Daily Technical Highlights – (BPPLAS, BRIGHT)

kiasutrader

Publish date: Tue, 20 Oct 2020, 09:25 AM

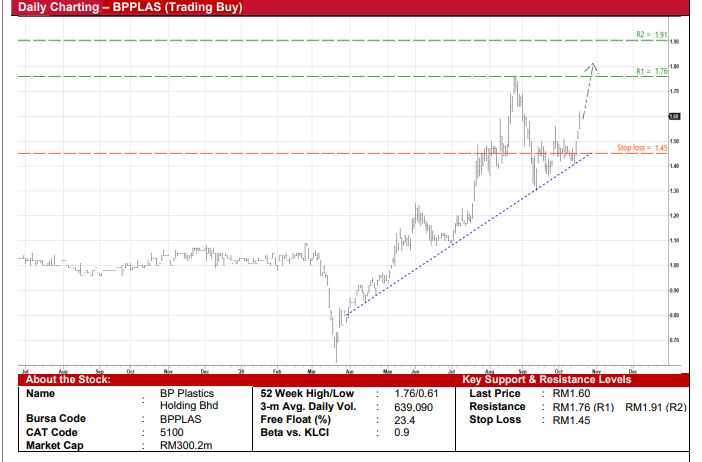

BP Plastics Holding Bhd (Trading Buy)

• BPPLAS is a manufacturer of plastics packaging products that are widely used in various industries such as food & beverage, building materials/construction, logistics, rubber, furniture, electrical and electronic (E&E) and others.

• The Group’s performance has been steady despite the Covid-19 disruptions as it posted a stronger net profit of RM8.5m (+87% YoY) in 2QFY20, which in turn lifted 1HFY20’s earnings to RM14.7m (+64% YoY).

• An added positive is its healthy financial position, backed by cash holdings & short-term investments of RM78.9m as of endJune this year, which translates to 42 sen per share or approximately one-quarter of its existing share price.

• On the chart, BPPLAS’ share price – which jumped 5.3% amid high trading interest yesterday – is expected to continue its bullish trend, supported by an ascending trendline that stretches back to the beginning of April this year.

• Riding on the upward momentum, the stock could climb further towards our resistance thresholds of RM1.76 (R1; 10% upside potential) and RM1.91 (R2; 19% upside potential).

• We have pegged our stop loss level at RM1.45 (or 9% downside risk from its last traded price of RM1.60).

Bright Packaging Industry Bhd (Trading Buy)

• BRIGHT is principally a manufacturer of aluminium foil packaging materials, catering primarily for tobacco packaging, liquor packaging, confectionery packaging and pharmaceutical packaging with exposure to the international markets.

• The Group turned in a net profit of RM0.7m in 3QFY20 (from a net loss of RM0.3m in 3QFY19), taking its 9-month results ended May 2020 to a marginal net loss of RM0.1m (which was an improvement from the net loss of RM0.6m previously).

• Interestingly, its debt-free balance sheet showed that the Group has cash holdings of RM49.7m as of end-May this year, which translates to 24.2 sen per share or almost the entire of its current share price of 24.5 sen.

• From a technical perspective, the stock may be approaching the tail-end of a consolidation phase after oscillating between RM0.21 and RM0.25 since early September this year.

• This is supported by the appearance of Dragonfly Doji on the chart last Tuesday, which signals probable upward price movements ahead.

• With the stock also on the verge of breaking out from a triangle formation, BRIGHT shares could be on the way to test our resistance hurdles of RM0.28 (R1) and RM0.32 (R2). This represents upside potentials of 14% and 31%, respectively.

• Our stop loss level is set at RM0.21 (or 14% downside risk).

Source: Kenanga Research - 20 Oct 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024