Kenanga Research & Investment

Daily Technical Highlights – (LAYHONG, CARIMIN)

kiasutrader

Publish date: Fri, 08 Feb 2019, 09:50 AM

LAYHONG (Not Rated)

- LAYHONG rose 1.5 sen (+3.75%) to close at RM0.415.

- Chart-wise, the share has been consolidating since late Oct-18. We note that the 20-day SMA has crossed above the 50-day SMA recently and key SMAs continue to contract. This, coupled with upticks from key momentum indicators leads us to believe that there could be potential upside to LAYHONG.

- Should the buying momentum emerge, we look towards RM0.500 (R1) as the first resistance level. Should the first level be taken out, the next resistance level can be found at RM0.600 (R2).

- Conversely, support levels can be identified at RM0.400 (S1) and RM0.330 (S2).

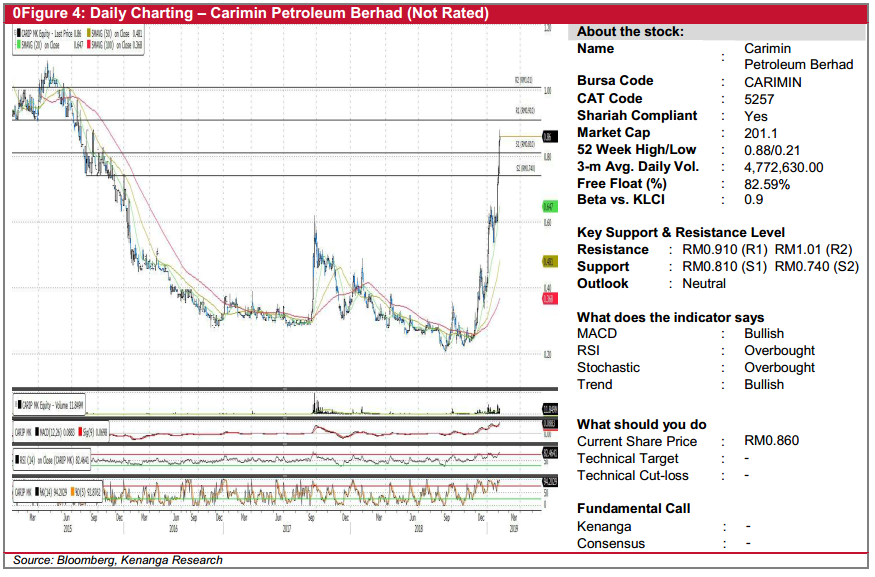

CARIMIN (Not Rated)

- CARIMIN gained 1.5 sen (+1.77%) yesterday to close at RM0.860.

- Chart-wise, the share has been on a massive rally since mid-Dec 2018. However, we believe that the rally is overextended and that a retracement is due to happen soon.

- We note the formation of a candlestick with long upper and lower tails yesterday signifying slowdown in buying momentum. Coupled with overbought signals from RSI and stochastic indicators, we believe that a correction may happen.

- Expect CARIMIN to retrace and find immediate support at RM0.810 (S1) and further below at RM0.740 (S2).

- On the other hand, should the buying momentum continue, we expect the share to face resistances at RM0.910 (R1) and RM1.01 (R2).

Source: Kenanga Research - 8 Feb 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments