Daily technical highlights – (GTRONIC, DIALOG)

kiasutrader

Publish date: Tue, 25 May 2021, 11:26 AM

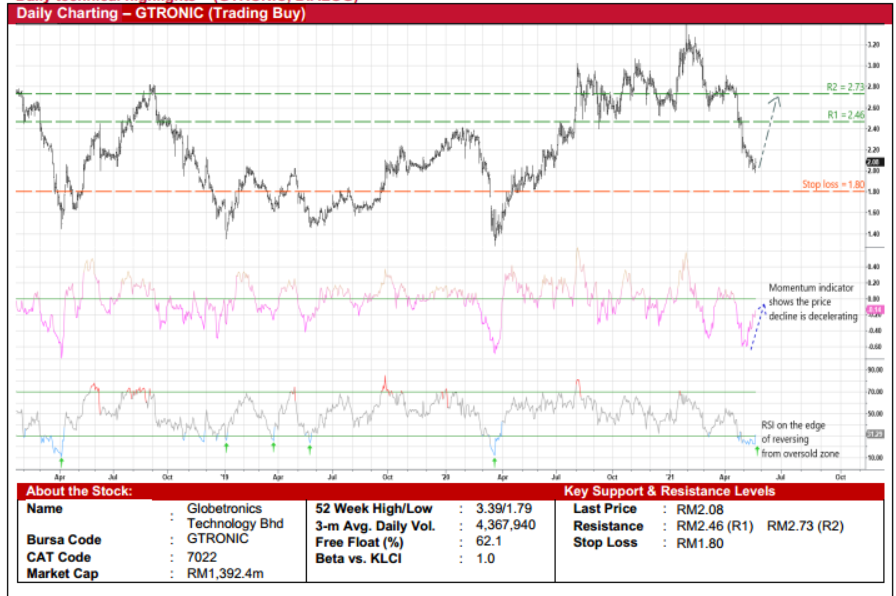

Globetronics Technology Bhd (Trading Buy)

• A price reversal could be on the horizon for GTRONIC shares after tumbling 25% from a recent high of RM2.79 about one month ago.

• On the chart, the stock is on the edge of climbing out from the RSI oversold zone while the rising momentum indicator below the zero line shows that the share price decline is decelerating.

• An ensuing technical rebound could lift the stock towards our resistance thresholds of RM2.46 (R1; 18% upside potential) and RM2.73 (R2; 31% upside potential).

• We have set our stop loss price at RM1.80 (or 13% downside risk from the last traded price of RM2.08).

• On the fundamental front, of late, GTRONIC – which is involved in the manufacture, assembly and testing of semiconductor components such as integrated circuits and sensors – was hit by earnings disappointment (after posting net profit of RM12.5m or +15% YoY in 1QFY21) and uncertain demand offtakes from key customers.

• Nonetheless, consensus is forecasting the group to register rising net profit of RM65.4m (+29% YoY) in FY December 2021 and RM73.8m (+13% YoY) in FY December 2022. This translates to forward PERs of 21.3x this year and 18.9x next year, respectively.

• In addition, the stock offers prospective dividend yields of 3.9%-4.5% based on consensus DPS of 8.1 sen for FY21 and 9.3 sen for FY22, backed by a debt-free balance sheet with cash holdings of RM161.3m (or 24.1 sen per share) as of end-March this year.

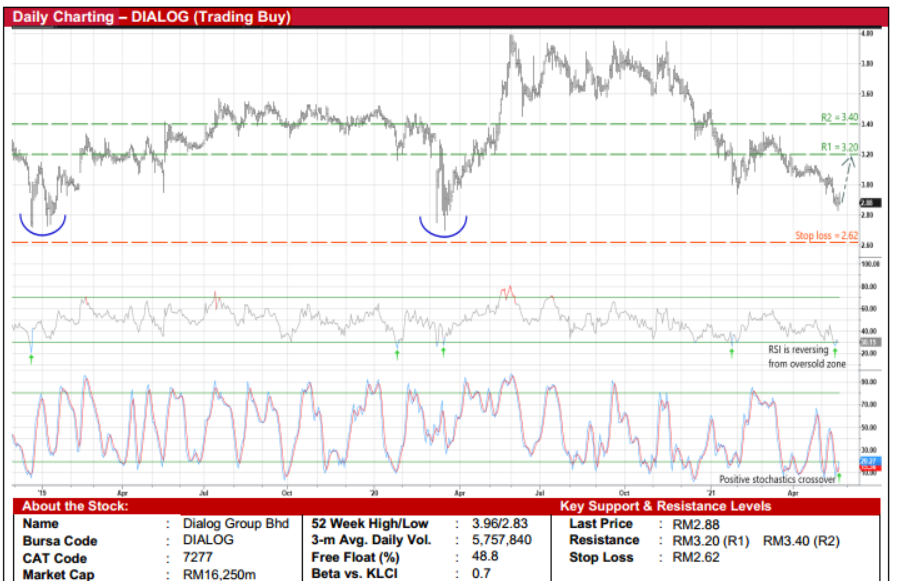

Dialog Group Bhd (Trading Buy)

• After sliding from a high of RM3.93 in mid-November last year to drift towards where it was back in January 2019 and March 2020 (when a double-bottom pattern was formed previously), DIALOG’s share price is poised to stage a technical rebound soon.

• Technically speaking, the stock is set to reverse from an oversold position with both the RSI value (which is about to cut across the oversold threshold) and the stochastics indicator (as the %K line has just crossed above the %D line) generating positive signals.

• Riding on the rebound strength, DIALOG shares could advance to challenge our resistance targets of RM3.20 (R1; 11% upside potential) and RM3.40 (R2; 18% upside potential).

• Our stop loss price is pegged at RM2.62 (9% downside risk).

• From a fundamental angle, DIALOG – an integrated technical service provider to the upstream, mid-stream and downstream sectors in the oil & gas and petrochemical industry – logged net profit of RM404.6m (-15% YoY) for the nine-month period ended March 2021.

• Moving forward, consensus is projecting the group to post net profit of RM537.5m (-15% YoY) in FY June 2021 and RM641.9m (+19% YoY) in FY June 2022. This translates to forward PERs of 30.2x this year and 25.3x next year, respectively.

Source: Kenanga Research - 25 May 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-24

GTRONIC2024-11-23

DIALOG2024-11-22

DIALOG2024-11-22

DIALOG2024-11-22

GTRONIC2024-11-22

GTRONIC2024-11-22

GTRONIC2024-11-22

GTRONIC2024-11-21

DIALOG2024-11-21

DIALOG2024-11-21

GTRONIC2024-11-21

GTRONIC2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-19

DIALOG2024-11-18

DIALOGMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024