Daily technical highlights – (ROHAS, SUNREIT)

kiasutrader

Publish date: Tue, 05 Oct 2021, 10:23 AM

Rohas Tecnic Bhd (Trading Buy)

• ROHAS is involved in the regional utility infrastructure markets, focussing primarily on power & energy, telecommunication and water & sewage.

• As the market leader in the manufacturing of steel lattice towers and monopoles for power transmission and telecommunications in Malaysia as well as in the provision of full turnkey solutions in EPCC (engineering, procurement, construction & commissioning) projects, ROHAS stands to benefit indirectly from the supply of fabricated towers and EPCC works when the National Digital Network plan (JENDELA) is rolled out with the winners of Phase 1 tender (valued at RM4.6b to construct 1,661 towers and install the 5G network) to be known as early as this month.

• Due to the various movement restrictions imposed by the government to curb the Covid-19 outbreak this year, the group’s business operations were impacted, resulting in a net loss of RM4.3m for the first half ended June 2021 (compared with 1HFY20’s net loss of RM1.6m). Nevertheless, the worst is likely to be in the past in view of of the gradual re-opening of the economy.

• On the chart, after overcoming the 100-day SMA line recently, the stock – which rose 4.8% on strong volume to finish at RM0.33 yesterday – may attempt to break away from a rectangle pattern soon.

• In particular, the positive technical stance is driven by the rising momentum indicator and bullish MACD crossover (above the signal line).

• An anticipated price breakout could then lift the shares towards our resistance thresholds of RM0.39 (R1; 18% upside potential) and RM0.44 (R2; 33% upside potential).

• We have placed our stop loss price at RM0.28 (or 15% downside risk).

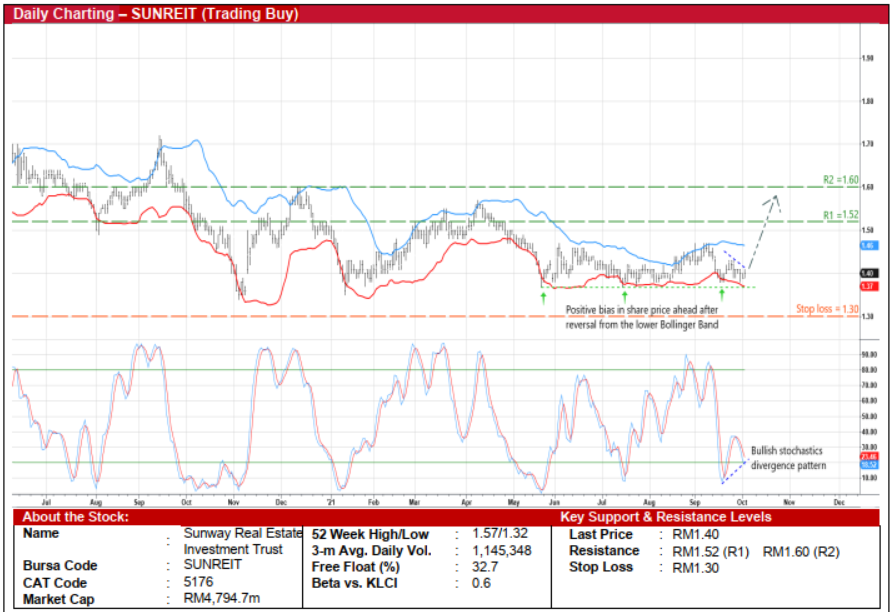

Sunway Real Estate Investment Trust (Trading Buy)

• After drifting sideways since May this year, SUNREIT shares may see an upward shift ahead.

• Currently treading near a short-term support line (at RM1.37), and following the share price’s crossing back above the lower Bollinger Band recently, its downside risk appears fairly limited at this juncture.

• With the occurrence of a bullish stochastics divergence pattern (as the %D line has formed two rising bottoms in the oversold area while the price movements were flattish), the stock will probably climb towards our resistance thresholds of RM1.52 (R1; 9% upside potential) and RM1.60 (R2; 14% upside potential).

• Our stop loss price is set at RM1.30 (which represents a downside risk of 7%).

• From a fundamental standpoint, SUNREIT – backed by its diversified portfolio of assets comprising retail malls, hotels, offices, medical centre, education institution and industrial property – is seen as a post-pandemic recovery play amid the progressive re-opening of economic activities in the country.

• Earnings-wise, after posting net profit of RM138.2m (-34% YoY) in FY June 2021, consensus is anticipating that the group will show a rebound in net earnings to RM262.4m (+90% YoY) for FY June 2022 and RM289.1m (+10% YoY) for FY June 2023.

• In terms of valuation, SUNREIT shares are presently trading at forward dividend yields of 4.8% and 5.5% based on consensus DPU projections of 6.7 sen for FY22 and 7.7 sen for FY23, respectively.

Source: Kenanga Research - 5 Oct 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024