Daily Technical Highlights – (SLVEST, CYPARK)

kiasutrader

Publish date: Fri, 16 Oct 2020, 09:48 AM

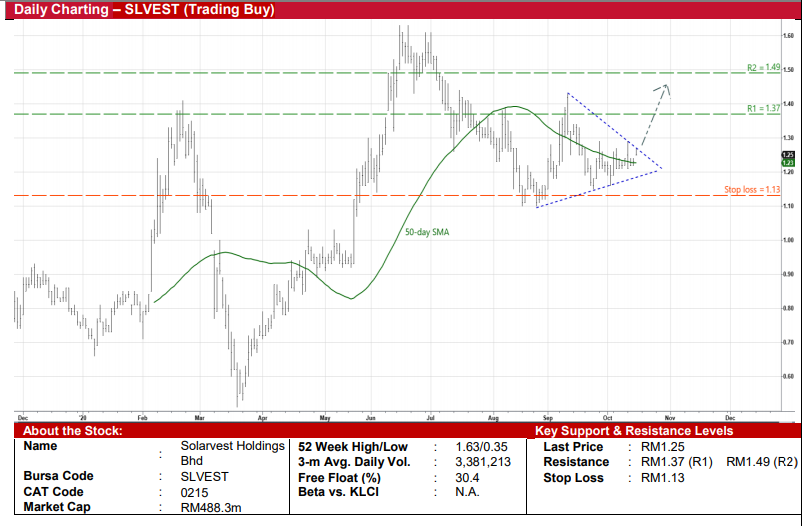

Solarvest Holdings Bhd (Trading Buy)

• SLVEST, as a solar EPCC contractor specialising in solar photovoltaic (PV) systems, is poised to ride on the bright prospects of the domestic solar industry. The recent roll out of the Renewable Energy Investment (under the Large-Scale Solar) programme is expected to offer ~1,000 MWp of solar quota for open tender (translating to about RM4b worth of investments).

• In addition, SLVEST’s plan to transfer its listing status from the ACE Market to the Main Market by the end of this year is expected to put the stock on the investment radar of a wider pool of investors going forward.

• This comes after the Group posted net profit of RM15.7m in FY March 2020 and RM0.8m in 1QFY21 while net cash & cash equivalents stood at RM50.8m (or 13 sen per share) as of end-June this year. Forward earnings visibility will be underpinned by an outstanding order book of RM178.4m as of June 2020.

• On the chart, after sliding from a peak of RM1.63 in mid-June to a trough of RM1.10 in mid-August this year, the stock has plotted higher lows subsequently. This could set the stage for SLVEST’s share price – which gapped up to rise above the 50-day SMA line yesterday – to overcome a downward sloping trendline ahead.

• A likely technical breakout may then lift the shares towards our resistance thresholds of RM1.37 (R1; 10% upside potential) and RM1.49 (R2; 19% upside potential).

• Our stop loss level is pegged at RM1.13 (or 10% downside risk from yesterday’s closing price of RM1.25)

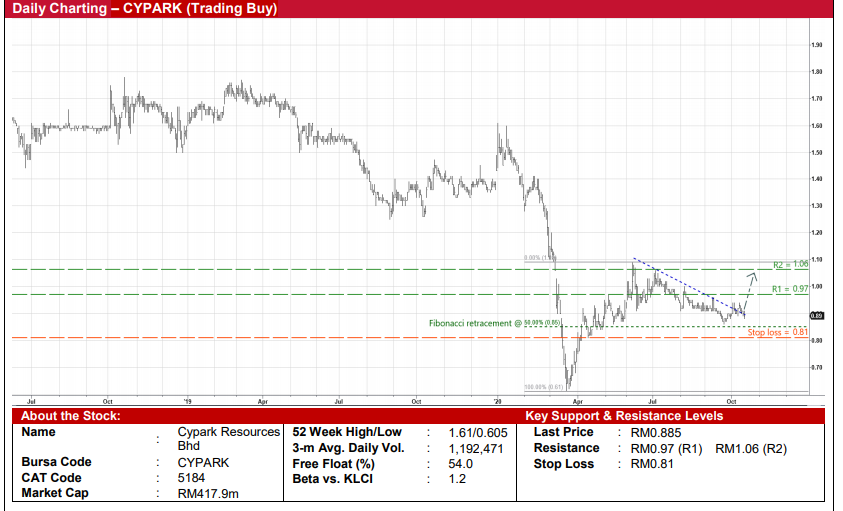

Cypark Resources Bhd (Trading Buy)

• CYPARK, which is involved in the integrated renewable energy, green technology, environmental engineering and construction engineering businesses, is a potential beneficiary of the rising demand for green and sustainable energy solutions.

• The Group reported a net profit of RM49.2m (-6.1% YoY) for the nine-month period ended July 2020. With the final quarter likely to come in better post-Covid-19 lockdown, consensus is currently projecting full-year earnings of RM74m in FY October 2020 and RM85m in FY October 2021. This translates to undemanding forward PERs of 5.6x and 4.9x, respectively.

• From a technical perspective, CYPARK shares may be reaching the tail-end of an existing consolidation phase. After pulling back from a high of RM1.09 in June to as low as RM0.86 in September this year – with the downslide supported by the Fibonacci retracement level of 50% (as measured from the March’s trough to the June’s peak) – the stock could be turning up soon following the crossing over of a descending trendline.

• Riding on the upward momentum, the share price is expected to rebound towards our resistance hurdles of RM0.97 (R1; 10% upside potential) and RM1.06 (R2; 20% upside potential).

• We have set our stop loss level at RM0.81 (representing an 8% downside risk from its last traded price of RM0.885).

Source: Kenanga Research - 16 Oct 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-25

SLVEST2024-11-25

SLVEST2024-11-25

SLVEST2024-11-25

SLVEST2024-11-25

SLVEST2024-11-25

SLVEST2024-11-23

SLVEST2024-11-22

SLVEST2024-11-22

SLVEST2024-11-21

SLVEST2024-11-20

SLVEST2024-11-19

CYPARK2024-11-19

SLVEST2024-11-18

CYPARK2024-11-18

SLVEST2024-11-14

CYPARK2024-11-13

SLVESTMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024