Kenanga Research & Investment

Daily Technical Highlights – (WIDAD, FGV)

kiasutrader

Publish date: Thu, 28 Feb 2019, 10:47 AM

WIDAD (Not Rated)

- Yesterday, WIDAD rose 0.5 sen (+1.45%) to close at RM0.350, on the back of higher-than-average trading volume.

- Chart-wise, the share has been on an uptrend after the formation of a “Golden Cross” earlier this month.

- Notably, the share is currently trading above all its SMAs underpinned by positive upticks from key momentum indicators, which may indicate more upside possibilities.

- Expect the share to test resistance at RM0.390 (R1) and RM0.415 (R2).

- Conversely, support levels can be identified at RM0.300 (S1) and RM0.270 (S2).

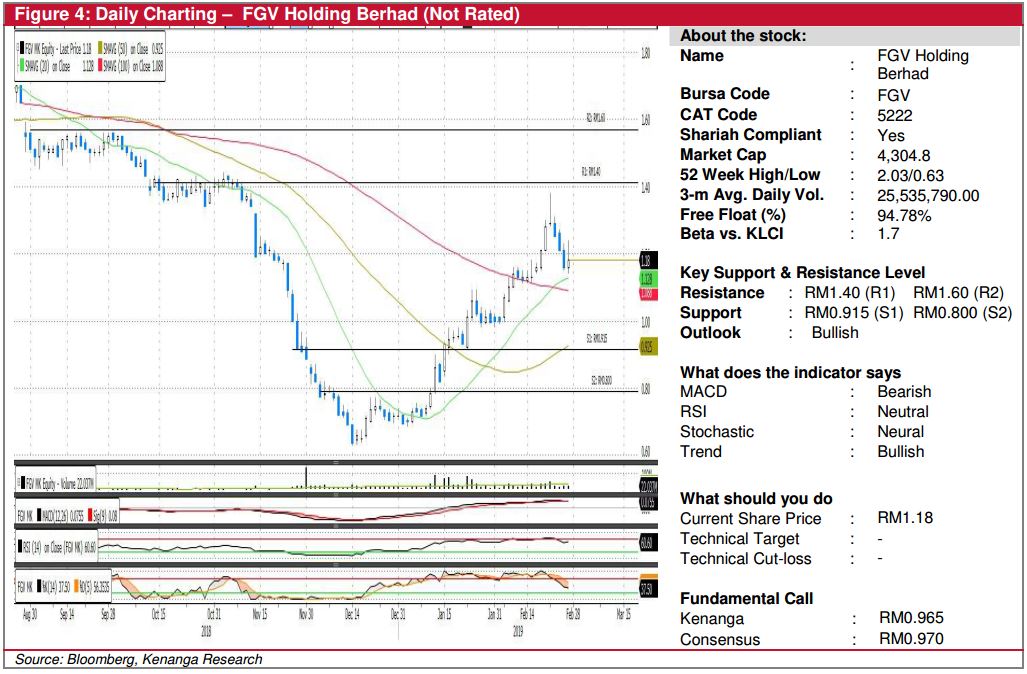

FGV (Not Rated)

- FGV gained 2.0 sen (1.72%) to close at RM1.18.

- The share has been on an uptrend since mid-December and has gradually ascended above all key SMAs.

- Yesterday candlestick formed a bullish candlestick, putting a stop to the three day consecutive drop which we believe to be a near term retracement.

- From here on we expect the share to rebound towards RM1.40 (R1) and RM1.60 (S2), backed by its increasing trading volume and positive upticks in key SMAs.

- Conversely, downside risks are identified at RM0.915 (S1) support level and RM0.800 (S2).

Source: Kenanga Research - 28 Feb 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments