Kenanga Research & Investment

Daily Technical Highlights – (BJTOTO, REVENUE)

kiasutrader

Publish date: Thu, 11 Jul 2019, 09:00 AM

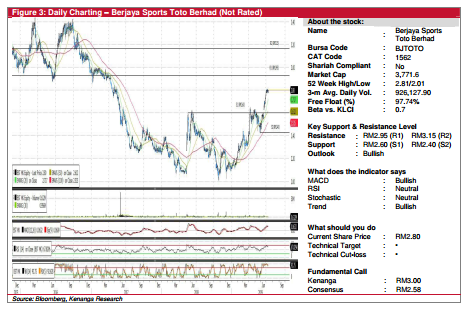

BJTOTO (Not Rated)

- Yesterday, BJTOTO gained 2.0 sen (+0.72%) to close at RM2.80.

- Chart-wise, the share has been on a steady uptrend since the beginning of the year. We note that the share is also currently trading above all of its key SMAs.

- Given its key momentum indicators, which are still trading within the neutral zone, we believe that there could be room for further upside.

- Should bullish momentum persist, resistance levels can be identified at RM2.95 (R1) and RM3.15 (R2).

- Conversely, downside supports can be found at RM2.60 (S1) and RM2.40 (S2).

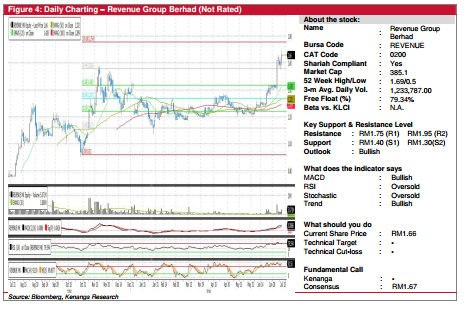

REVENUE (Not Rated)

- REVENUE rose 6.0 sen (+3.75%) to end at RM1.66 yesterday, on the back of stronger-than-average trading volume.

- Of late, we noticed the share managed to break through and hold above its key resistance level at RM1.55, following the formation of a long white candlestick a few days ago.

- Coupled with upticks from key technical indicators, we believe that the share may continue trending upwards.

- Expect the share to test resistance levels at RM1.75 (R1) and RM1.95 (R2).

- Conversely, key support level can be identified at RM1.40 (S1) and RM1.30 (S2).

Source: Kenanga Research - 11 Jul 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments