Daily Technical Hightlights - (GPACKET, OMESTI)

kiasutrader

Publish date: Tue, 06 Oct 2020, 09:08 AM

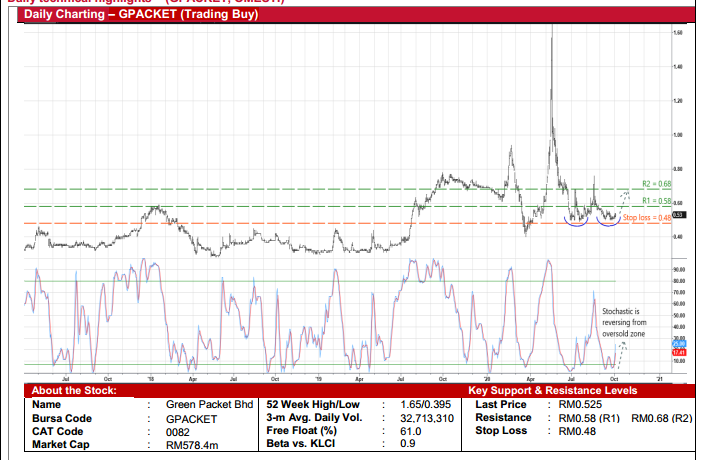

Green Packet Bhd (Trading Buy)

• GPACKET was in the news recently when it joined hands with listed MMAG Holdings to utilise the Group’s kiplePay digital payment system and solution for the use of e-wallet for migrant foreign workers in Malaysia.

• This initiative will develop further its digital services business (which comprises e-wallet, payment gateway, various technological solution platforms) as the Group also has plans to bid for a digital banking licence.

• Interestingly, from a valuation perspective, the stock could get a lift from yesterday’s sharp share price rise of 22.3% in G3 Global (which is involved in Artificial Intelligence technology and Big Data platform and is 28.2% owned by GPACKET). Its share of G3 Global’s current market valuation of RM1,564m works out to be RM441m, representing approximately threequarters of GPACKET’s existing market cap.

• Technically speaking, the stock – which is currently languishing near a double-bottom formation – appears enticing from a risk-return trade-off perspective.

• As the stochastic indicator reverses from an oversold zone (with the %K line simultaneously crossing above the %D line), GPACKET’s share price could rebound to reach our resistance thresholds of RM0.58 (R1; 11% upside potential) and RM0.68 (R2; 30% upside potential).

• Conversely, our stop loss level is set at RM0.48 (or 9% downside risk from yesterday’s closing price of RM0.525).

Omesti Bhd (Trading Buy)

• OMESTI’s share price is technically oversold after plummeting from a high of RM0.84 in early August to RM0.495 currently.

• Following its retracement back to where it was in June this year, the stock could bounce up from a double-bottom pattern to plot a trend reversal ahead. • On the chart, riding on the positive momentum, OMESTI shares will probably test our resistance thresholds of RM0.56 (R1) and RM0.63 (R2). This translates to upside potentials of 13% and 27%, respectively.

• We have pegged our stop loss level at RM0.45 (or 9% downside risk).

• In terms of corporate development, OMESTI – which is a grouping of ICT companies with activities that are focused on the development and delivery of solutions to assist clients achieve their digital transformation strategies – has recently been awarded a contract worth RM14.4m by Jabatan Pengangkutan Jalan Malaysia (JPJM) to undertake the Automated Awareness Security System (AwAS) project for a duration of 18 months.

Source: Kenanga Research - 6 Oct 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024