Daily Technical Highlights – (SCICOM, LOTUS)

kiasutrader

Publish date: Wed, 21 Oct 2020, 09:09 AM

Scicom (MSC) Bhd (Trading Buy)

• SCICOM is one of Malaysia’s leading Business Process Outsourcing (BPO) companies, providing integrated and innovative solutions in the areas of Customer Lifecycle Management, Education, e-Commerce, Digital Marketing and GovernmentTechnology.

• In July this year, the Company has entered into an agreement with listed Microlink Solutions to set up a 50:50 JV company to collectively bid for tenders with regard to e-Government solutions and services in Malaysia.

• The Group has been profitable with annual net earnings ranging between RM20m and RM45m in the past five years. In the recently FY ended June 2020, net profit rose to RM22.1m (+9% YoY).

• With a balance sheet that has zero debt and cash & cash equivalents of RM29.1m (or 8.2 sen per share) as of end-June this year, SCICOM is in a financially healthy position.

• Technically speaking, SCICOM shares could have hit a bottom already after falling from a peak of RM1.16 in July to as low as RM0.84 in September this year, with the downslide being cushioned by the Fibonacci retracement line of 50% (as measured from the March’s trough to the July’s peak). This is supported by the formation of a saucer bottom, which indicates a likely trend reversal.

• On the back of renewed buying momentum, the stock is expected to rise towards our resistance hurdles of RM1.04 (R1; 11% upside potential) and RM1.15 (R2; 22% upside potential).

• We have placed our stop loss level at RM0.84 (or 11% downside risk from yesterday’s closing price of RM0.94).

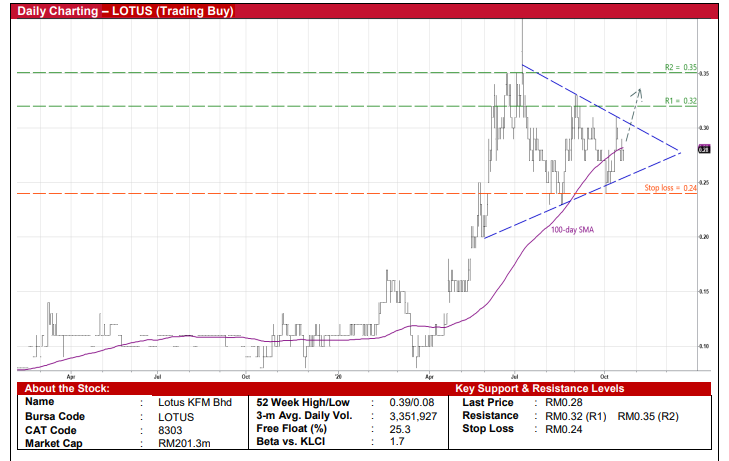

Lotus KFM Bhd (Trading Buy)

• LOTUS is principally engaged in flour milling and trading in its related products with the two main sources of revenue comprising wheat flour and trading of tapioca flour.

• Following the completion of a regularization exercise in November 2019, the Group is turning around after seeing losses for the past 10 years since FY2009.

• In essence, LOTUS has returned to the black in the most recent three quarters with quarterly net earnings coming in between RM0.7m and RM5.1m.

• Reflecting its improved financial position too, the Group is debt free with cash holdings of RM34.6m (or 5 sen per share) as of end-June this year.

• On the chart, the stock is currently in a position to overcome the 100-day SMA line and break out from a bullish symmetrical triangle pattern.

• The positive technical momentum suggests that LOTUS’ share price could be making its way to test our resistance thresholds of RM0.32 (R1; 14% upside potential) and RM0.35 (R2; 25% upside potential).

• Our stop loss level is set at RM0.24 (or 14% downside risk from its last traded price of RM0.28).

Source: Kenanga Research - 21 Oct 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024