Daily technical highlights – (UCHITEC, MAYBULK)

kiasutrader

Publish date: Tue, 23 Feb 2021, 09:47 AM

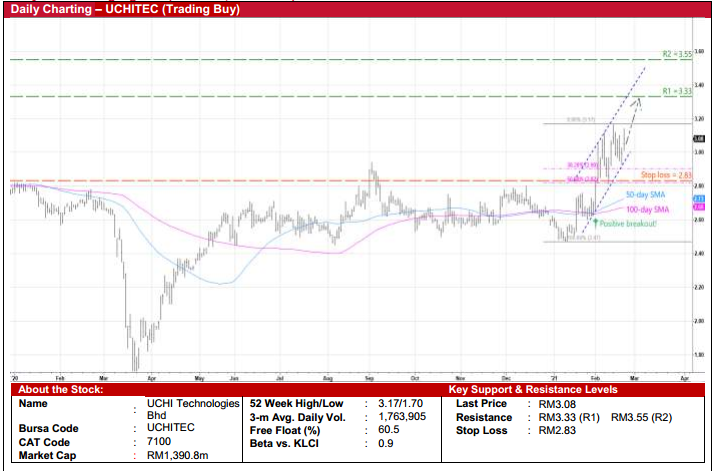

UCHI Technologies Bhd (Trading Buy)

• UCHITEC is primarily an Original Design Manufacturer (ODM) that specialises in the design and development of electronic control modules, which are then manufactured and delivered to customers for further assembly into their finished products.

• With Europe being its largest export market (accounting for ~90% of sales), the Group’s customers comprise multi-national companies who are global leaders in producing high-end household and commercial appliances (such as fully automated coffee machines) and laboratory or industrial instruments (such as precision weighing scales, centrifuges and deep freezers).

• Its exposure in supplying electronic control systems to ultra-low temperature freezer makers such as Eppendorf (a leading life science company) has positioned UCHITEC as a potential play on the Covid-19 vaccination theme.

• For the 9-month period ended Sep 2020, the Group reported net profit of RM51.5m (-8% YoY) amid the Covid-19-triggered business disruptions while its debt-free balance sheet is backed by cash holdings of RM117.4m (or 26 sen per share).

• Consensus is currently projecting its earnings to come in at RM71m for FY Dec 20 and RM75m for FY Dec 21, which translates to forward PER of 18.5x this year. Based on FY21F DPS of 15.5 sen, the stock offers an attractive dividend yield of 5.0%.

• Technically speaking, UCHITEC – which recently tested both the 50% and 38% Fibonacci retracement levels and subsequently plotted higher highs and higher lows – is expected to continue its uptrend pattern.

• With the simultaneous crossings by the faster SMA above the slower SMA and the share price over both the 50-day and 100- day SMA lines, the stock – which attracted heavy trading volume yesterday – could ride on the renewed buying interest to challenge our resistance targets of RM3.33 (R1; 8% upside potential) and RM3.55 (R2; 15% upside potential).

• Our stop loss price is set at RM2.83 (or 8% downside risk).

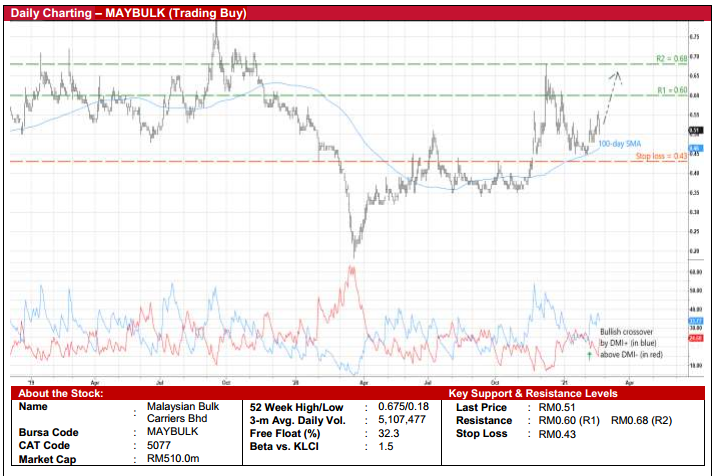

Malaysian Bulk Carriers Bhd (Trading Buy)

• After turning up from a low of RM0.355 in end-October to as high as RM0.68 in early December last year, MAYBULK’s share price has pulled back subsequently to close at RM0.51 yesterday.

• Amid the prevailing share price correction, its upward trajectory remains intact as the stock is still treading above the 100-day SMA line while the recent crossing of the DMI Plus over the DMI Minus is seen as a bullish signal too.

• Against the positive technical backdrop, we reckon MAYBULK shares will likely climb towards our resistance thresholds of RM0.60 (R1) and RM0.68 (R2). This represents upside potentials of 18% and 33%, respectively.

• We have placed our stop loss price at RM0.43 (or 16% downside risk).

• On the fundamental front, MAYBULK (which is principally engaged in the dry bulk shipping services covering the world’s shipping lanes) posted net profit of RM29.0m for the nine-month period ended Sep 2020 (versus net loss of RM19.0m previously). While the headline number was lifted mainly by gain on liquidation of a subsidiary (of RM51.3m), its operating performance has been adversely affected by reduced hired days and lower charter rates during the period.

Source: Kenanga Research - 23 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024