Daily technical highlights – (MYNEWS, ZHULIAN)

kiasutrader

Publish date: Thu, 26 Nov 2020, 11:17 AM

MyNews Holdings Bhd (Trading Buy)

• A technical rebound could be on the horizon for MYNEWS shares after sliding to RM0.545 at the end of last month (its lowest level since March 2016). The stock has since recovered slightly to close at RM0.60 yesterday.

• Our positive technical view is also driven by the share price’s recent crossovers of the 50-day SMA line and a negative sloping trendline.

• With that, the stock could be making its way towards our resistance thresholds of RM0.67 (R1) and RM0.79 (R2). This represents upside potentials of 12% and 32%, respectively.

• Our stop loss price is set at RM0.54 (or 10% downside risk).

• In terms of corporate development, MYNEWS has signed a licensing agreement last month with BGF Retail (South Korea’s biggest convenience store operator and owner of the popular convenience store brand CU) to operate and sub-franchise CU outlets in Malaysia. With the first store scheduled to be opened in early 2021, the venture is expected to expand MYNEWS’ foothold in the local market.

• The Group – which operates in the retail convenience segment in Malaysia and production of ready-to-eat food and bakery products to serve its retail chain – was adversely affected by business restrictions arising from the Covid-19 pandemic when it reported net loss of RM4.1m (versus a net profit of RM23.6m previously) in the 9-month period ended July 2020.

• Still, the worst may be over for MYNEWS as consensus is forecasting the Group to post a net loss of RM2m for FY October 2020 before recovering to a net profit of RM17m for FY October 2021, which translates to a forward PER of 24x next year.

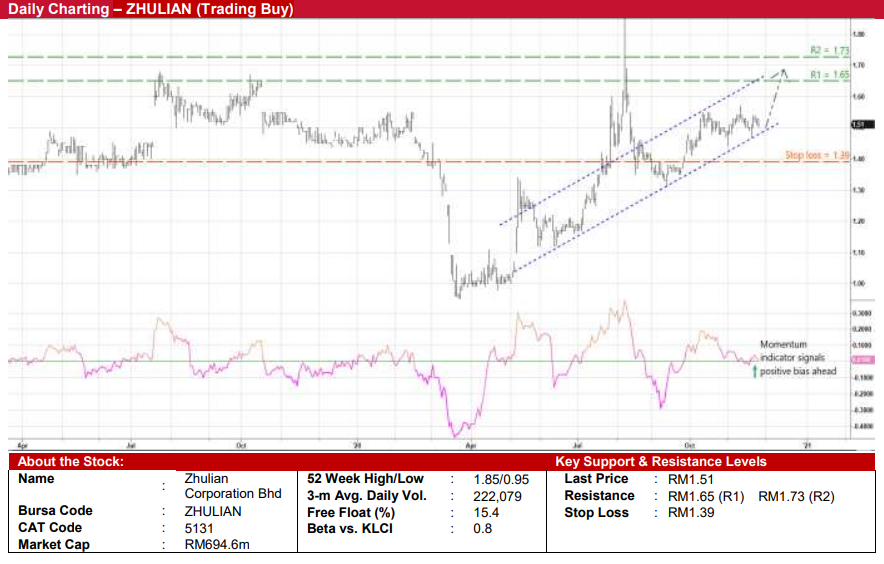

Zhulian Corporation Bhd (Trading Buy)

• After bouncing up from a trough of RM0.95 in March this year, ZHULIAN shares subsequently plotted higher lows to form an ascending trendline along the way.

• Further, with the momentum indicator on the rise after crossing above the zero line, the stock is expected to extend the uptrend pattern ahead.

• Hence, technically speaking, ZHULIAN’s share price could continue its upward trajectory to climb towards our resistance targets of RM1.65 (R1; 9% upside potential) and RM1.73 (R2; 15% upside potential).

• We have pegged our stop loss level at RM1.39 (or 8% downside risk from its last traded price of RM1.51).

• On the fundamental front, ZHULIAN – a manufacturer of jewellery and consumer products that are sold through a direct marketing network – was still profitable despite feeling the impact of the Covid-19 outbreak as its net profit came in at RM33.2m (-18% YoY) for the 9-month ended August 2020.

• The Group is financially strong with a debt-free balance sheet that is backed by cash holdings of RM179.7m (39.1 sen per share or approximately one-quarter of its current share price) as of end-August this year.

Source: Kenanga Research - 26 Nov 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024