Daily technical highlights – (GDB, RANHILL)

kiasutrader

Publish date: Fri, 18 Dec 2020, 08:47 AM

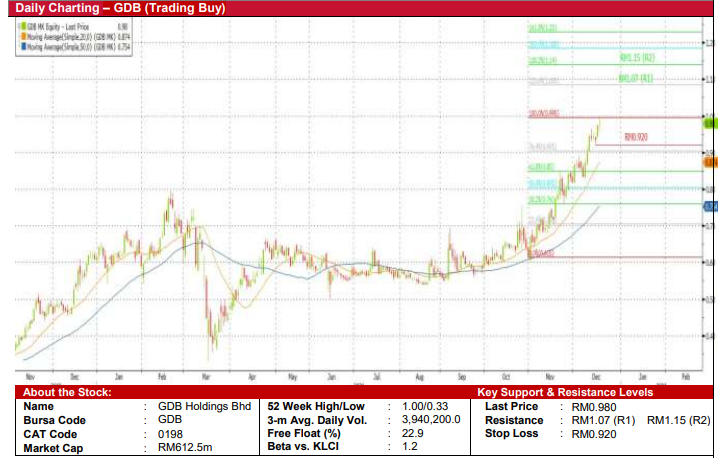

GDB Holdings Bhd (Trading Buy)

• GDB is a construction company that provides its services in the residential, commercial and mixed development projects. The group also provides its services in the supply and installation of construction materials through its sub-contractors.

• QoQ, the group’s revenue in 2QFY20 increased to RM95.9m (+146% QoQ) following the resumption of its operations post the relaxation of the restricted movement control order. This, in turn, led the group’s net profit to increase to RM7.5m (+92% QoQ).

• On 26th October, the group announced that its subsidiary Grand Dynamic Builders Sdn Bhd (GDSDB) has signed a Letter of Intent with Damai City Sdn Bhd (a wholly-owned subsidiary of KSK Land Sdn Bhd) to appoint GDSDB as the main contractor to complete the remaining main building works for the proposed development of an integrated mixed development project known as “8 conlay” for a contract sum of RM1.2b. The contract win is viewed positively as it will improve the earnings visibility for the group.

• Chart-wise, the stock has continued to climb higher after the formation of a saucer pattern (from April to late November this year). With the shorter-term key SMA continues to tread above the longer-term key SMA, we thus believe that the stock would continue to trend higher.

• With that, our overhead resistance levels are positioned at RM1.07 (R1; +9% upside potential) and RM1.15 (R2; +17% upside potential).

• Our stop loss level is pegged at RM0.920 (-6% downside risk

Ranhill Utilities Bhd (Trading Buy)

• RANHILL is involved in the water supply services space, providing the source-to-tap water in Johor. The group’s services also extend into the energy segment via its Independent Power Producer (IPP) concession in Sabah under a 21-year power purchase agreement with Sabah Electricity Sdn Bhd.

• We like the water utility business for its stable income stream given the exclusive license to provide source-to-tap water throughout Johor which spans across 45 years.

• In addition, the group intends to expand its renewable energy resources segment through its: (i) participation in the LSS4 (large scale solar power plants) tenders, (ii) collaboration agreement to develop a 1,150MW CCGT plant in Kedah to supply 100% of its power to Thailand, and (iii) Tawau geothermal power plant project to supply clean energy for the East Coast of Sabah. We view these ventures positively given the rising theme of Environmental Social and Governance (E.S.G).

• Chart-wise, the stock has been trending downwards after hitting an all-time high of RM1.44 (on 27th August 2019). Ichimokuwise, the stock could be potentially heading for a “Kumo Breakout” to reverse its downtrend should the buying interest resume.

• With that, our next resistance levels are set at RM0.935 (R1; +9% upside potential) and RM1.00 (R2; +16% upside potential).

Source: Kenanga Research - 18 Dec 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024