Daily technical highlights – (CYPARK, MALAKOF)

kiasutrader

Publish date: Thu, 11 Mar 2021, 09:36 AM

Cypark Resources Bhd (Trading Buy)

• CYPARK, which is involved in the integrated renewable energy, green technology, environmental engineering and construction engineering businesses, offers exposure to the rising demand for green and sustainable energy solutions.

• It is a potential beneficiary of the upcoming award of multiple packages of solar energy generation capacity (totalling 1,000MW) to be offered under the government’s fourth large-scale solar programme (LSS4) worth a total of RM4b.

• From a valuation perspective, based on consensus net profit forecasts of RM88m for FY Oct 21 and RM105m for FY Oct 22, CYPARK shares are presently trading at undemanding forward PERs of 7.8x this year and 6.5x next year, respectively (or hovering between -0.5SD and +0.5SD from its historical mean). The Group previously posted lower net earnings of RM70.7m (- 23% YoY) in FY Oct 20 mainly due to the Covid-19-triggered work delays, with the timing of recognition to be shifted to FY21 now.

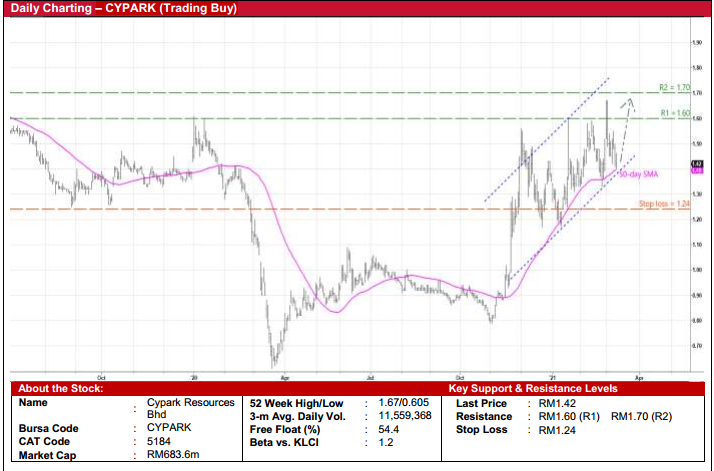

• On the chart, after bouncing up from a low of RM0.79 in the beginning of November last year, the stock has subsequently plotted higher highs and higher lows to chart a positive sloping path.

• Currently treading near the lower end of the ascending price channel and the 50-day SMA line, CYPARK could be resuming its upward trajectory soon.

• This being the case, the stock will probably climb towards our resistance thresholds of RM1.60 (R1; 13% upside potential) and RM1.70 (R2; 20% upside potential).

• We have pegged our stop loss price at RM1.24 (or 13% downside risk from its last traded price of RM1.42).

Malakoff Corporation Bhd (Trading Buy)

• MALAKOF is an independent power and water producer whose core businesses include power generation, water desalination, operations & maintenance and waste management and environmental services.

• The Group has reportedly submitted its bid for the government’s fourth large-scale solar programme (LSS4) which consists of various packages of solar energy generation capacity (totalling 1,000MW) worth RM4b.

• After posting net earnings (from continuing operations) of RM286.6m (+4% YoY) in FY Dec 20, consensus is projecting MALAKOF’s bottomline to come in at RM326m in FY21 and RM343m in FY22. This translates to forward PERs of 13.0x this year and 12.3x next year, respectively (which are between -2SD and -1SD below its historical mean).

• An added positive is its attractive dividend yields of 6.9%-7.3% based on consensus DPS forecasts of 6.0 sen for FY21 and 6.3 sen for FY22.

• From a charting perspective, a technical rebound could be forthcoming following a 15.2% tumble in the stock price from RM1.02 in the later part of August last year to close at RM0.865 yesterday.

• With the momentum indicator just cutting above the zero line and still rising, MALAKOF shares (which inched up 3% on relatively strong volume yesterday) will likely turn up towards our resistance levels of RM0.95 (R1; 10% upside potential) and RM1.02 (R2; 18% upside potential).

• Our stop loss price is set at RM0.79 (representing a 9% downside risk).

Source: Kenanga Research - 11 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024