Daily Technical Highlights – (GTRONIC, MCLEAN)

kiasutrader

Publish date: Tue, 07 Sep 2021, 09:27 AM

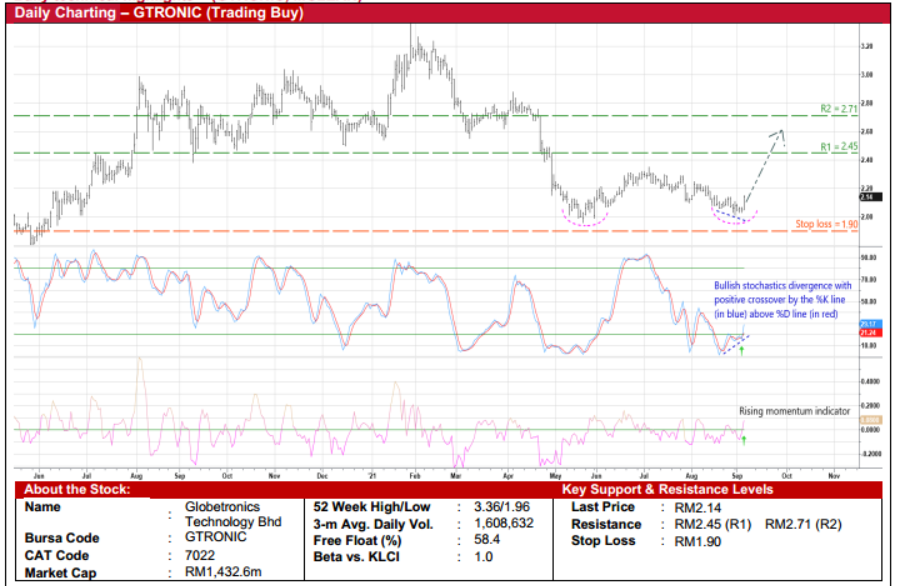

Globetronics Technology Bhd (Trading Buy)

• With a possible double-bottom pattern in the making, GTRONIC shares could be staging a technical rebound soon.

• In essence, an upward shift in the stock is anticipated following: (i) the presence of a bullish stochastics divergence (afterthe %D line has formed two rising bottoms in the oversold area as the stock drifted lower) while the %K line has crossed overthe %D line to trigger a buy signal at the same time, and (ii) the rising momentum indicator’s climb above the zero line.

• On the way up, the share price will probably challenge our resistance targets of RM2.45 (R1; 14% upside potential) andRM2.71 (R2; 27% upside potential).

• We have placed our stop loss price at RM1.90 (or 11% downside risk from yesterday’s close of RM2.14).

• The recent share price weakness – down 5.7% since 27 July – might have already discounted the earnings disappointmentafter GTRONIC (which is involved in the manufacture, assembly and testing of semiconductor components such as integratedcircuits and sensors) announced net profit of RM18.8m (up 18% YoY) in 1HFY21.

• Going forward, consensus is projecting the group to post a net profit rebound to RM56.3m (+11% YoY) in FY December 2021and RM66.9m (+19% YoY) in FY December 2022. This translates to forward PERs of 25.4x this year and 21.4x next year,respectively.

• With a debt-free balance sheet that is backed by cash holdings of RM179.8m (or 26.9 sen per share) as of end-June thisyear, the stock offers prospective dividend yields of 3.5%-4.1% based on consensus DPS estimates of 7.4 sen for FY21 and8.7 sen for FY22.

MClean Technologies Bhd (Trading Buy)

• After drifting sideways since mid-May this year, MCLEAN shares – which inched up 2.4% to end at RM0.42 on relatively highvolume yesterday – may attempt to break out from the existing consolidation pattern ahead.

• Preliminary technical signs of an anticipated price run-up could be seen from: (i) the %K line crossing over the %D line as thestochastics indicator reverses from an oversold position, and (ii) the recent appearance of the bullish dragonfly dojicandlestick.

• With that, the stock will likely climb towards our resistance thresholds of RM0.50 (R1) and RM0.58 (R2), representing upsidepotentials of 19% and 38%, respectively.

• Our stop loss price is set at RM0.35 (or 17% downside risk), which is placed just below the 61.8% Fibonacci retracementlevel.

• Fundamentally speaking, MCLEAN – which provides surface treatment, precision cleaning and packaging services mainly forthe hard disk drive (HDD), consumer electronics and oil & gas industries with operations located in Malaysia, Singapore,Thailand and China – is an indirect proxy to the growing demand for storage for enterprise and cloud data.

• The group made a slight net loss of RM0.6m in 2QFY21 (vs 2QFY20’s net profit of RM0.3m), bringing 1HFY21’s net loss toRM1.3m (vs 1HFY20’s net loss of RM0.5m) as its overall performance was affected by business disruptions arising from theCovid-19 pandemic and lower other income contributions.

• Nonetheless, its stable balance sheet (with a marginal net cash position of RM0.7m as of end-June this year) suggests thatMCLEAN is financially resilient to weather through the prevailing challenging industry environment.

Source: Kenanga Research - 7 Sept 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024