Daily technical highlights – (DPHARMA, THETA)

kiasutrader

Publish date: Fri, 26 Nov 2021, 09:43 AM

Duopharma BioTech Berhad (Trading Buy)

• DPHARMA is a pharmaceutical company that develops and markets generic drugs. In August, DPHARMA has been granted conditional registration approval for Sinopharm’s Covid-19 vaccine, which is intended for distribution to the private sector in Malaysia.

• With the deal projected to contribute positively to DPHARMA’s profits, consensus is expecting the group to achieve a net profit of RM70m (+19% YoY) in FY21 and RM78m (+12% YoY) in FY22.

• These translate to forward PERs of 23x and 21x, respectively.

• Technically speaking, after peaking at RM3.285 in November last year, the stock has fallen 53% to as low as RM1.54 in November this year.

• Since then, the stock has formed a higher low, possibly indicating that the downtrend has ended.

• And yesterday, the stock convincingly broke above the 20-day SMA, suggesting that it could be riding a short-term uptrend ahead.

• Coupled with the rising MACD and Parabolic SAR indicators, we believe the stock could continue to trend higher.

• On its way up, the stock could potentially challenge our resistance levels of RM1.92 (R1; 13% upside potential) and RM2.10 (R2; 24% upside potential).

• We have pegged our stop loss level at RM1.52 (or an 11% downside risk).

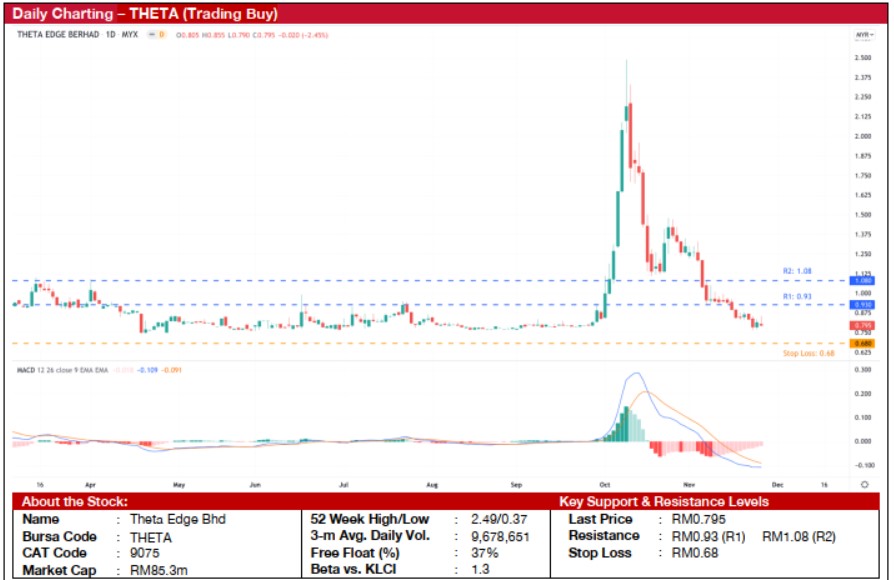

Theta Edge Berhad (Trading Buy)

• THETA – which is a 38.4%-owned associate of Tabung Haji - offers information and communications technology services. The company sets up and runs wireless networks for telemetry, remote meter reading and telecommunications, in addition to the provision of systems integration and managed telecommunications services.

• In FY20, THETA made a net loss of RM7m, compared to a net profit of RM0.18m in FY19. For 1HFY21, the group posted smaller net loss of RM0.5m (versus net loss of RM2.9m previously).

• With the impending rollout of Jendela Phase 1 contracts to build 1,661 sites, THETA could emerge as among the front runners given its strong qualifications that are backed by its Network Facilities Providers (NFP) and Network Service Provider (NSP) licenses issued by MCMC.

• Should THETA secure some of the Jendela Phase 1 contracts, this is expected to boost its earnings prospects.

• Chart-wise, the stock sky-rocketed 215% from RM0.79 to RM2.49 in a span of 9 trading days towards the end of September when the Ministry of Multimedia and Communications reportedly indicated that the winners of the Jendela Phase 1 tender would be announced in October.

• After the speculative buying frenzy had cooled down, the stock fell in tandem by 69% to a low of RM0.765 this month.

• Following which, the stock seems to have found support at the strong support line of RM0.77, a price level which the stock has been hovering above throughout 2021.

• With the MACD indicator showing slowing downward momentum, we believe the stock is in a position to stage a technical rebound soon.

• On its way up, the stock could potentially challenge our resistance levels of RM0.93 (R1; 17% upside potential) and RM1.08 (R2; 36% upside potential).

• We have pegged our stop loss level at RM0.68 (or a 14% downside risk).

Source: Kenanga Research - 26 Nov 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

THETA2024-11-22

THETA2024-11-22

THETA2024-11-21

DPHARMA2024-11-20

DPHARMA2024-11-19

DPHARMA2024-11-18

THETA2024-11-18

THETA2024-11-18

THETA2024-11-18

THETA2024-11-18

THETA2024-11-18

THETA2024-11-18

THETA2024-11-18

THETA2024-11-18

THETA2024-11-18

THETA2024-11-18

THETA2024-11-15

DPHARMA2024-11-15

DPHARMA2024-11-13

DPHARMAMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024