Daily technical highlights – (HWGB, LYC)

kiasutrader

Publish date: Tue, 10 Nov 2020, 12:05 PM

Ho Wah Genting Bhd (Trading Buy)

• HWGB just announced that the Group has obtained approval (which would be valid for one year) from the Ministry of Health of Indonesia to manufacture medical devices comprising surgical face masks, COVID-19 rapid test cassettes and liquid chemical sterilants / high level disinfectants.

• This marks a further step for the Group to diversify into the healthcare-related businesses following its previously disclosed plans to undertake research study for the development of Covid-19 vaccines, as well as the import & distribution of Covid19 test kits and other medical devices in Malaysia.

• On the chart, HWGB’s share price has bounced up from a trough of RM0.46 in the beginning of October to reach as high as RM0.91 in the second half of last month. After plotting a series of higher lows subsequently, the stock is now on the edge of breaking out from a short-term symmetrical triangle pattern.

• The upward bias stance is also backed by the share price crossover of its 50-day SMA line in the later part of last week.

• Riding on the positive momentum, HWGB shares could be on the way to test our resistance thresholds of RM0.91 (R1; 14% upside potential) and RM1.01 (R2; 26% upside potential).

• We have pegged our stop loss price at RM0.70 (or 12% downside risk from its last traded price of RM0.80).

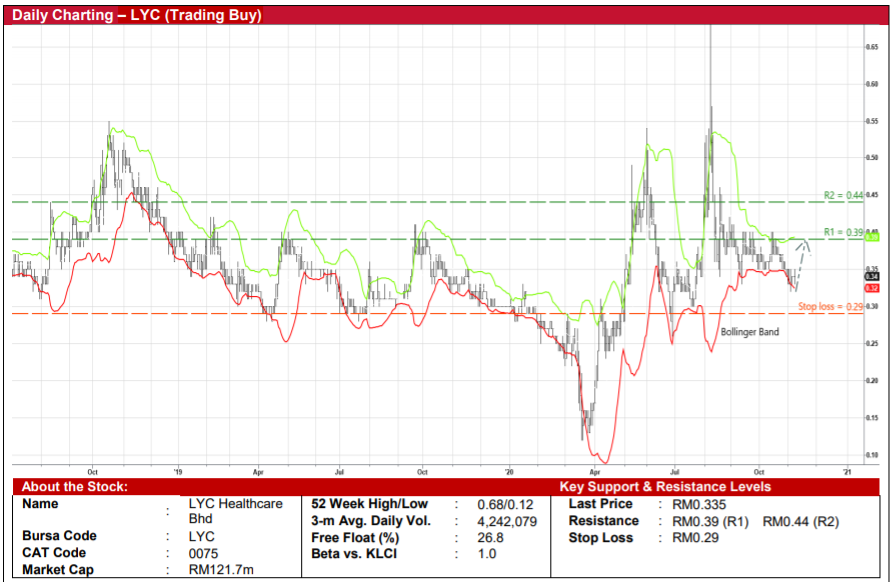

LYC Healthcare Bhd (Trading Buy)

• LYC is involved in the healthcare business, providing mother and child care related services such as postnatal & postpartum care and confinement care.

• The Group has also diversified into other healthcare segments such as senior living homes, family clinic, childcare services, cosmetic & aesthetic and fertility services. In addition, it is venturing into Singapore via the acquisitions of two companies that operate medical centres for SGD14.2m.

• From a technical perspective, the stock – after rebounding from a low of RM0.32 in early November – has cut above the lower boundary of the Bollinger Band to trigger a buy signal last Thursday.

• On the back of the positive momentum, LYC shares could climb towards our resistance hurdles of RM0.39 (R1) and RM0.44 (R2). This represents upside potentials of 16% and 31%, respectively.

• Our stop loss price is set at RM0.29 (or 13% downside risk from yesterday’s closing price of RM0.335).

Source: Kenanga Research - 10 Nov 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024