Kenanga Research & Investment

Daily Technical Highlights – (IWCITY, CARIMIN)

kiasutrader

Publish date: Fri, 31 May 2019, 10:24 AM

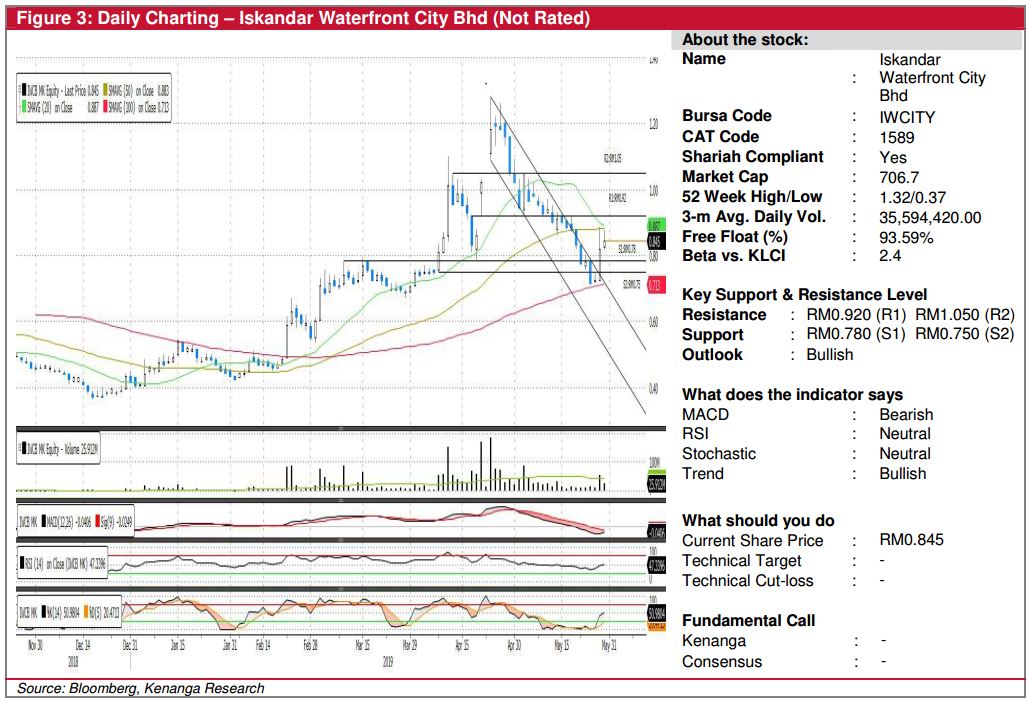

IWCITY (Not Rated)

- IWCITY gained 2.5 sen (+3.05%) to close at RM0.845 yesterday.

- The stock has been trading within the descending channel since mid-April 2019 after the share gapped up twice coupled with heavy trading volume.

- Lately, the share has broken out from the descending channel with higher-than-average trading volume and attempting to test the resistance at 20 and 50-days SMAs, hence we are expecting the share to continue its upward movement.

- Should buying momentum persist, resistance can be seen at RM0.920 (R1) and RM1.050 (R2)

- On the other hand, key support level can be found at RM0.780 (S1) and RM0.750 (S2).

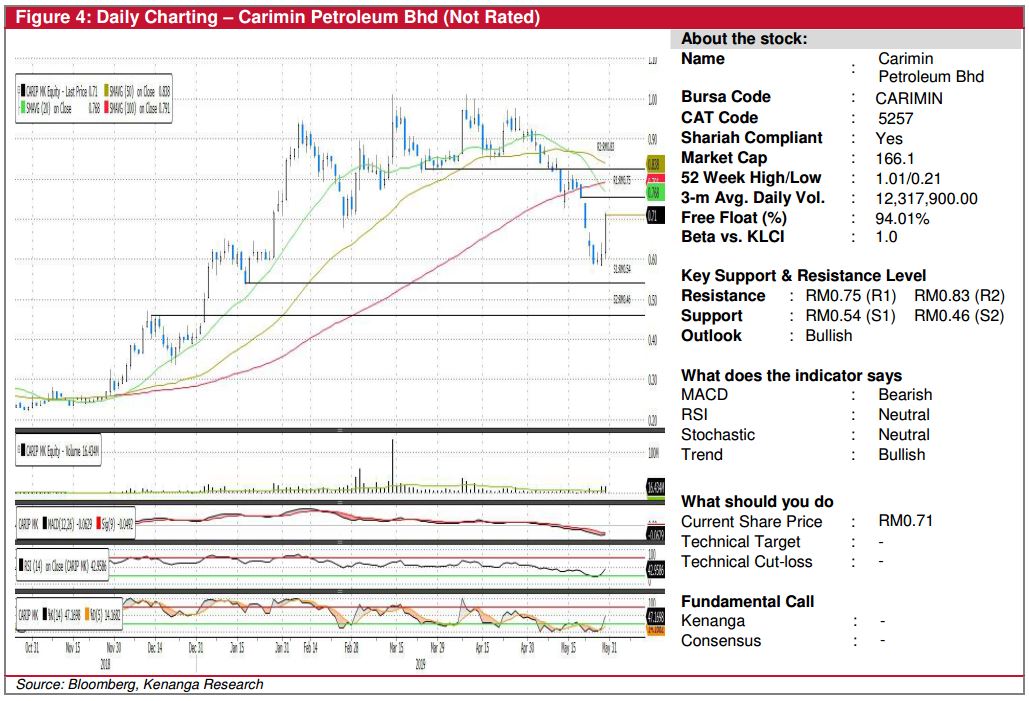

CARIMIN (Not Rated)

- CARIMIN increased by 10.0sen (+16.39%) to end at RM0.710 yesterday.

- Chart-wise, the stock has broken below the key SMAs since mid-May 2019 and lately it has started to rebound from the downward movement after forming a Doji candle. The strong buying sentiment was confirmed by the formation of long bullish candle yesterday coupled with above-average trading volume.

- Hence, we expect the stock to test its resistance at RM0.750 (R1) and RM0.830 (R2).

- Conversely, downside support can be seen at RM0.540 (S1) and RM0.460 (S2).

Source: Kenanga Research - 31 May 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments