Daily technical highlights – (YTLREIT, MUHIBAH)

kiasutrader

Publish date: Wed, 11 Nov 2020, 11:26 AM

YTL Hospitality REIT Bhd (Trading Buy)

• The availability of vaccines to overcome the Covid-19 pandemic is expected to spur a swift recovery in the hospitality industry. This will then benefit YTLREIT – which owns a wide portfolio of prime hotel properties spread across Malaysia, Japan and Australia – after being severely hit by the multiple lockdowns triggered by the virus outbreak.

• Capturing the Group’s deteriorating fundamentals, its share price plunged 49% YTD to a record low of RM0.69 in early November this year, which was even below its March 2020 trough of RM0.70.

• Following news that the supply of Covid-19 vaccines might be ready in the near future, YTLREIT shares gapped up 6.9% on heavy volume yesterday to close at RM0.77.

• A crossing above its 50-day SMA line is indicating that the share price uptrend could persist.

• On the back of the price trend reversal, the stock will probably climb further to reach our resistance thresholds of RM0.87 (R1; 13% upside potential) and RM0.95 (R2; 23% upside potential).

• We have set our stop loss price at RM0.68 (or 12% downside risk).

• Based on consensus DPU expectations of 2.8 sen for FY June 2021 and 3.7 sen for FY June 2022, YTLREIT currently offers prospective dividend yields of 3.6% and 4.8%, respectively.

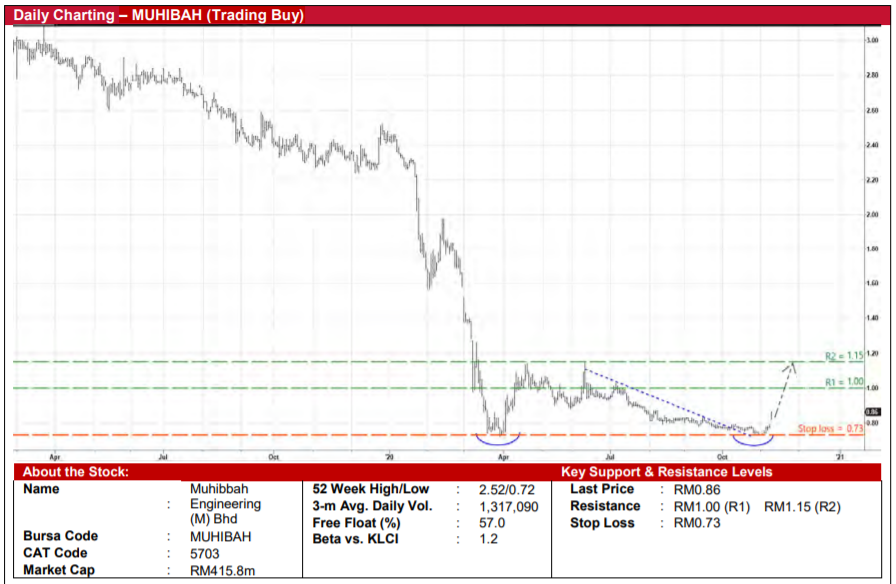

Muhibbah Engineering (M) Bhd (Trading Buy)

• MUHIBAH stands to benefit from the accessibility of Covid-19 vaccines as a resumption in international travelling is expected to boost its three airport concessions business in Cambodia. (In addition, the Group is an engineering construction company and integrated solutions provider for maritime, oil & gas and infrastructure projects).

• On the chart, the stock – after plummeting 71% YTD to a recent low of RM0.725 in the beginning of November – has bounced off from a double-bottom pattern following yesterday’s 9.6% jump to end at RM0.86 amid strong buying interest.

• The ongoing trend reversal is also backed by the share price’s breakout of a downward sloping trendline that stretches back to mid-June this year.

• Riding on the positive momentum, MUHIBAH shares will probably extend the run-up to test our resistance hurdles of RM1.00 (R1) and RM1.15 (R2). This represents upside potentials of 16% and 34%, respectively.

• Our stop loss price is pegged at RM0.73 (or 15% downside risk).

• Meanwhile, the stock will be traded ex-dividend tomorrow (with the dividend per share of 2.5 sen payable on 24 November).

Source: Kenanga Research - 11 Nov 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024