Daily technical highlights – (SERBADK, DELEUM)

kiasutrader

Publish date: Wed, 25 Nov 2020, 10:23 AM

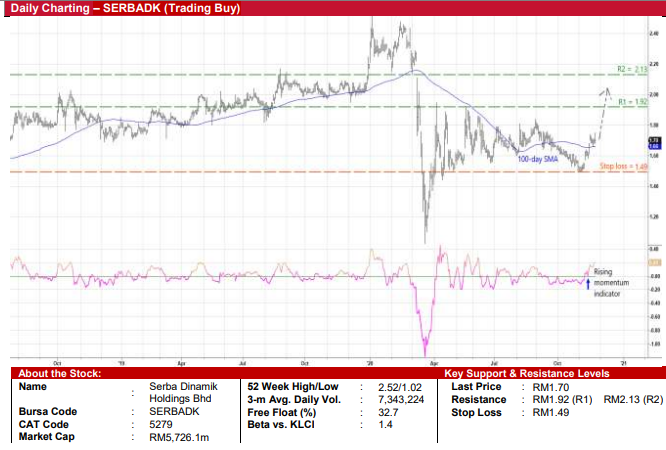

Serba Dinamik Holdings Bhd (Trading Buy)

• SERBADK – an international energy services group providing a multitude of engineering services & solutions ranging from Operation & Maintenance (O&M), Engineering, Procurement, Construction & Commissioning (EPCC) and other supporting products and services mainly to the oil & gas, power and water industries – has just reported a strong set of earnings.

• The Group saw its net profit jumping 31% YoY to RM148m in 3QFY20, taking the 9-month results ended September 2020 to RM429.6m (+21% YoY).

• Consensus is currently projecting SERBADK to make net earnings of RM582m in FY December 2020 and RM668m in FY December 2021, which translates to forward PERs of 9.8x this year and 8.6x next year.

• On the chart, following the rebound from a low of RM1.49 in early November this year to close at RM1.70 yesterday, SERBADK shares will likely plot higher highs ahead after cutting above the 100-day SMA line last week.

• Riding on the upward trajectory, the rising momentum indicator could push the share price towards our resistance levels of RM1.92 (R1; 13% upside potential) and RM2.13 (R2; 25% upside potential).

• We have placed our stop loss price at RM1.49 (or 12% downside risk).

Deleum Bhd (Trading Buy)

• An integrated service provider of a diverse range of specialised products and support services in the upstream oil and gas industry, DELEUM has remained profitable – with annual earnings ranging between RM26m and RM45m over the past five years – against a historical backdrop of volatile crude oil prices.

• Nonetheless, the Group posted a net loss of RM9.0m in 1HFY20 (versus net profit of RM11.5m previously) as its bottomline was hit by lumpy impairment charges and foreign exchange losses (totalling RM18.0m).

• With a balance sheet that is backed by net cash holdings of RM93.2m (equivalent to 23.2 sen per share or more than one-third of its existing share price) as of end-June this year, the Group is well-positioned to weather through the challenging oil & gas industry landscape.

• From a technical perspective, a trend reversal for the stock may be currently in progress after overcoming a negative sloping trendline that stretches back to November last year.

• The positive technical view is also supported by the share price crossover of its 50-day SMA line recently.

• Riding on the upward momentum, DELEUM shares could climb towards our resistance thresholds of RM0.71 (R1) and RM0.80 (R2), which represents upside potentials of 18% and 33%, respectively.

• Our stop loss price is pegged at RM0.51 (or 15% downside from the last traded price of RM0.60).

Source: Kenanga Research - 25 Nov 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024