Kenanga Research & Investment

Daily Technical Highlights – (SIGN, CCK)

kiasutrader

Publish date: Thu, 25 Apr 2019, 08:51 AM

SIGN (Not Rated)

- SIGN gained 2.5 sen (+4.95%) to close at RM0.530 yesterday on the back of stronger- than-average trading volume.

- Chart-wise, SIGN has been on uptrend since end-February, leading all key moving averages upwards in a fanning state.

- Continuation of the bullish trend is further backed by improvement seen in key momentum indicators while key SMAs remains in “Golden Cross” state.

- Should follow through buying momentum be sustained, expect the share to advance towards RM0.565 (R1), with a decisive takedown will then see next resistance RM0.640 (R2).

- Downside support level can be found at RM0.470 (S1) and RM0.400 (S2).

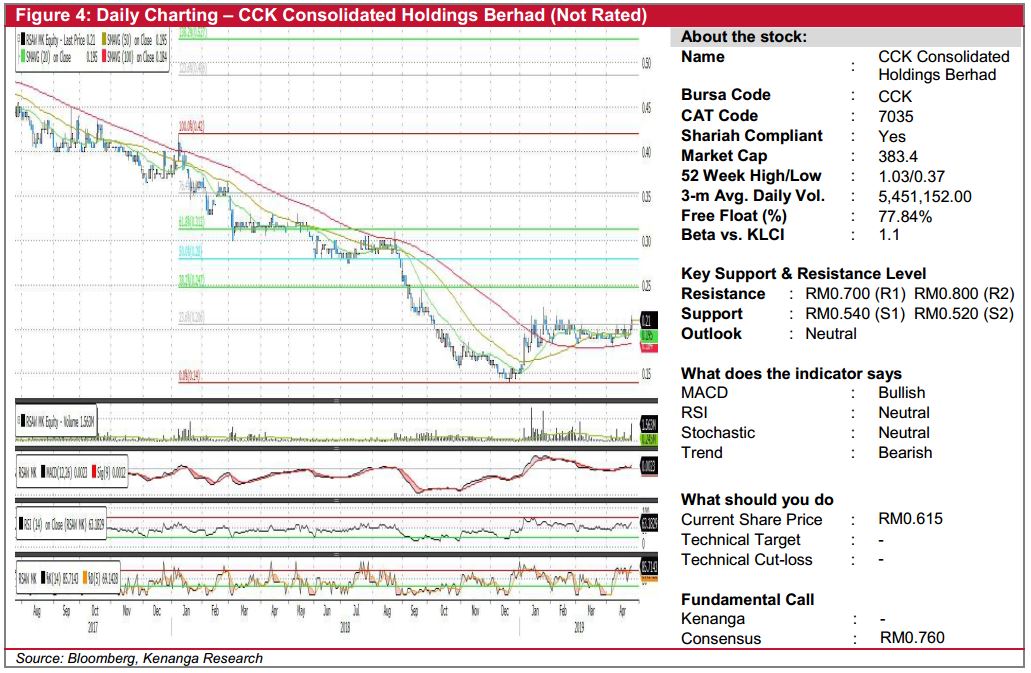

CCK (Not Rated)

- CCK gained 3.0 sen (+5.13%) to close at RM0.615 on higher-than-average trading volume.

- Chart-wise, yesterday’s close marking the share breaking out from its 20-day SMA.

- Momentum indicators are increasingly positive as displayed by the bullish MACD crossover and upticks seen in RSI and Stochastic.

- From here, key resistances to look out for are RM0.700 (R1) and RM0.800 (R2) further up.

- Conversely, immediate support level can be found at RM0.540 (S1), closer to its 100-day SMA, with the next support level at RM0.520 (S2).

Source: Kenanga Research - 25 Apr 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments