Kenanga Research & Investment

Daily Technical Highlights – (FRONTKN, OPCOM)

kiasutrader

Publish date: Fri, 29 Mar 2019, 11:13 AM

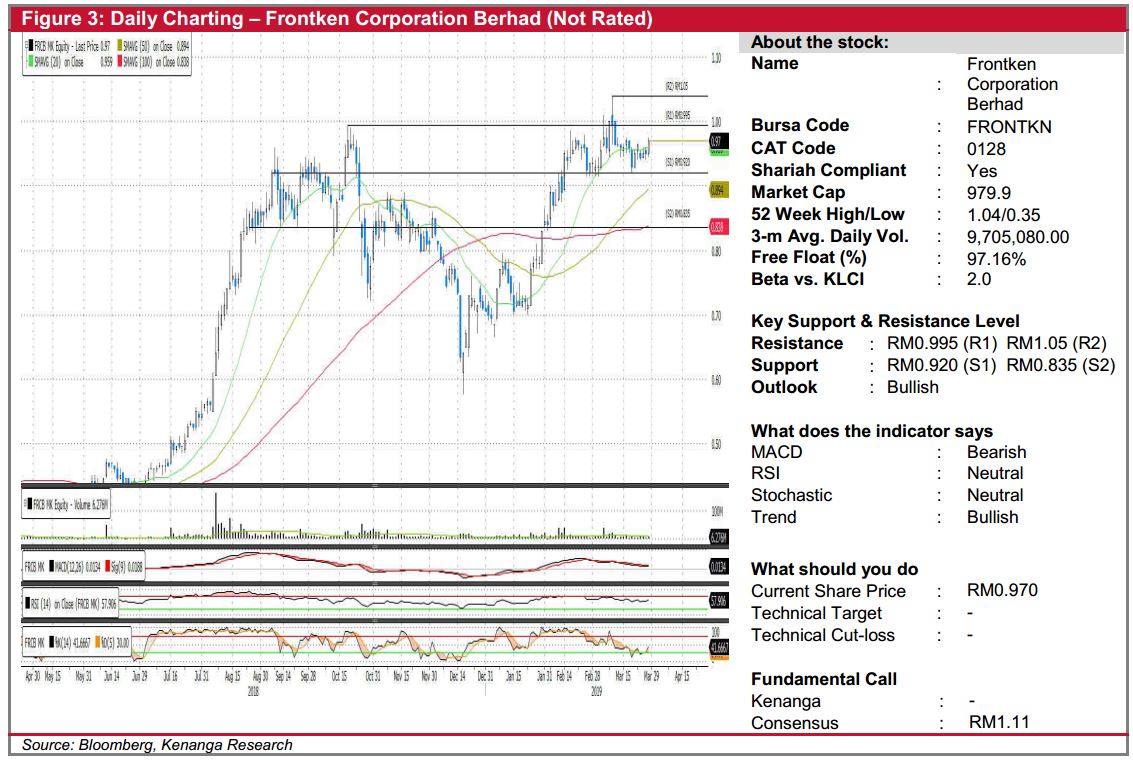

FRONTKN (Not Rated)

- FRONTKN gained 2.0 sen (+2.11%) to end at RM0.970.

- Last year, the share took a dip in mid-October and trended below all key SMAs till mid-December before starting its rally. We believe the rally could persist given that upticks in key momentum indicators. Stochastic is also bouncing off from oversold level, which leads us to believe that there could be further upside.

- We expect the share to test its overhead resistance at RM0.995 (R1) and RM1.05 (R2).

- Meanwhile, downside supports can be seen at RM0.920 (S1) and RM0.835 (S2).

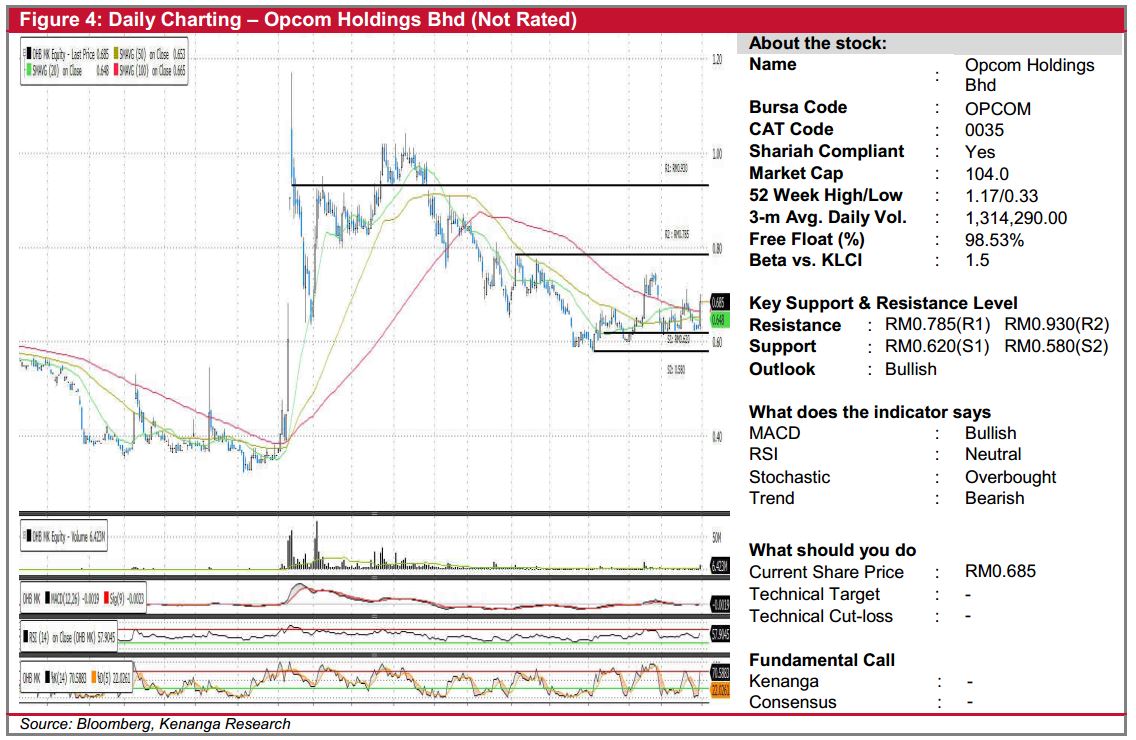

OPCOM (Not Rated)

- Yesterday, OPCOM gained 5.5 sen (8.73%) to close at RM0.685 backed by above-average trading volume.

- In late-February, the share has experienced a sharp decline with the formation of three consecutive bearish candlesticks. However, the share soon found support at RM0.620 (S1) and has since traded between its key SMAs.

- Yesterday share saw a formation of a long bullish candlestick that punched through all key SMAs, indicating strong buying momentum. Coupled with encouraging upticks in key technical indicators, we believe the rally is yet to be over.

- Expect the share to test its resistance at RM0.785 (R1) and RM0.930 (R2.)

- Conversely, downside support can be found at RM0.620 (S1) and RM0.580 (S2).

Source: Kenanga Research - 29 Mar 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments