Daily technical highlights – (TUNEPRO, CJCEN)

kiasutrader

Publish date: Thu, 18 Nov 2021, 09:45 AM

Tune Protect Group Bhd (Trading Buy)

• TUNEPRO is currently undergoing a strategic transformation initiative guided by their “3-Year Strategic Plan” which was launched towards the end of 1H2021.

• As part of its transformation strategy, TUNEPRO intends to position itself as an ASEAN-based insurance company focusing on new product offerings that will cater to customers’ individual demand.

• Going forward, we believe that its portfolio mix coupled with the newly launched Covid-related travel insurance plans (which leverage on the resumption of domestic and international travels) would contribute positively to the bottom-line.

• For the latest quarter of 3QFY21, amid the business disruptions arising from the Covid-related lockdowns, TUNEPRO reported revenue of RM103.8m (-5.6% YoY) and a marginal net loss of RM0.8m versus a net profit of RM5.0m in the corresponding quarter.

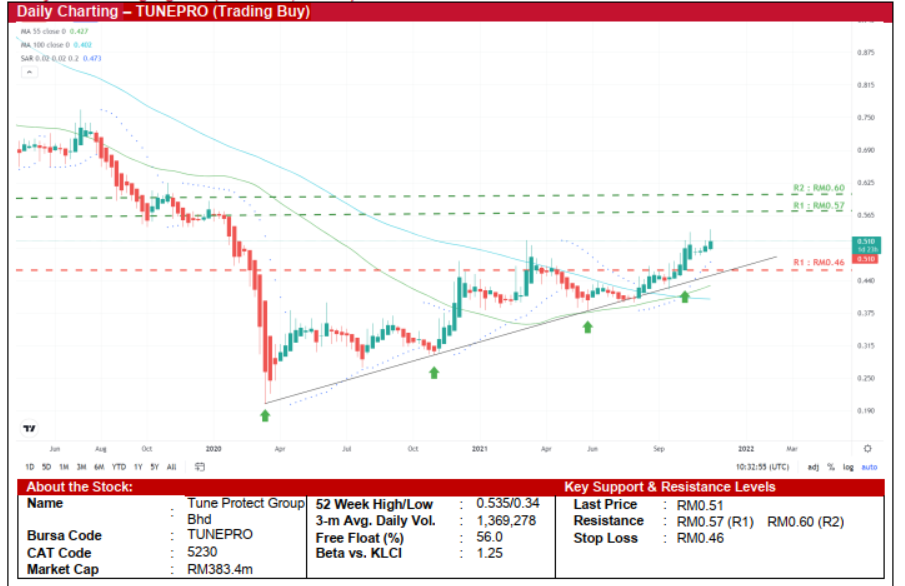

• Chart-wise, the stock plunged to a low of RM0.20 (in mid-March 2020), registering a decline of 74% from its peak price of RM0.765 (at the beginning of July 2019). Subsequently, the stock plotted higher highs to close at RM0.51 yesterday.

• Following the crossover by the shorter-term SMA above the longer-term SMA in the beginning of October 2021, and coupled with the Parabolic SAR indicator trending upwards, we believe TUNEPRO’s stock price will continue to rise.

• As such, the stock could climb to challenge our resistance thresholds of RM0.57 (R1; 12% upside potential) and RM0.60 (R2; 18% upside potential).

• We pegged the stop loss price at RM0.46 (a 10% downside risk).

CJ Century Logistics Holdings Bhd (Trading Buy)

• From a technical perspective, after hitting a high of RM0.785 around end August 2018, the stock saw a decline before bottoming out at RM0.205 around mid-March 2020, representing a decline of 74% from its peak.

• Thereafter, the stock has gradually recouped its losses by trending higher, plotting consecutive higher highs along the way to form an upward sloping trendline which stretches back to March 2020. Acting as a strong support line currently, the stock has comfortably stayed above the trendline as it surged 7% to close at RM0.64 yesterday.

• With CJCEN shares also treading around the upper band of the Keltner Channel, this further indicates its rising price strength.

• In addition, with the ADX heading upwards, we anticipate the stock could continue to climb and challenge our resistance targets of RM0.73 (R1) and RM0.77 (R2), which represent upside potentials of 14% and 20%, respectively.

• We have pegged our stop loss price at RM0.56, which translates to a downside risk of 13.0%.

• Fundamentally, CJCEN’s business activities encompass 4 segments, namely: (i) integrated logistics, (ii) oil logistics, (iii) procurement logistics, and (iv) data management solutions.

• CJCEN reported a wider net loss of RM8.2m in 2QFY21, dragged down by higher operating expenses against a loss of only RM0.7m in 2QFY20.

Source: Kenanga Research - 18 Nov 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024