Daily technical highlights – (SALCON, RGB)

kiasutrader

Publish date: Tue, 22 Dec 2020, 08:45 AM

Salcon Bhd (Trading Buy)

• SALCON – a leading water and wastewater engineering company – is a potential beneficiary of ongoing initiatives by the government to provide reliable water supply services. This includes last week’s news that Air Selangor would be calling for tenders for the first phase of the Rasau water treatment plant valued at about RM4b next year.

• To complement its other existing businesses in technology services, transportation and property development, the Group has also announced plans: (a) in November this year to venture into the manufacturing of latex, nitrile and medical high-risk gloves; and (b) earlier this month to diversify into the renewable energy sector via the generation and supply of solar photovoltaic energy.

• The Group – which reported smaller net loss of RM6.2m in the nine-month ended September 2020 (versus net loss of RM10.8m previously) – is in a net cash position of RM84.2m as of end-September this year. SALCON subsequently has completed a private placement exercise in early November to raise RM33.8m, thus boosting its cash pile to RM118.1m (or 11.9 sen per share equivalent to slightly less than half of the existing share price).

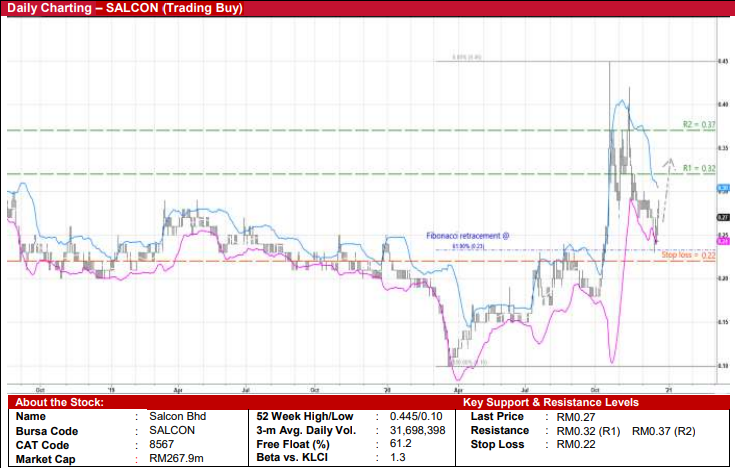

• On the chart, after tumbling from a high of RM0.445 on 20 October this year to as low as RM0.23 in mid-December, the stock could have found support at the 61.8% Fibonacci retracement level.

• With the share price previously moving below before subsequently crossing back above the lower Bollinger Band, SALCON is set to ride on the positive momentum to climb towards our resistance thresholds of RM0.32 (R1; 19% upside potential) and RM0.37 (R2; 37% upside potential).

• We have placed our stop loss price at RM0.22 (or 19% downside risk from its last traded price of RM0.27).

RGB International Bhd (Trading Buy)

• RGB is a potential recovery play on an anticipated revival of the gaming industry in the region. The Group is a leading supplier of electronic gaming machines and casino equipment as well as a key machine concession provider with a primary geographical presence in Malaysia, Singapore and Indo China.

• The worst may be over for the Group after posting net loss of RM22.3m in the nine-month ended September 2020 (compared with net profit of RM25.1m previously) as its businesses were badly hit by restrictions arising from the Covid-19 movement controls. In addition, its balance sheet is backed by net cash holdings of RM9.2m as of end-September.

• From a technical perspective, RGB shares could stage an intermediate rebound after plotting lower lows since February 2017 to close at RM0.14 yesterday.

• Moreover, the recent share price crossover of its 100-day SMA line signals an upward bias for the stock.

• On the way up, RGB will likely test our immediate resistance target of RM0.17 (R1). A break past R1 will then push the shares to challenge our next resistance hurdle of RM0.21 (R2). This represents upside potentials of 21% and 50%, respectively.

• Our stop loss price is pegged at RM0.11 (or 21% downside risk).

Source: Kenanga Research - 22 Dec 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024