Daily technical highlights – (HARBOUR, SYSCORP)

kiasutrader

Publish date: Tue, 21 Dec 2021, 09:20 AM

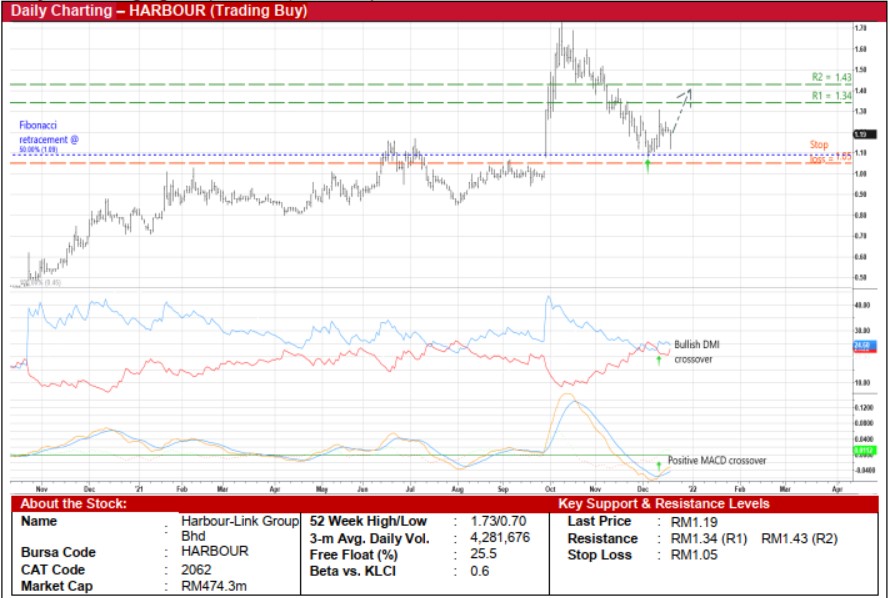

Harbour-Link Group Bhd (Trading Buy)

• A leading shipping, marine and integrated logistics provider which is also involved in the engineering & construction contracting business for oil and gas and power industries, HARBOUR stands to benefit from a post-pandemic recovery in trade activities and elevated freight rates.

• After posting net profit of RM60.6m (+134% YoY) in FY June 2021, the group’s robust earnings momentum continued with 1QFY22’s bottomline coming in at RM17.5m (+87% YoY).

• Following the strong financial performance, HARBOUR has declared a first interim DPS of 2.5 sen (the ex-date is today while payment date is on 10 January 2022).

• An added attraction is the group’s healthy balance sheet, which is backed by net cash & investment securities holdings of RM154.3m (translating to 38.7 sen per share or approximately one-third of its existing share price) as of end-September 2021.

• Technically speaking, its share price correction from a high of RM1.73 in early October this year may be over already after bouncing off from a trough of RM1.08 early this month, a level that coincided with the 50% Fibonacci retracement line.

• Coupled with the DMI Plus crossing above the DMI Minus and the MACD line cutting over the signal line recently, the stock is expected to strengthen further ahead.

• Riding on the positive momentum, HARBOUR shares could climb towards our resistance targets of RM1.34 (R1; 13% upside potential) and RM1.43 (R2; 20% upside potential).

• Our stop loss price level is pegged at RM1.05 (or a 12% downside risk from yesterday’s close of RM1.19).

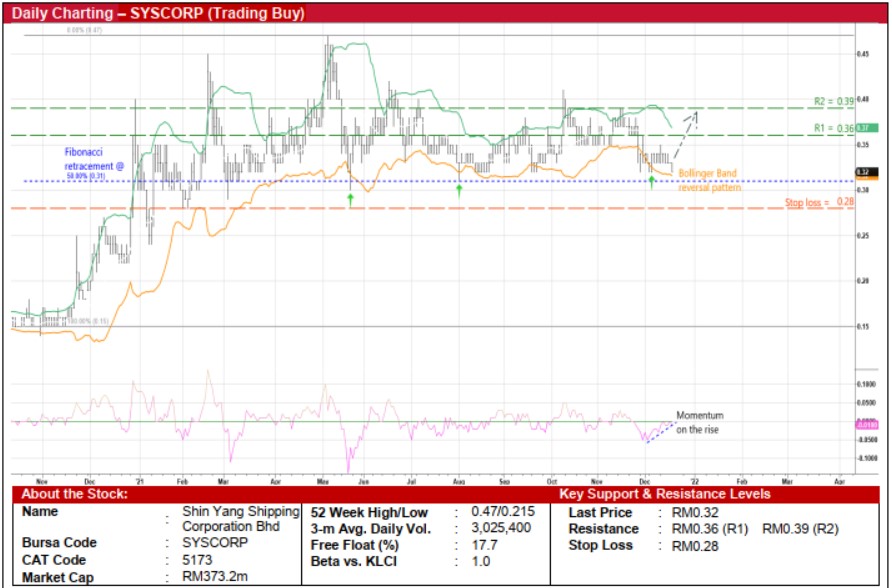

Shin Yang Shipping Corporation Bhd (Trading Buy)

• Following a sideways trading pattern since late May this year, SYSCORP shares could show a positive bias ahead after bouncing off from the 50% Fibonacci retracement line recently.

• In particular, an upward shift is anticipated after the share price has crossed back above the lower Bollinger Band while the rising momentum indicator is in the midst of cutting above the zero-line.

• With that, the stock will probably be making its way to challenge our resistance thresholds of RM0.36 (R1; 12% upside potential) and RM0.39 (R2; 22% upside potential).

• We have placed our stop loss price level at RM0.28 (which represents a 12% downside risk).

• Fundamentally, SYSCORP’s core businesses are shipping, shipbuilding, ship repair and forwarding agency. Its shipping operations cover dry bulk, liquid bulk, containers and coastal, barges and tug and international shipping segments.

• After returning to the black with net profit of RM17.1m in FY June 2021 (versus FY20’s net loss of RM146.1m), the group’s net earnings continued to rise to RM11.9m (+303% YoY) in 1QFY22.

Source: Kenanga Research - 21 Dec 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024