Daily technical highlights – (TOMYPAK, AME)

kiasutrader

Publish date: Fri, 20 Nov 2020, 09:29 AM

Tomypak Holdings Bhd (Trading Buy)

• TOMYPAK is a company that is involved in the manufacturing of flexible packaging materials, polyethylene, polypropylene films and sheets in Malaysia. The company sells its products to the overseas (mainly South East Asia) and local markets to customers which are mainly involved in the FMCG segment.

• In its recent 2QFY20 results, the group has turned around with a net profit of RM4m from a loss of RM6.5m in its previous quarter. This was mainly due to: (i) the successful marketing efforts to expand its international customer base which commands higher margins, and (ii) its 2nd plant in Senai Industrial Estate (which has increased the group’s total capacity to 50,000mt/year or 4x its previous annual capacity) breaking even.

• Ichimoku-wise, the stock has found support at its Kumo Cloud in September 2020 and subsequently resumed its upward movements. Given the bullish Kumo Cloud pattern and an uptick in RSI, we thus expect the upward momentum to continue.

• Should the buying interest persist, the stock could experience a “Kumo Bounce” and trend higher towards our overhead resistance levels of RM0.915 (R1; +12% upside potential) and RM0.945 (R2; +15% upside potential).

• Our stop loss level is pegged at RM0.725 (-12% downside risk).

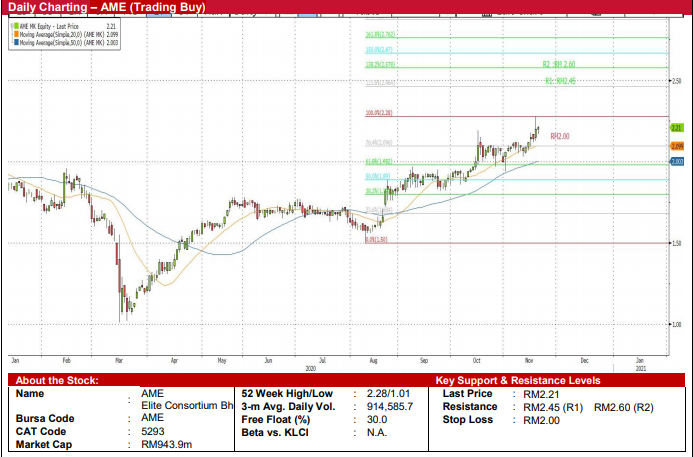

AME Elite Consortium Berhad (Trading Buy)

• AME is a fully integrated industrial property specialist which provides: (i) property management, (ii) development, (iii) construction, and (iv) engineering solutions.

• The group has recently entered into a Heads of Agreement (HOA) with UEM Sunrise to purchase 72 plots of industrial land in SiLC phase 3 measuring up to 169.8 acres for a purchase consideration of c.RM434.3m. We view this move positively as it would expand the group’s land bank and provide earnings visibility in the longer term.

• Moreover, the group is currently experiencing high demand for industrial properties from its existing customers such as Jstar Motion and Shengda New Energy, both of which have plans to expand their existing plants in Johor Bahru.

• The stock has been riding on an upward rally since the breakout in mid-August this year. With its shorter term SMA treading above its longer-term SMA, we thus believe the buying interest could persist to lift the stock higher.

• Based on our Fibonacci projections, our resistance levels are set at RM2.45 (R1; +11% upside potential) and RM2.60 (R2; +18% upside potential).

• Meanwhile, our stop loss level is pegged at RM2.00 (-10% downside risk).

Source: Kenanga Research - 20 Nov 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024