Daily technical highlights – (CCK, GPACKET)

kiasutrader

Publish date: Thu, 18 Feb 2021, 10:09 AM

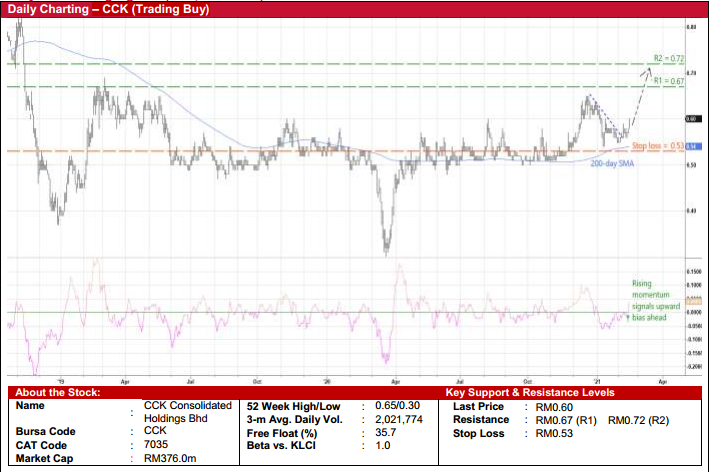

CCK Consolidated Holdings Bhd (Trading Buy)

• CCK’s share price jumped 5% on strong volume to close at RM0.60 yesterday, extending its rebound after overcoming a downward sloping trendline recently.

• The upward trajectory is supported by the stock’s continuous moves above its 200-day SMA line. And with the momentum indicator on the increase after cutting above the zero level, CCK shares will likely advance further ahead.

• On the chart, the stock could climb towards our resistance targets of RM0.67 (R1) and RM0.72 (R2), which translate to upside potentials of 12% and 20%, respectively.

• Our stop loss price is set at RM0.53 (representing 12% downside risk).

• On the fundamental front, CCK reported net profit of RM9.2m (+20% YoY; +22% QoQ) in 3QFY20, taking its nine-month results ended September 2020 to RM24.9m (+4% YoY). Consensus is currently projecting the Group to make full-year earnings of RM33m in FY20 and RM35m in FY21, which would then value the shares at forward PER of 10.7x this year.

• Essentially, defensive investors would like CCK’s resilient earnings outlook as the Group sells basic food items such as fresh dressed chicken & chicken parts, frozen products, table eggs, fresh fruits and vegetables, in addition to operating a chain of retail stores.

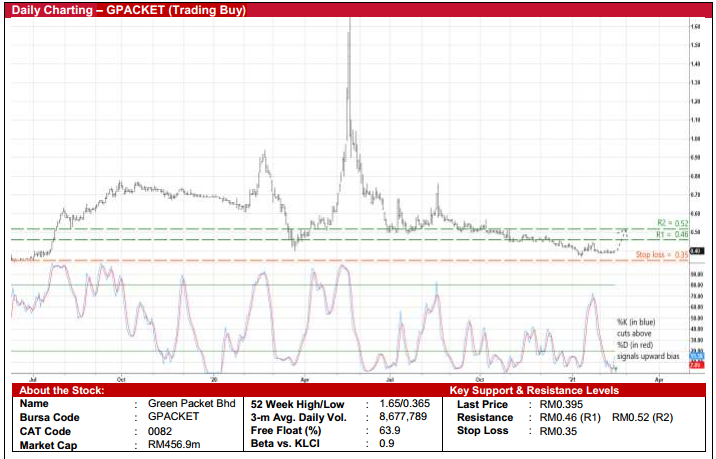

Green Packet Bhd (Trading Buy)

• After tumbling from a high of RM0.76 in mid-August last year to close at RM0.395 yesterday, GPACKET shares could stage a technical rebound from an oversold position.

• A share price bounce up may be on the cards based on the stochastic indicator, as the %K line has just crossed above the %D line with both values currently hovering below the oversold level.

• If so, then the stock is expected to climb towards our resistance thresholds of RM0.46 (R1; 16% upside potential) and RM0.52 (R2; 32% upside potential).

• We have set our stop loss price at RM0.35 (or 11% downside risk).

• In terms of fundamental outlook, GPACKET has ambitious plans to grow its digital services business (comprising e-wallet, payment gateway, various technological solution platforms) to complement its legacy telecommunication-related divisions (namely software & devices and communication services segments). In addition, it owns a 28.2% stake in G3 Global, a listed company on Bursa Malaysia which is involved in Artificial Intelligence technology and Big Data platform. There is also an intention to bid for a digital banking licence in Malaysia.

Source: Kenanga Research - 18 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

dusti

Gpack can reach previous high of 1.69?

2021-02-20 21:12