Daily technical highlights – (PRLEXUS, OVH)

kiasutrader

Publish date: Fri, 06 Nov 2020, 10:18 AM

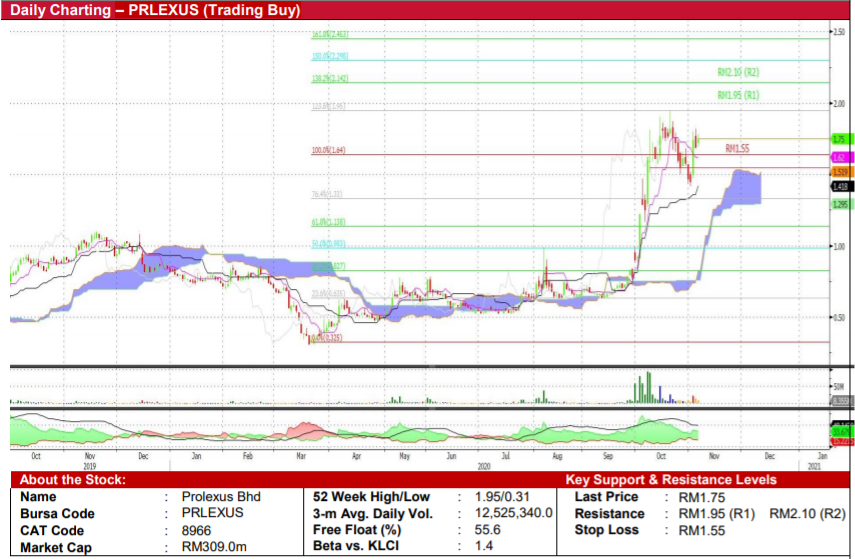

Prolexus Bhd (Trading Buy)

• PRLEXUS is an apparel company that has 3 facilities in Malaysia and China. The company also works closely with top fashion brands such as Nike, Converse, Under Armour and GAP.

• QoQ, the group has turned from a loss of RM8m to a significant profit of RM23.9m in 4QFY ended July 2020. This was mainly due to its venture into the production of reusable fabric facemask under its brand called “ProXmask”. All in, this brought the group’s full-year earnings in FY20 to RM17.6m (+293% YoY).

• In addition, the group is currently in the midst of registering its facemask with the U.S Food and Drug Administration (FDA) to expand into the U.S market. We view this venture positively, as the demand for PPE goods in the U.S is highly correlated to the number of Covid cases which has continued to climb.

• Ichimoku-wise, following the retracement from its high of RM1.95 as of 20th October 2020, the stock has found support near its base-line. Coupled with the bullish Kumo Clouds, which continue to display a positive bias, we thus believe the uptrend shall persist.

• Based on the Fibonacci projections, our overhead resistance levels are positioned at RM1.95 (R1; +11% upside potential) and RM2.10 (R2; +20% upside potential).

• Meanwhile, our stop loss is pegged at RM1.55 (11% downside risk).

Ocean Vantage Holdings Bhd (Trading Buy)

• OVH is a Sarawak-based company principally involved in the support services for the Oil and Gas industry, in both the upstream and downstream activities. The group is mainly involved in the: (i) engineering, procurement and construction (EPC) and project management, (ii) supply of manpower, (iii) supply of material tools and equipment, and (iv) provision of drilling rig charter services.

• The group announced yesterday a Letter of Award from Andeli Solar Sdn Bhd to build a large scale solar (“LSS”) plant for Coral Power Sdn Bhd (a 70%-owned subsidiary of Minetech), which comes with a contract sum of RM29.6m. The group will undertake off-shore and on-shore works including engineering, procurement, construction and commissioning (“EPCC”) and expects the project to be completed in 4 months. We view the move positively, given the diversification of its revenue stream into the renewable energy segment in light of the E.S.G investment theme which continues to gain traction.

• The stock had plummeted from an all-time high of RM0.780 as of 4th August 2020 to a low of RM0.415 as of 6th October. Given the formation of a series of higher lows in the stock’s RSI value and the formation of a saucer pattern, we thus believe this could signal a potential trend reversal.

• Should the buying momentum persist, our overhead resistance levels are set at RM0.635 (R1; +14% upside potential) and RM0.690 (R2; +24% upside potential).

• Meanwhile, our stop loss is pegged at RM0.485 (or 13% downside risk).

• Fundamentally, the group is in a net cash position of RM6.9m, which translates to 1.7 sen/share, as of 2QFY20.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024