Daily Technical Highlights - (SMETRIC, DANCO)

kiasutrader

Publish date: Thu, 08 Oct 2020, 09:13 AM

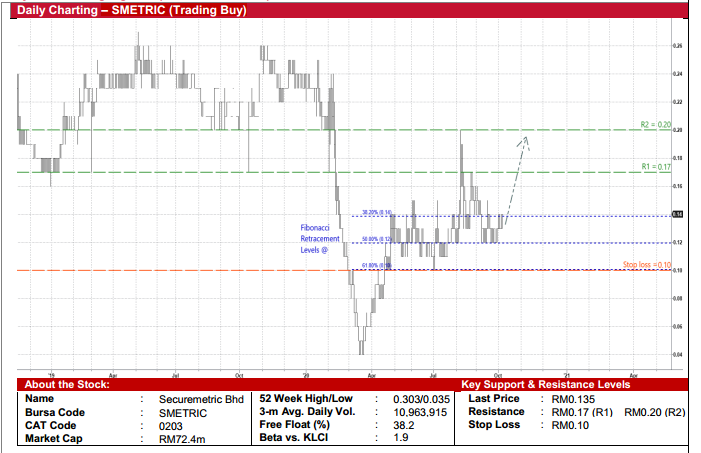

Securemetric Bhd (Trading Buy)

• SMETRIC offers digital security solutions in Malaysia, Vietnam, the Philippines, Indonesia and Singapore.

• SMETRIC is a beneficiary of the digital transformation trend in the wake of the Covid-19 pandemic, banking on its newly launched SigningCloud services, a cloud-based platform that enables customers to sign electronic documents online using certified digital signatures in a seamless and secured environment.

• In the latest quarterly results, the Group turned around with net profit of RM0.5m in 2QFY20 (from net loss of RM2.1m in 1QFY20), thus narrowing its 1HFY20 net loss to RM1.6m (versus net profit of RM1.8m previously).

• On its balance sheet, net cash holdings stood at RM22.6m (translating to 4.2 sen per share or almost one-third of its existing share price) as of end-June 2020.

• Technically speaking, SMETRIC’s share price uptrend – following its ascent from RM0.035 in mid-March to peak at RM0.20 in early August – remains intact, judging by its ensuing rebounds after previously testing the Fibonacci retracement lines of 50% and 62% (see chart).

• That said, we reckon the stock is on track to challenge our resistance thresholds of RM0.17 (R1; 26% upside potential) and RM0.20 (R2; 48% upside potential).

• Our stop loss level is set at RM0.10 (or 26% downside risk from yesterday’s closing price of RM0.135).

Dancomech Holdings Bhd (Trading Buy)

• DANCO – which serves primarily the palm oil, oleochemicals, oil & gas and water & waste water industries – is principally involved in the trading and distribution of: (a) process control equipment (such as valves, switches, actuators), (b) measurement instruments (such as gauges, recorders); (c) industrial pumps, and (d) the provision of material handling system solutions.

• The Group has been making annual earnings of between RM11.2m and RM15.4m in the last five years. It posted net profit of RM3.2m (-15% YoY) in the latest 2QFY20 results, lifting its 1HFY20’s earnings to RM6.3m (-18% YoY).

• DANCO has recently completed its acquisition of a 70% stake in MTL Engineering (which was acquired for RM23.8m) as a diversification initiative to venture into metal fabrication, metal stamping, tool and die-making. MTL Engineering is expected to contribute positively to DANCO’s bottomline immediately based on the former’s historical earnings track record of between RM5m and RM6m p.a.

• With net cash holdings of RM61.8m (translating to 20 sen per share or slightly more than one-third of its current share price) as of end-June 2020, DANCO is in a strong financial position to scout for more acquisitions going forward.

• On the chart, after pulling back from a high of RM0.635 in early September, the sighting of a Dragonfly Doji in the later part of last month signals a potential uptrend reversal.

• This is supported by the formation of a symmetrical triangle, which is a bullish continuation pattern.

• A probable breakout from the triangle pattern could push DANCO’s share price towards our resistance thresholds of RM0.61 (R1; 11% upside potential) and RM0.65 (R2; 18% upside potential).

• We have pegged our stop loss level at RM0.49 (or 11% downside risk from its last traded price of RM0.55).

Source: Kenanga Research - 8 Oct 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024