Daily technical highlights – (SUNREIT, IGBREIT)

kiasutrader

Publish date: Wed, 18 Aug 2021, 09:18 AM

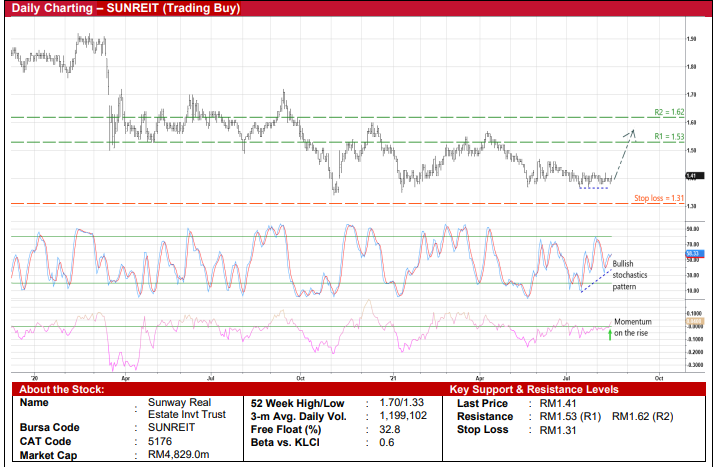

Sunway Real Estate Investment Trust (Trading Buy)

• From a risk-return perspective, SUNREIT shares appear technically attractive at this juncture. After sliding from a high of RM1.57 in early April this year to RM1.41 currently, its share price is now hovering below the mid-March 2020 low of RM1.46 and not too far from the post-pandemic trough of RM1.33 (in early November last year). This suggests relatively limited downside risk.

• Meanwhile, a technical rebound could be forthcoming based on the positive stochastics signal (with the %D line plotting rising bottoms as the share price remained flattish) and increasing momentum indicator (which has just crossed above the zero line).

• An ensuing price reversal is expected to lift the stock towards our resistance thresholds of RM1.53 (R1) and RM1.62 (R2), translating to upside potentials of 9% and 15%, respectively.

• Our stop loss price is pegged at RM1.31 (or 7% downside risk).

• Fundamentally, SUNREIT – backed by its diversified portfolio of assets comprising retail malls, hotels, offices, medical centre, education institution and industrial property – is set to show an earnings recovery on account of an eventual re-opening of economic activities when the Covid-19 pandemic is brought under control.

• In terms of earnings outlook, consensus is forecasting the group to make net profit of RM241.4m (+16% YoY) for FY June 2021 and RM269.4m (+12% YoY) for FY June 2022.

• Valuation-wise, SUNREIT shares are presently trading at forward dividend yields of 4.8% and 5.0% based on consensus DPU projections of 6.8 sen for FY21 and 7.0 sen for FY22, respectively.

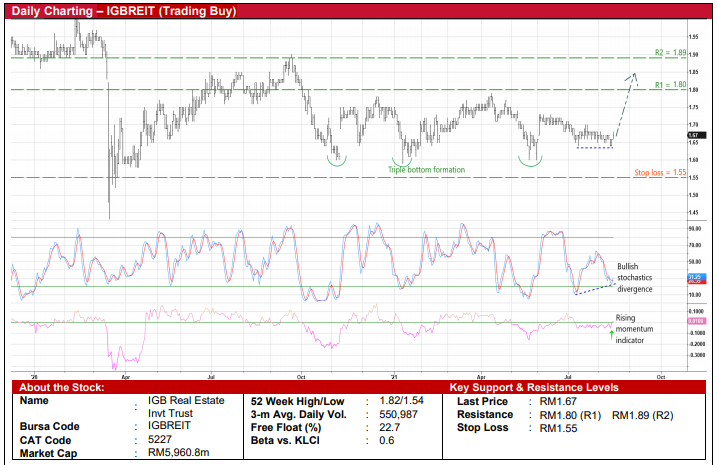

IGB Real Estate Investment Trust (Trading Buy)

• After charting a triple-bottom pattern, IGBREIT shares will probably ride on an upward trajectory ahead.

• This comes as the appearance of a bullish stochastics divergence pattern (with the %D line forming two rising bottoms in the oversold area while the share price treaded sideways) and the rising momentum indicator could push the stock to higher levels ahead.

• With that, we have set our resistance targets at RM1.80 (R1; 8% upside potential) and RM1.89 (R2; 13% upside potential).

• Our stop loss price is pegged at RM1.55 (or 7% downside risk).

• On the fundamental front, IGBREIT – as a retail-focussed REIT which owns two huge malls in the Klang Valley – is seen as an economic re-opening play amid hopes that the worst of the Covid-19 outbreak will come to a pass in the near future.

• Reflecting the positive earnings outlook, consensus is forecasting IGBREIT’s net profit to recover from RM212.8m (-10% YoY) in FY December 2021 to RM297.9m (+40% YoY) in FY December 2022.

• In terms of valuation, based on consensus DPU projections of 6.4 sen for FY21 and 8.3 sen for FY22, IGBREIT’s forward dividend yields currently stand at 3.8% this year and 5.0% next year, respectively

Source: Kenanga Research - 18 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 28, 2024