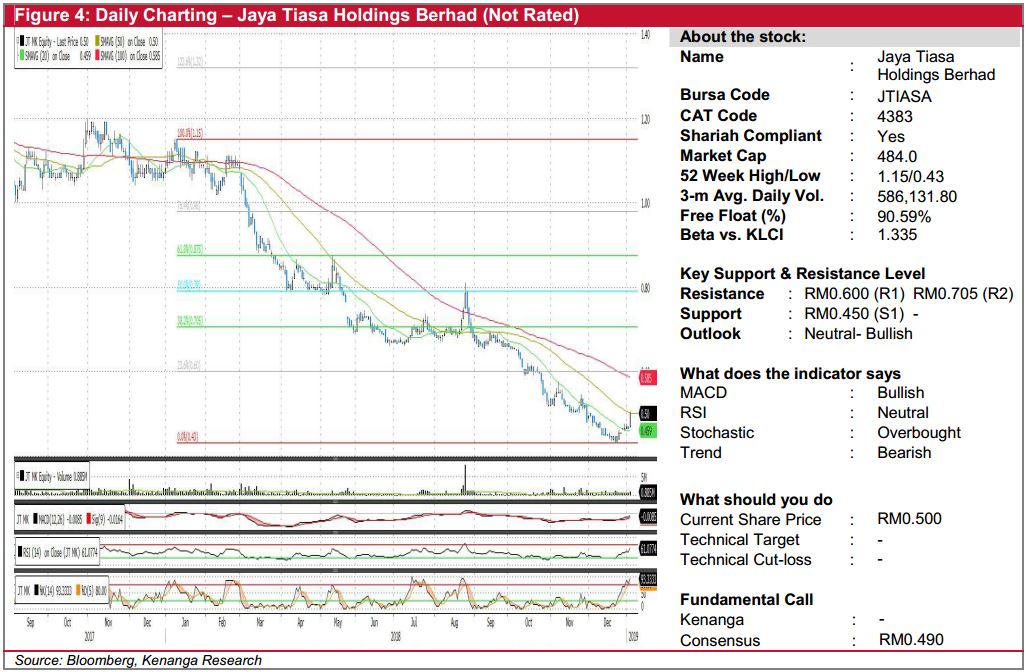

JTIASA (Not Rated)

- Yesterday, JTIASA gained 3.5 sen (+7.53%), to close at RM0.500.

- Technically, yesterday’s bullish candlestick could suggest a reversal as the share appears to have bottomed out.

- Indicators are displaying improvement with MACD crossing above the signal line while other oscillators are showing meaningful upticks.

- From here, expect JTIASA to advance towards RM0.600 (R1) closer to its 100-day SMA. Should this level be taken out, next resistance level to target is RM0.705 (R2).

- Conversely, watch out for the immediate support level at RM0.450 (S1), where a break below is deemed highly negative.

Source: Kenanga Research - 4 Jan 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments