Daily technical highlights – (TGUAN, SCGM)

kiasutrader

Publish date: Fri, 02 Jul 2021, 10:01 AM

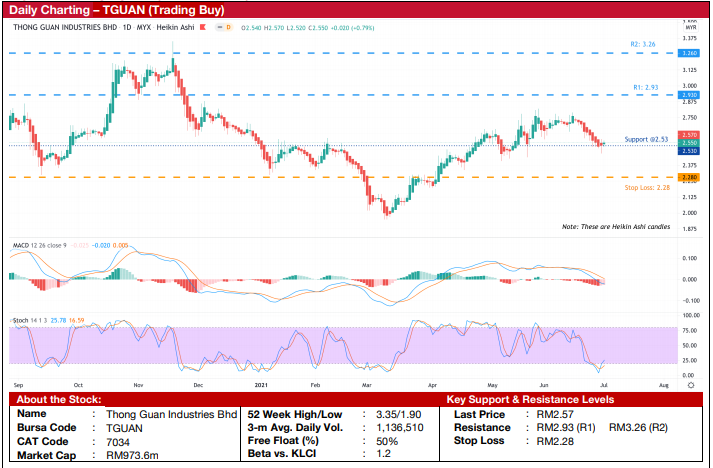

Thong Guan Industries Berhad (Trading Buy)

• TGUAN manufactures stretch films, garbage bags, courier bags and a variety of other plastic packaging. It serves customers around the world and is planning to drive growth in North America and Europe by growing sales volume and acquiring new customers.

• Resin prices have been gradually falling after peaking in March 2021. Despite the drop in the main raw material cost, plastic manufacturers’ selling prices have remained elevated, which would boost profit margins in the coming quarters.

• In FY20, TGUAN achieved a net profit of RM76.3m. Moving forward, our research team is estimating net profit of RM87.4m in FY21 and RM94.8m in FY22, implying 15% and 9% YoY growth, respectively. This translates to forward PERs of 11.1x this year and 10.3x next year, respectively.

• Technically speaking, the stock began to chart an uptrend pattern since March 2021, forming higher lows on its way up. While the stock has pulled back 8% from RM2.78 since mid-June 2021, we reckon it has recently found support at RM2.53.

• The Heikin Ashi candlesticks show that the short-term correction may be coming to an end as the latest two candlesticks indicate that a price reversal is on the horizon. We see the current price weakness as a good buying opportunity.

• With the MACD and stochastic indicators showing signs of upward momentum, we believe the share price could potentially challenge our resistance levels of RM2.93 (R1; 14% upside potential) and RM3.26 (R2; 27% upside potential).

• We have pegged our stop loss at RM2.28 (11% downside risk).

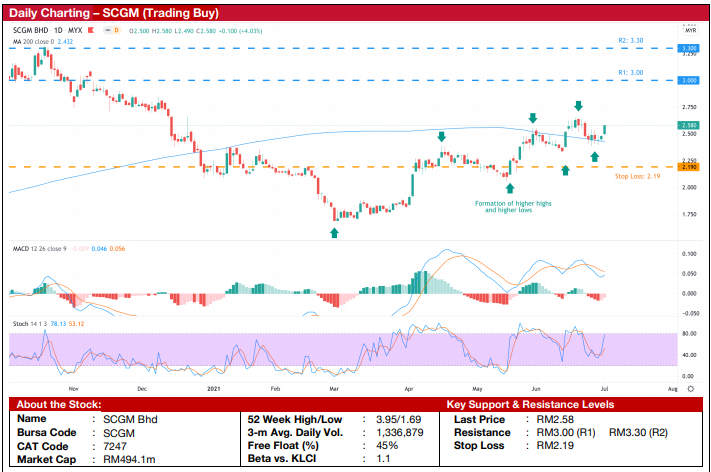

SCGM Berhad (Trading Buy)

• SCGM manufactures food & beverage packaging, namely takeaway trays and plastic containers for fresh foods in supermarkets. In 2020, SCGM has diversified into the manufacturing of face shields and face masks.

• Like other plastic manufacturers, since March 2021, SCGM has benefited from falling resin costs and elevated selling prices, allowing them to expand margins. In addition, SCGM’s high-margin products are also experiencing strong sales, boosting further its margins.

• Since the re-implementation of lockdowns following the resurgence of Covid-19 cases in Malaysia and Singapore in April 2021, SCGM has seen strong orders for its takeaway packaging products and face masks.

• The Group recently announced a core net profit of RM34m for FY ended April 2020. Moving forward, our research team is estimating that SCGM will achieve net profit of RM37.4m in FY21 and RM40.2m in FY22. This translates to forward PERs of 13.2x this year and 12.3x next year, respectively.

• Technically speaking, the stock remains in an upward trend, signalled by: (i) its formation of higher lows and higher highs since March 2021, and (ii) its recent crossing above the 200-day SMA.

• With the MACD and stochastic indicators showing signs of strengthening momentum, we believe the share price could potentially challenge our resistance levels of RM3.00 (R1; 16% upside potential) and RM3.30 (R2; 28% upside potential).

• We have pegged our stop loss at RM2.19 (15% downside risk)

Source: Kenanga Research - 2 Jul 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024