Daily technical highlights - (SMETRIC, OMESTI)

kiasutrader

Publish date: Tue, 23 Mar 2021, 10:22 AM

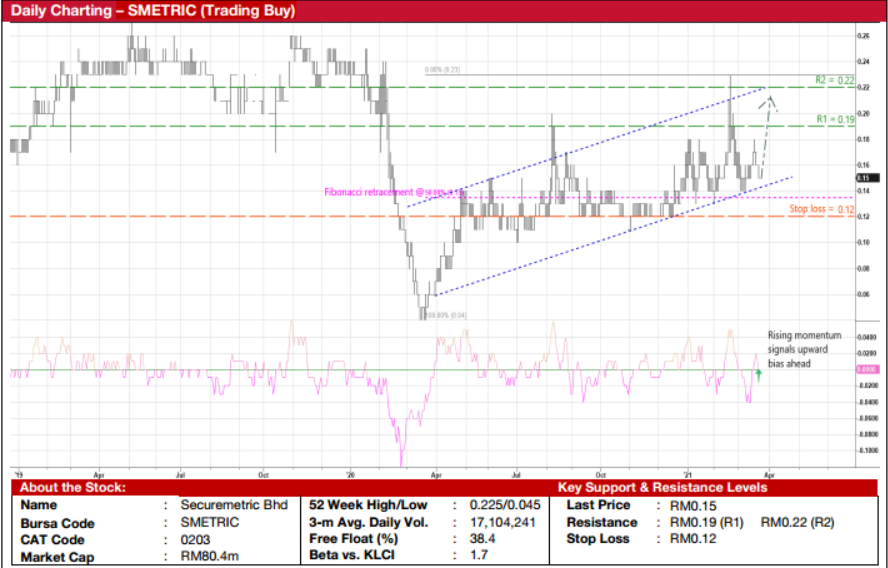

Securemetric Bhd (Trading Buy)

• SMETRIC offers digital security solutions in Malaysia, Vietnam, the Philippines, Indonesia and Singapore.

• Via its SigningCloud services – a cloud-based platform that enables customers to sign electronic documents online using certified digital signatures in a seamless and secured environment – the Group is a proxy to the government’s recently announced digital economy blueprint (MyDIGITAL) to implement the national digital identity and digital signatures by 2025.

• Fundamentally speaking, SMETRIC – which was profitable in the preceding five years (with annual net earnings ranging between RM0.6m and RM6.0m) – reported net loss of RM4.9m in FY Dec 2020 (mainly hit by impairment losses on trade receivables and inventories written off as well as business disruptions arising from the Covid-19 pandemic).

• The Group’s debt-free balance sheet is backed by net cash holdings of RM26.5m (or 4.9 sen per share which works out to be approximately one-third of its existing share price) as of end-December 2020.

• From a charting perspective, after pulling back from a high of RM0.23 about one month ago, the stock has recently found support to bounce up from the 50% Fibonacci retracement level (as measured from a trough of RM0.04 in March last year to the peak of RM0.23). This has set the stage for the share price to resume its upward trajectory inside an ascending channel.

• With the momentum indicator on the verge of breaking past the zero line, SMETRIC shares will probably trend higher towards our resistance thresholds of RM0.19 (R1; 27% upside potential) and RM0.22 (R2; 47% upside potential).

• We have pegged our stop loss price at RM0.12 (or 20% downside risk from the last traded price of RM0.15).

Omesti Bhd (Trading Buy)

• OMESTI’s share price could stage a technical rebound soon after tumbling 24% from a recent high of RM0.64 in February this year to close at RM0.485 yesterday.

• With the RSI indicator just climbed out from the oversold region, its share price will likely find renewed strength to plot a recovery ahead.

• On the way up, the stock is expected to fill the gap that was opened during the pullback in early March. As such, OMESTI shares may rise to test our resistance target of RM0.55 (R1; 13% upside potential). A breakaway from R1 could then lift the stock towards our next resistance threshold of RM0.62 (R2; 28% upside potential).

• Our stop loss price is set at RM0.44 (or 9% downside risk).

• From a fundamental perspective, OMESTI (which consists of a grouping of ICT companies with activities that are focused on the development and delivery of solutions to assist clients achieve their digital transformation strategies) turned in a net profit of RM3.0m in the nine-month period ended December 2020, compared with the previous year’s corresponding period of RM28.4m (which had benefitted from a one-off gain of RM24.6m arising from the disposal of a subsidiary).

Source: Kenanga Research - 23 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024