Kenanga Research & Investment

Daily Technical Highlights – (YINSON, MRCB)

kiasutrader

Publish date: Thu, 16 May 2019, 08:54 AM

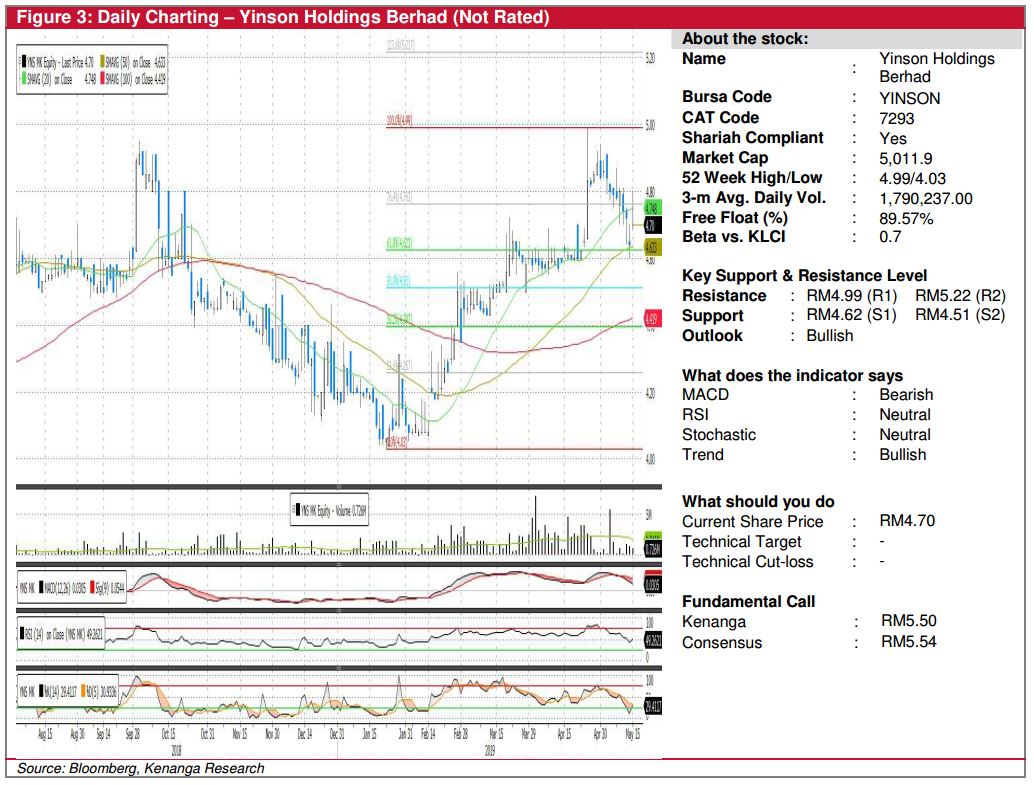

YINSON (Not Rated)

- Yesterday, YINSON rose 6.0 sen (+1.29%) to close at RM4.70.

- Lately, the share has been taking a breather from its bullish run that started since the beginning of this year. Nevertheless, the trading volumes that came with the correction were uninspiring, prompting us to believe that the rally may yet be over.

- Furthermore, stochastic indicator was seen rebounding from the oversold zone.

- Expect the share to test its decisive resistance at RM4.99 (R1), where a decisive takeout of R1 should see the next resistance at RM5.22 (R2).

- Conversely, support levels can be found at RM4.62 (S1) and RM4.51 (S2).

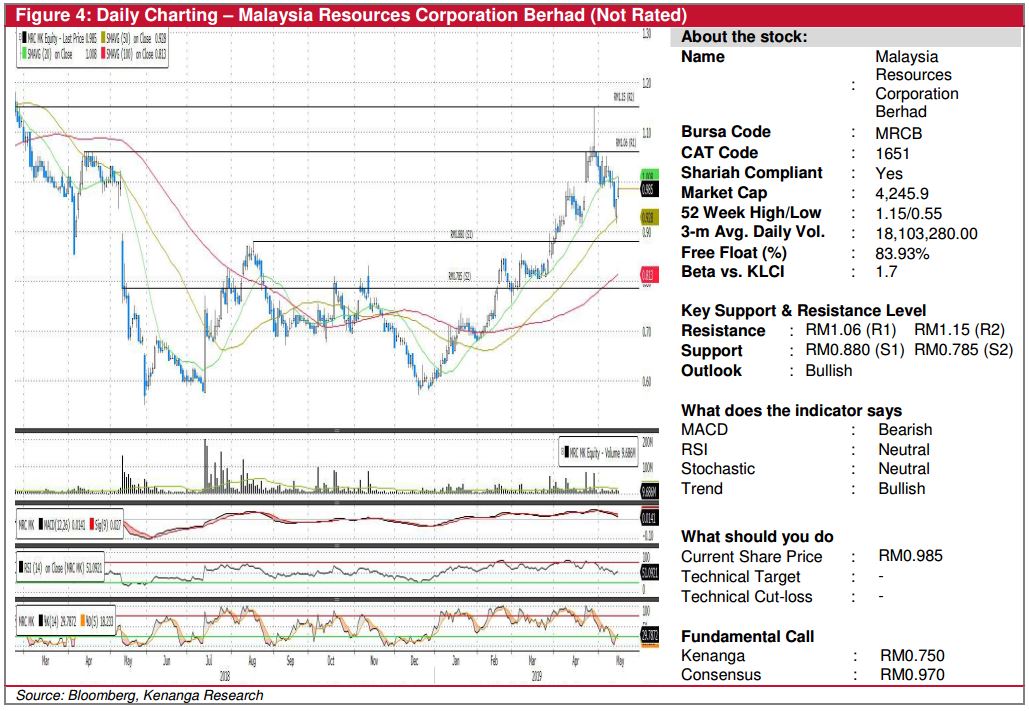

MRCB (Not Rated)

- MRCB gained 2.0 sen (+2.07%) yesterday to end at RM0.985.

- Chart-wise, the share’s overall uptrend still remains intact with both of its shorter-term SMAs still trading above its longer-term SMA.

- Nonetheless, the share is likely to consolidate within the near-term as technical indicators appear uninspired.

- From here, resistance levels can be identified at RM1.06 (R1) and RM1.15 (R2).

- On the other hand, RM0.880 (S1) is a good support level for interested investors to put some position in while a break below RM0.785 (S2) is deemed highly negative.

Source: Kenanga Research - 16 May 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

YINSON2024-11-25

MRCB2024-11-25

YINSON2024-11-25

YINSON2024-11-25

YINSON2024-11-22

YINSON2024-11-22

YINSON2024-11-22

YINSON2024-11-21

YINSON2024-11-21

YINSON2024-11-21

YINSON2024-11-20

YINSON2024-11-20

YINSON2024-11-20

YINSON2024-11-20

YINSON2024-11-19

YINSON2024-11-19

YINSON2024-11-19

YINSON2024-11-18

YINSON2024-11-18

YINSON2024-11-18

YINSON2024-11-18

YINSON2024-11-18

YINSON2024-11-15

YINSON2024-11-15

YINSON2024-11-15

YINSONMore articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments