Daily technical highlights – (PAVREIT, YTLREIT)

kiasutrader

Publish date: Wed, 15 Dec 2021, 09:24 AM

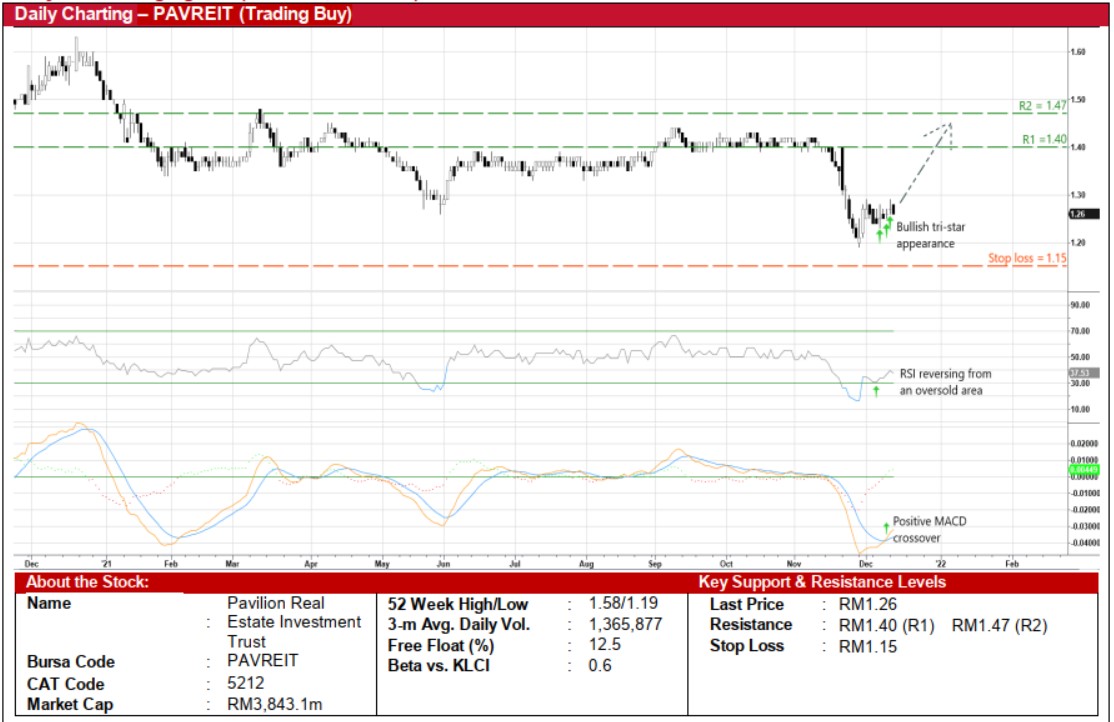

Pavilion Real Estate Investment Trust (Trading Buy)

• After tumbling from RM1.40 in mid-November this year to a low of RM1.19 at the end of November, PAVREIT shares – which closed at RM1.26 yesterday to hover below the March 2020 trough of RM1.29 – will probably stage a technical rebound ahead.

• On the chart, an upward shift in the share price is anticipated following: (i) the appearance of bullish tri-star candlesticks formation, (ii) the reversal of the RSI indicator from an oversold position, and (iii) the MACD line crossing above the signal line in an oversold area.

• On the way up, the stock could bounce up towards our resistance thresholds of RM1.40 (R1; 11% upside potential) and RM1.47 (R2; 17% upside potential).

• Our stop loss price level is pegged at RM1.15 (representing a 9% downside risk).

• Fundamentally, after posting net profit of RM71.7m (-6% YoY) in 9MFY21, PAVREIT – which owns a portfolio of retail real estate in the Klang Valley (including its most prominent asset, Pavilion Kuala Lumpur) – is expected to show a brighter earnings outlook as economic activities pick up.

• Consensus is projecting the group to register net earnings of RM111.4m for FY December 2021 and RM195.0m for FY December 2022.

• Valuation-wise, the stock presently offers prospective dividend yields of 5.1%-5.8% based on consensus DPS estimates of 6.4 sen for FY22 and 7.3 sen for FY23.

YTL Hospitality REIT (Trading Buy)

• Following a recent share price retracement from a high of RM1.03 in mid-October this year to RM0.915 currently, YTLREIT shares may be due for a technical rebound ahead.

• As the stock bounces off the lower end of an ascending price channel, coupled with the RSI reversal from an oversold position and the rising momentum indicator, the share price could climb towards our resistance thresholds of RM1.01 (R1; 10% upside potential) and RM1.06 (R2; 16% upside potential).

• We have set our stop loss price level at RM0.83 (or a 9% downside risk).

• On the fundamental front, the worst is probably over for YTLREIT (which owns a wide portfolio of prime hotel properties spread across Malaysia, Japan and Australia) as the hospitality industry recovers post-pandemic.

• After announcing net earnings of RM82.8m in FY June 2021 (versus FY20’s RM9.6m) that was followed by net profit of RM14.8m (-11% YoY) in 1QFY22, the group’s bottomline is projected to come in at RM114.6m in FY22 and RM153.5m in FY23 based on consensus expectations.

• In terms of dividend returns, consensus is forecasting DPU estimates of 3.9 sen for FY June 2022 and 8.1 sen for FY June 2023, which translate to prospective dividend yields of 4.3%-8.9%.

Source: Kenanga Research - 15 Dec 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024